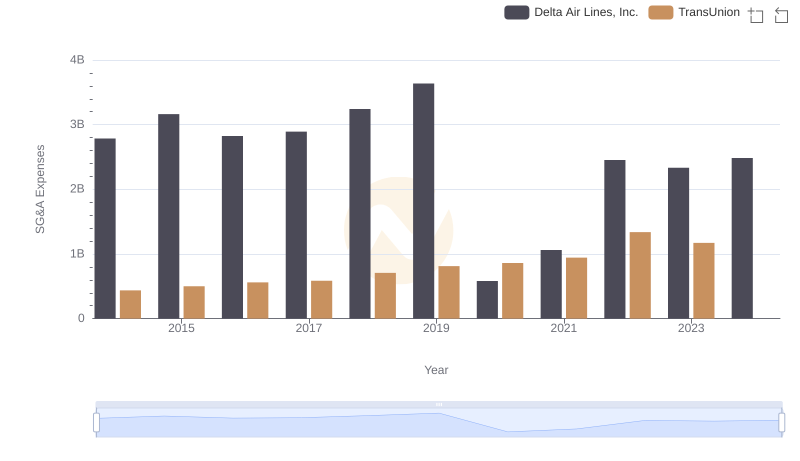

| __timestamp | Delta Air Lines, Inc. | Owens Corning |

|---|---|---|

| Wednesday, January 1, 2014 | 2785000000 | 487000000 |

| Thursday, January 1, 2015 | 3162000000 | 525000000 |

| Friday, January 1, 2016 | 2825000000 | 584000000 |

| Sunday, January 1, 2017 | 2892000000 | 620000000 |

| Monday, January 1, 2018 | 3242000000 | 700000000 |

| Tuesday, January 1, 2019 | 3636000000 | 698000000 |

| Wednesday, January 1, 2020 | 582000000 | 664000000 |

| Friday, January 1, 2021 | 1061000000 | 757000000 |

| Saturday, January 1, 2022 | 2454000000 | 803000000 |

| Sunday, January 1, 2023 | 2334000000 | 831000000 |

| Monday, January 1, 2024 | 2485000000 |

Data in motion

In the ever-evolving landscape of corporate finance, managing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability. Delta Air Lines, Inc. and Owens Corning, two industry leaders, offer a fascinating study in cost management over the past decade.

From 2014 to 2023, Delta Air Lines saw its SG&A expenses fluctuate significantly, peaking in 2019 before a sharp decline in 2020, likely due to the pandemic's impact. By 2023, expenses had stabilized, showing a 36% decrease from their 2019 high. In contrast, Owens Corning's SG&A expenses exhibited a steady upward trend, increasing by approximately 71% from 2014 to 2023.

This divergence highlights the distinct challenges and strategies each company faces in their respective industries. While Delta navigates the volatile airline sector, Owens Corning steadily grows within the building materials market. Understanding these dynamics is key for investors and analysts alike.

