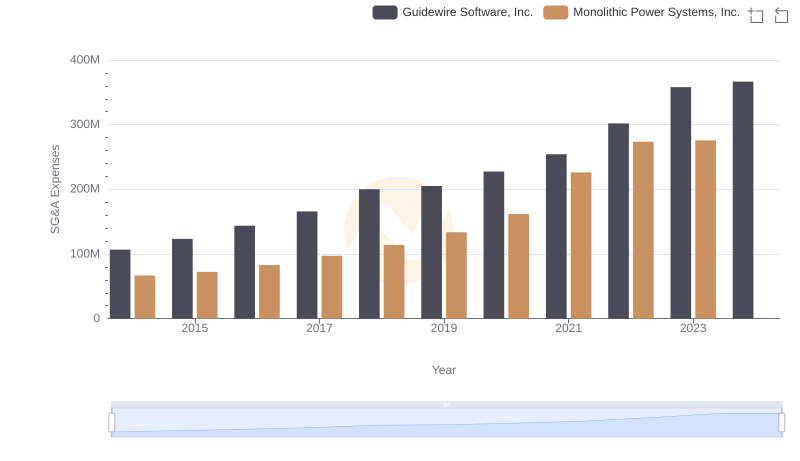

| __timestamp | Guidewire Software, Inc. | Monolithic Power Systems, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 148947000 | 129917000 |

| Thursday, January 1, 2015 | 147184000 | 152898000 |

| Friday, January 1, 2016 | 151834000 | 177792000 |

| Sunday, January 1, 2017 | 191559000 | 212646000 |

| Monday, January 1, 2018 | 296707000 | 259714000 |

| Tuesday, January 1, 2019 | 324350000 | 281596000 |

| Wednesday, January 1, 2020 | 338015000 | 378498000 |

| Friday, January 1, 2021 | 375054000 | 522339000 |

| Saturday, January 1, 2022 | 460394000 | 745596000 |

| Sunday, January 1, 2023 | 447130000 | 799953000 |

| Monday, January 1, 2024 | 397136000 |

Data in motion

In the ever-evolving landscape of technology, understanding the cost dynamics of leading companies is crucial. Monolithic Power Systems, Inc. and Guidewire Software, Inc. have shown distinct trends in their cost of revenue over the past decade. From 2014 to 2023, Guidewire Software's cost of revenue increased by approximately 200%, peaking in 2022. Meanwhile, Monolithic Power Systems experienced a staggering growth of over 500% in the same period, with a notable surge in 2022. This divergence highlights the varying operational strategies and market conditions faced by these companies. Interestingly, data for Monolithic Power Systems in 2024 is missing, suggesting potential shifts or reporting changes. As we delve into these insights, it becomes evident that cost management remains a pivotal factor in sustaining competitive advantage in the tech industry.

