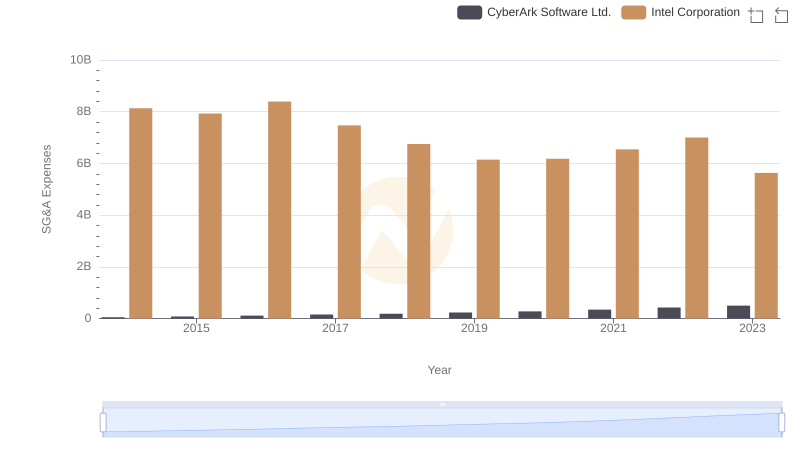

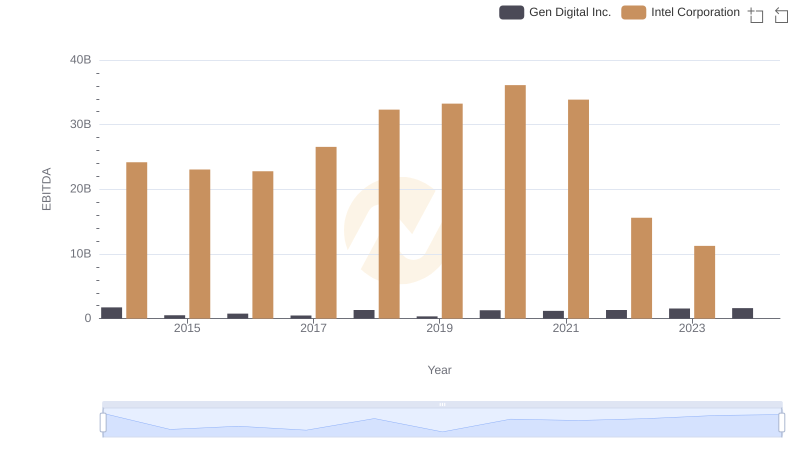

| __timestamp | Gen Digital Inc. | Intel Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 2880000000 | 8136000000 |

| Thursday, January 1, 2015 | 2702000000 | 7930000000 |

| Friday, January 1, 2016 | 1587000000 | 8397000000 |

| Sunday, January 1, 2017 | 2023000000 | 7474000000 |

| Monday, January 1, 2018 | 2171000000 | 6750000000 |

| Tuesday, January 1, 2019 | 1940000000 | 6150000000 |

| Wednesday, January 1, 2020 | 1069000000 | 6180000000 |

| Friday, January 1, 2021 | 791000000 | 6543000000 |

| Saturday, January 1, 2022 | 1014000000 | 7002000000 |

| Sunday, January 1, 2023 | 968000000 | 5634000000 |

| Monday, January 1, 2024 | 1337000000 | 5507000000 |

Unlocking the unknown

In the ever-evolving landscape of technology, cost management remains a pivotal factor for success. Over the past decade, Intel Corporation and Gen Digital Inc. have showcased distinct strategies in managing their Selling, General, and Administrative (SG&A) expenses. From 2014 to 2023, Intel's SG&A expenses have seen a gradual decline, dropping approximately 31% from their peak in 2016. This reflects Intel's strategic shift towards optimizing operational efficiency. In contrast, Gen Digital Inc. experienced a more volatile trajectory, with a significant 66% reduction in SG&A expenses from 2014 to 2021, followed by a resurgence in recent years. This fluctuation highlights Gen Digital's adaptive approach in response to market dynamics. Notably, the data for 2024 is incomplete, indicating a potential shift in reporting or strategy. As these tech giants continue to innovate, their cost management strategies will undoubtedly play a crucial role in shaping their future.