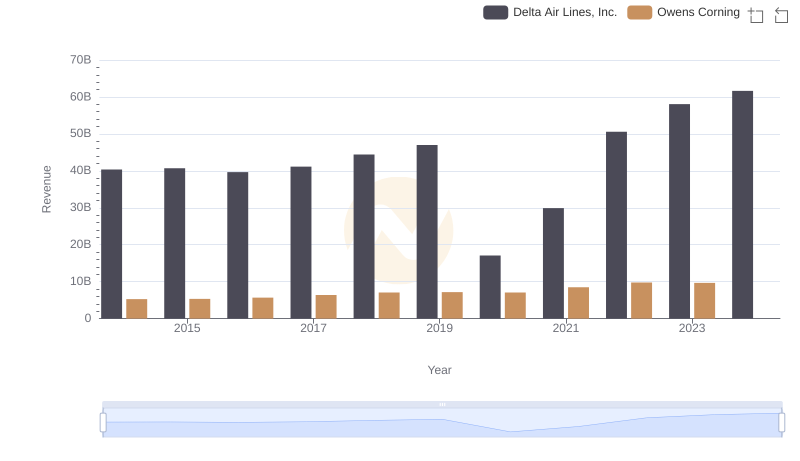

Revenue Showdown: Delta Air Lines, Inc. vs Owens Corning

Cost Management Insights: SG&A Expenses for Delta Air Lines, Inc. and TransUnion

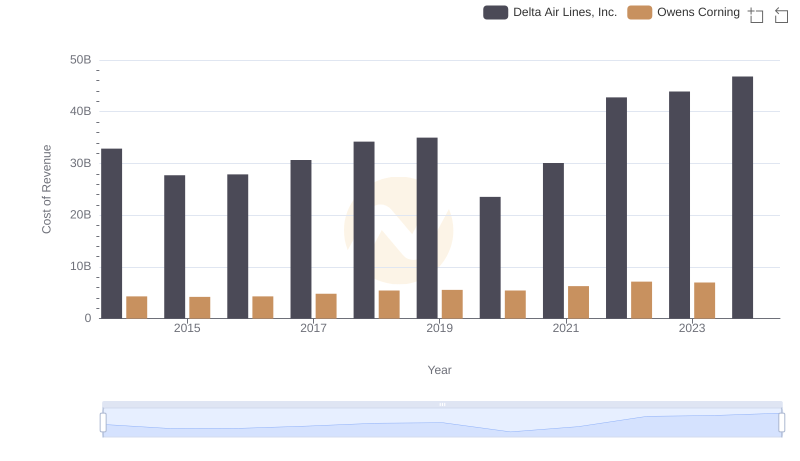

Comparing Cost of Revenue Efficiency: Delta Air Lines, Inc. vs Owens Corning

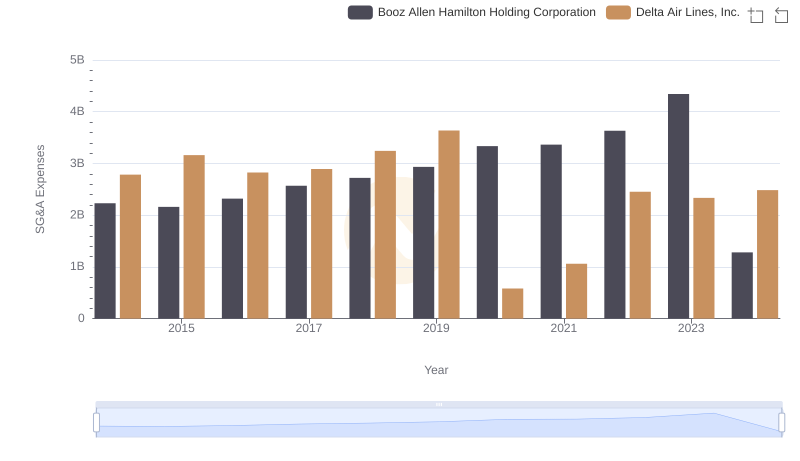

Delta Air Lines, Inc. and Booz Allen Hamilton Holding Corporation: SG&A Spending Patterns Compared

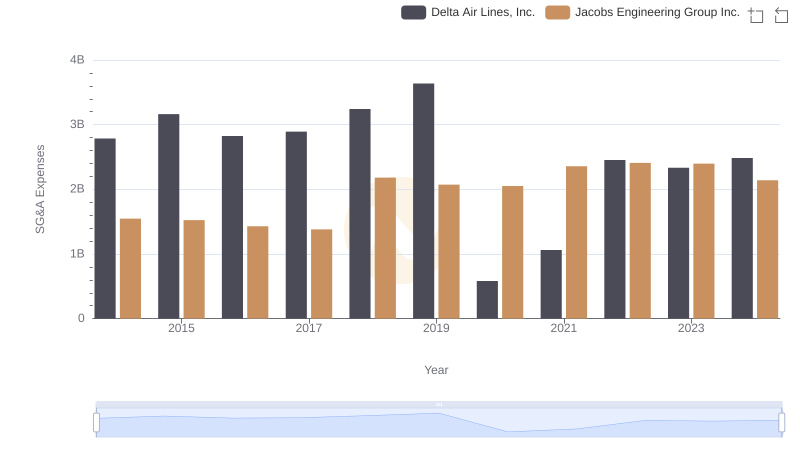

Delta Air Lines, Inc. and Jacobs Engineering Group Inc.: SG&A Spending Patterns Compared