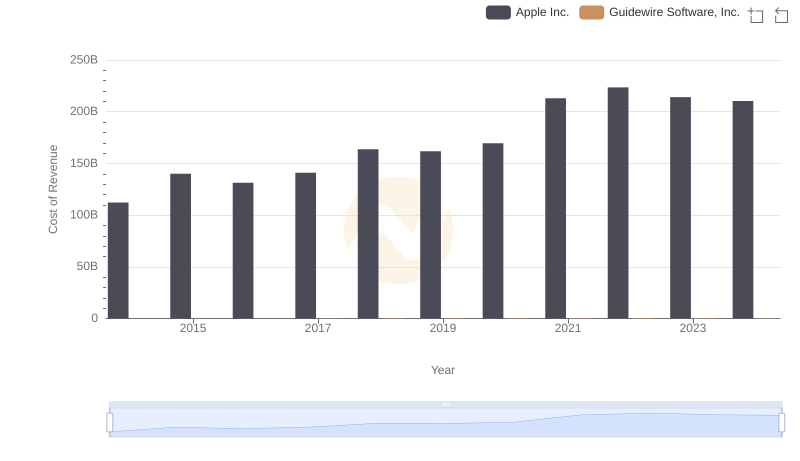

Apple Inc. vs Guidewire Software, Inc.: Efficiency in Cost of Revenue Explored

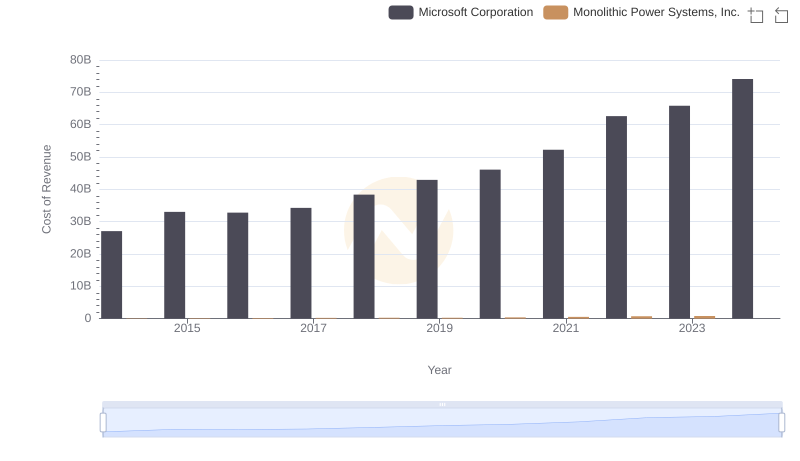

Cost of Revenue Comparison: Microsoft Corporation vs Monolithic Power Systems, Inc.

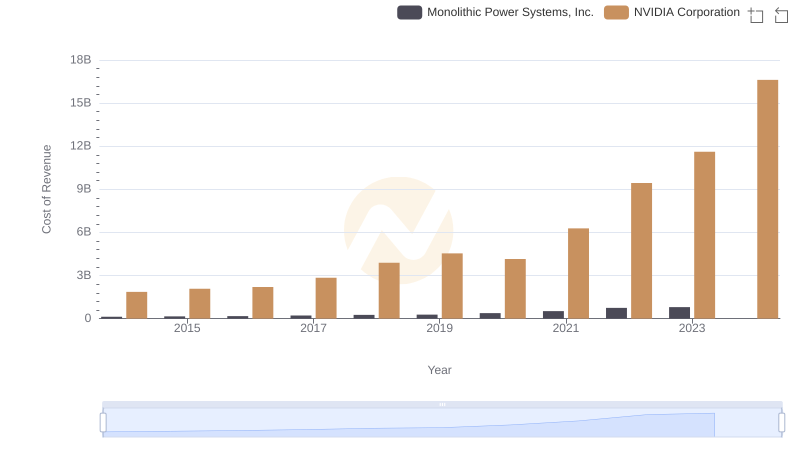

Analyzing Cost of Revenue: NVIDIA Corporation and Monolithic Power Systems, Inc.

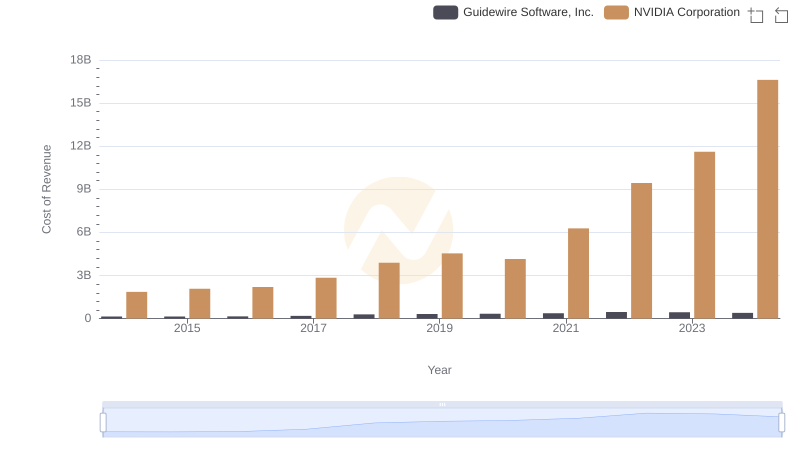

Cost Insights: Breaking Down NVIDIA Corporation and Guidewire Software, Inc.'s Expenses

Comparing Cost of Revenue Efficiency: Taiwan Semiconductor Manufacturing Company Limited vs Monolithic Power Systems, Inc.

Comparing Cost of Revenue Efficiency: Taiwan Semiconductor Manufacturing Company Limited vs Guidewire Software, Inc.

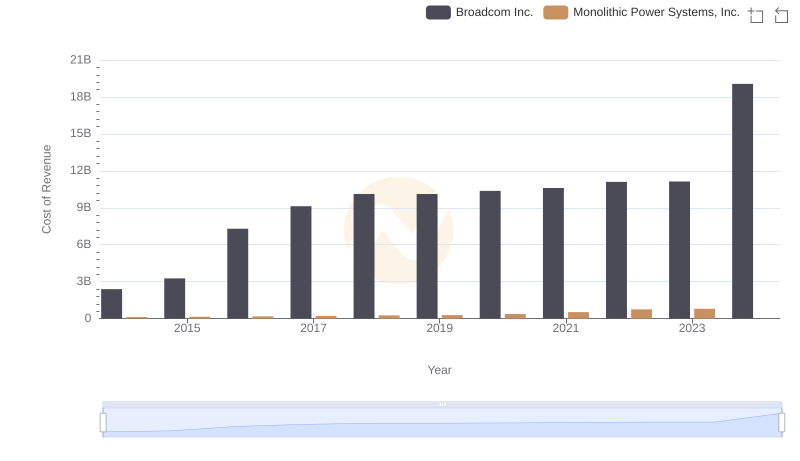

Analyzing Cost of Revenue: Broadcom Inc. and Monolithic Power Systems, Inc.