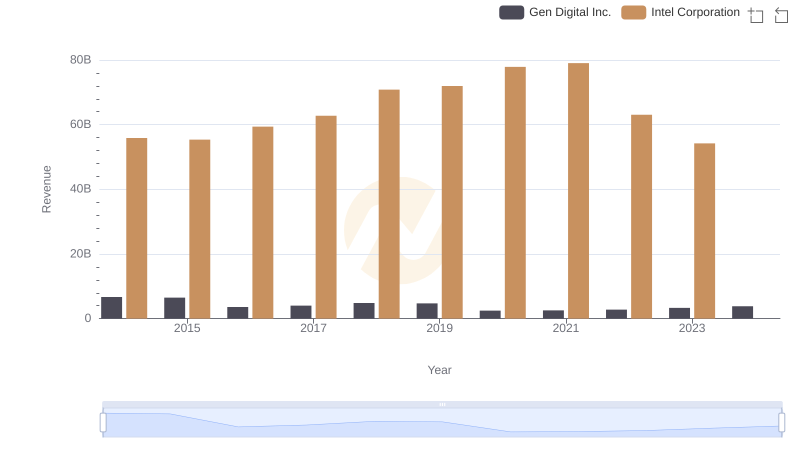

Intel Corporation or Gen Digital Inc.: Who Leads in Yearly Revenue?

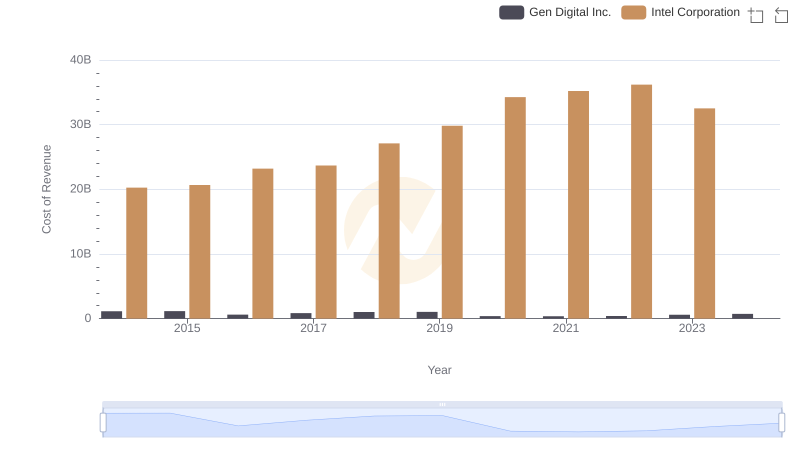

Intel Corporation vs Gen Digital Inc.: Efficiency in Cost of Revenue Explored

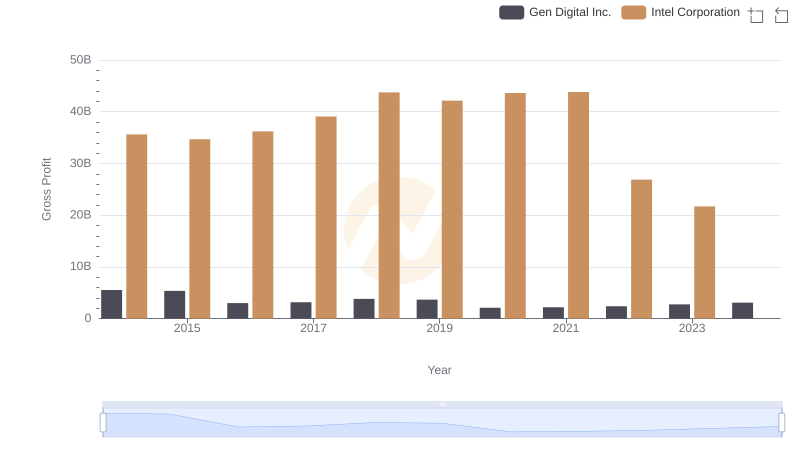

Key Insights on Gross Profit: Intel Corporation vs Gen Digital Inc.

Operational Costs Compared: SG&A Analysis of Intel Corporation and CyberArk Software Ltd.