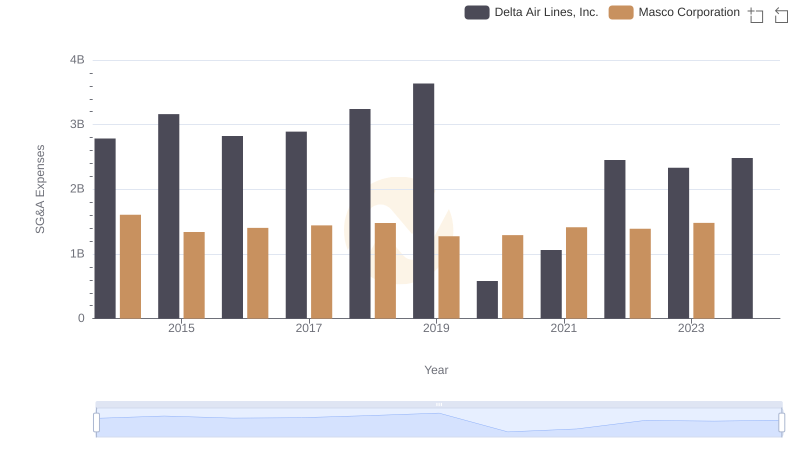

Comparing SG&A Expenses: Delta Air Lines, Inc. vs Masco Corporation Trends and Insights

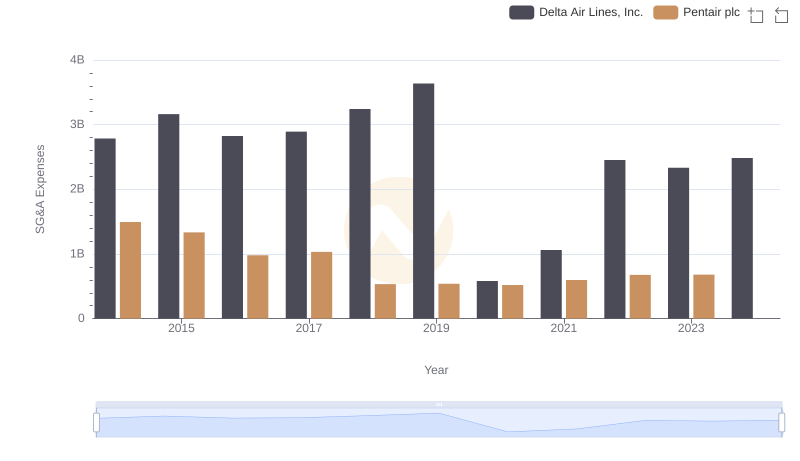

Comparing SG&A Expenses: Delta Air Lines, Inc. vs Pentair plc Trends and Insights

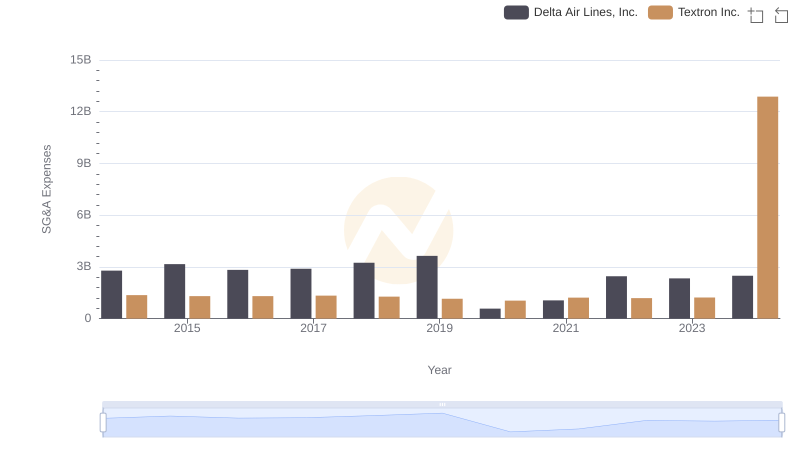

Delta Air Lines, Inc. and Textron Inc.: SG&A Spending Patterns Compared

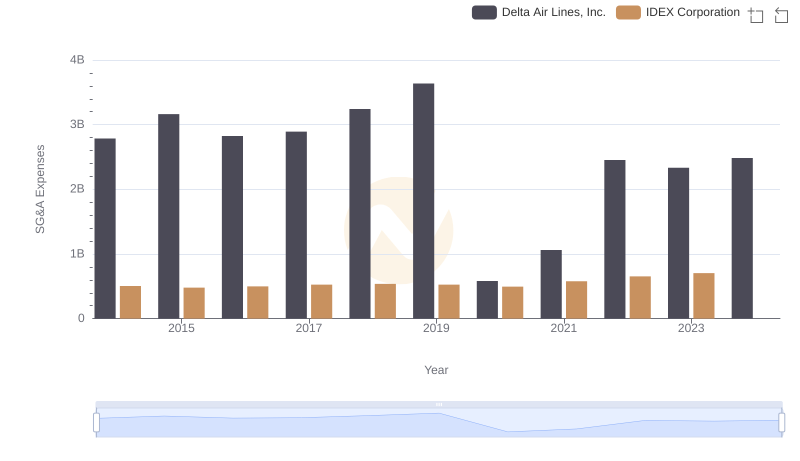

Operational Costs Compared: SG&A Analysis of Delta Air Lines, Inc. and IDEX Corporation