Cost of Revenue Trends: Broadcom Inc. vs Guidewire Software, Inc.

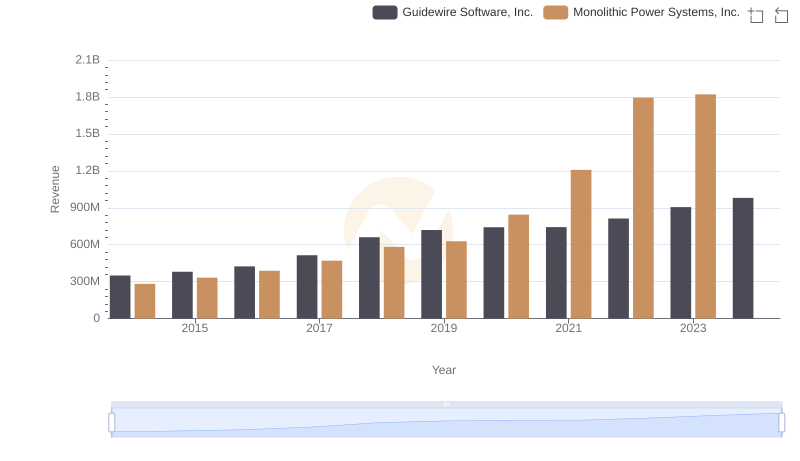

Monolithic Power Systems, Inc. or Guidewire Software, Inc.: Who Leads in Yearly Revenue?

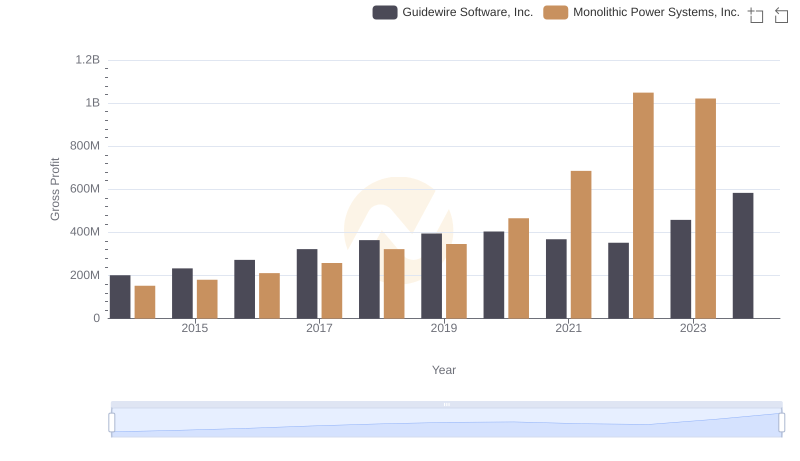

Key Insights on Gross Profit: Monolithic Power Systems, Inc. vs Guidewire Software, Inc.

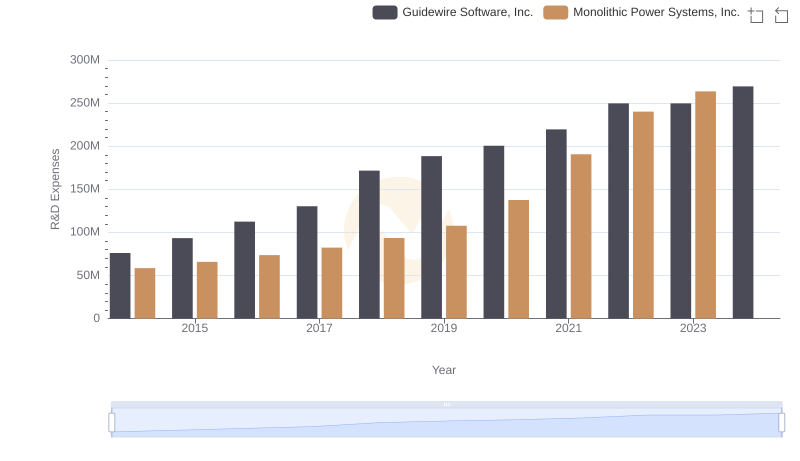

Monolithic Power Systems, Inc. or Guidewire Software, Inc.: Who Invests More in Innovation?

Comparing SG&A Expenses: Monolithic Power Systems, Inc. vs Guidewire Software, Inc. Trends and Insights