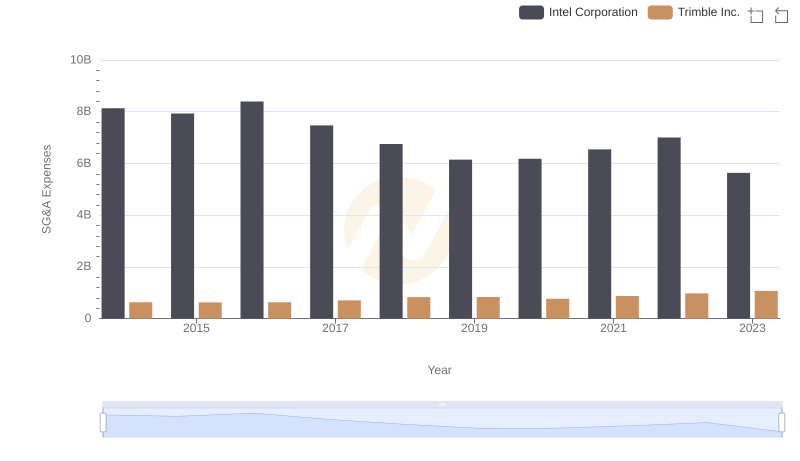

SG&A Efficiency Analysis: Comparing Intel Corporation and Trimble Inc.

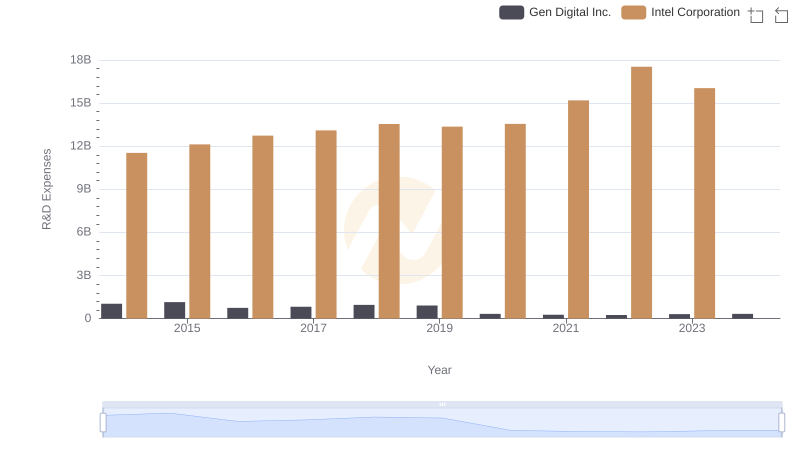

Analyzing R&D Budgets: Intel Corporation vs Gen Digital Inc.

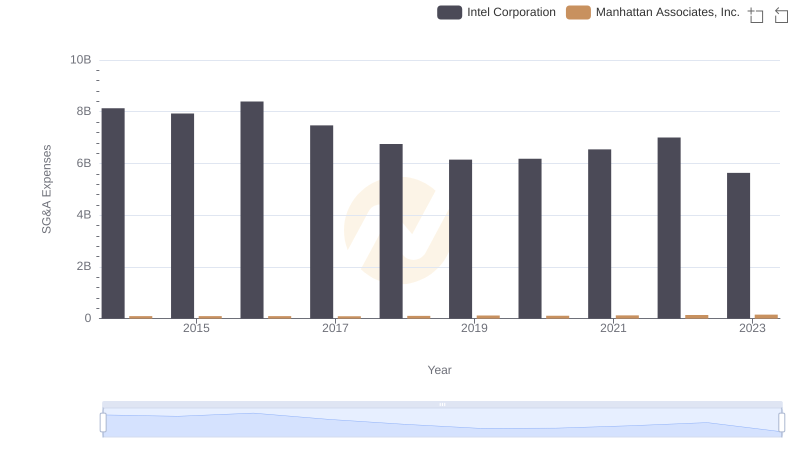

Intel Corporation and Manhattan Associates, Inc.: SG&A Spending Patterns Compared

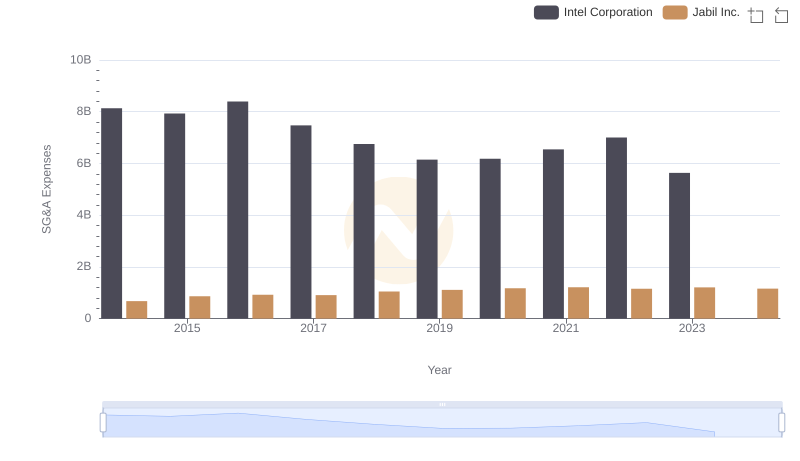

Breaking Down SG&A Expenses: Intel Corporation vs Jabil Inc.