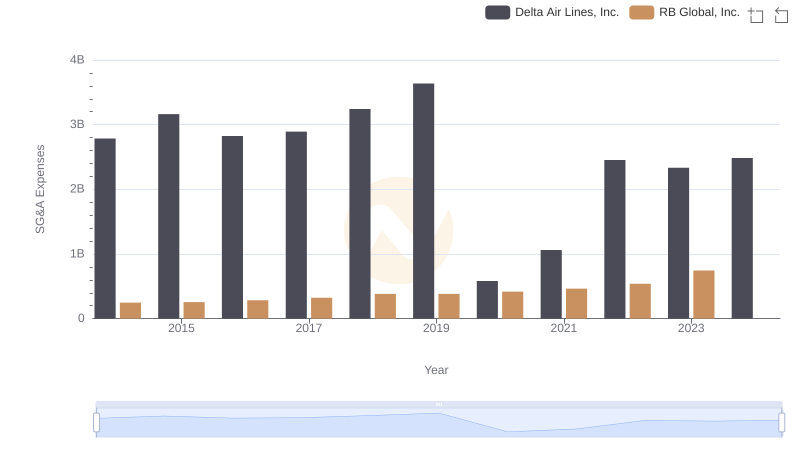

Breaking Down SG&A Expenses: Delta Air Lines, Inc. vs RB Global, Inc.

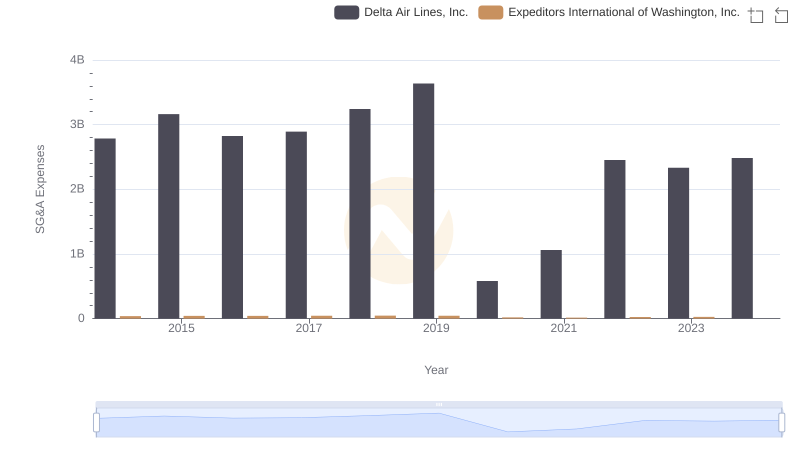

Operational Costs Compared: SG&A Analysis of Delta Air Lines, Inc. and Expeditors International of Washington, Inc.

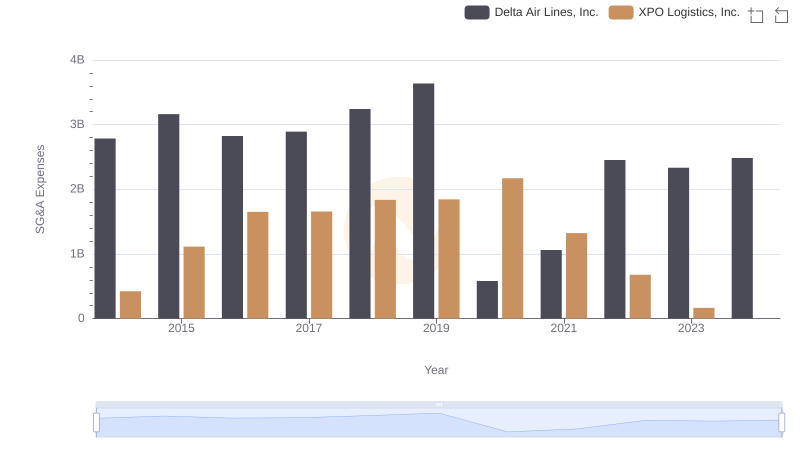

Delta Air Lines, Inc. or XPO Logistics, Inc.: Who Manages SG&A Costs Better?