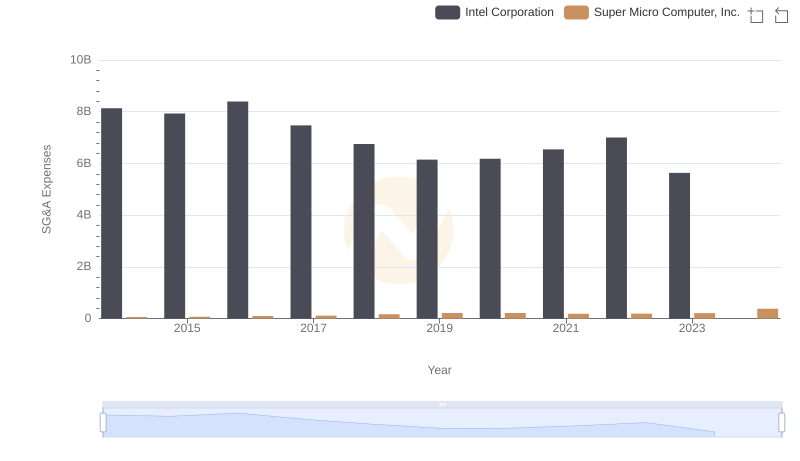

Breaking Down SG&A Expenses: Intel Corporation vs Super Micro Computer, Inc.

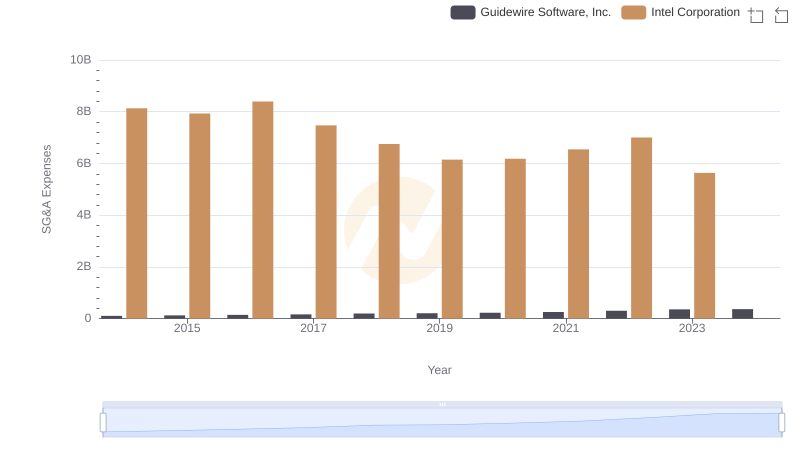

Cost Management Insights: SG&A Expenses for Intel Corporation and Guidewire Software, Inc.

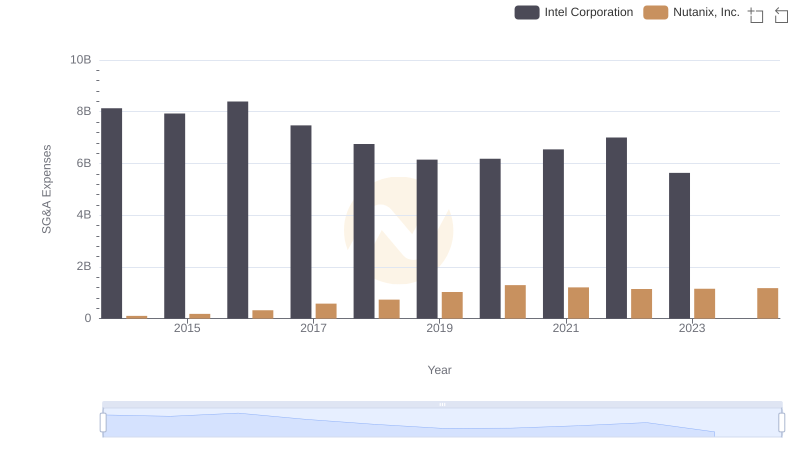

Intel Corporation or Nutanix, Inc.: Who Manages SG&A Costs Better?

Intel Corporation vs Gen Digital Inc.: In-Depth EBITDA Performance Comparison