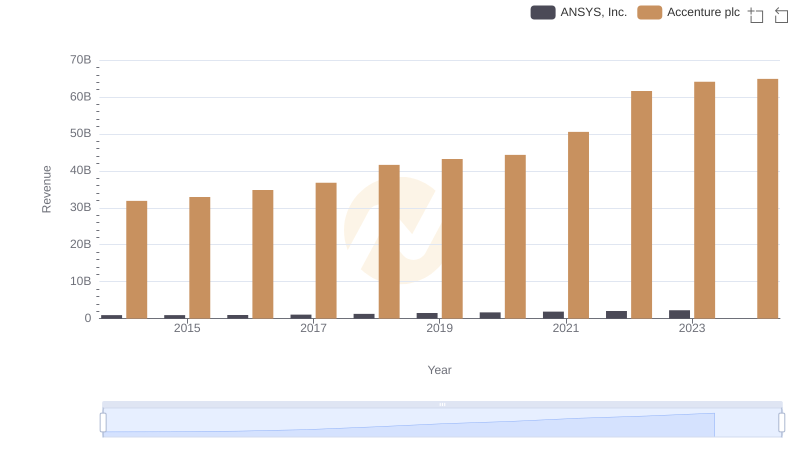

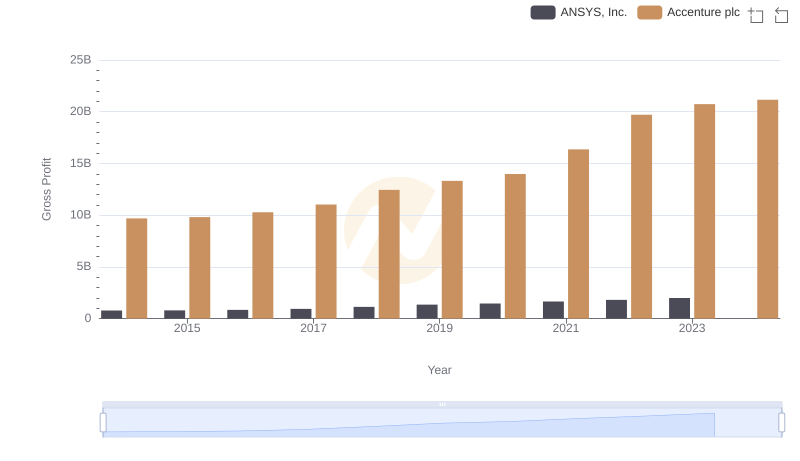

| __timestamp | ANSYS, Inc. | Accenture plc |

|---|---|---|

| Wednesday, January 1, 2014 | 153386000 | 22190212000 |

| Thursday, January 1, 2015 | 147246000 | 23105185000 |

| Friday, January 1, 2016 | 146860000 | 24520234000 |

| Sunday, January 1, 2017 | 150164000 | 25734986000 |

| Monday, January 1, 2018 | 155885000 | 29160515000 |

| Tuesday, January 1, 2019 | 166273000 | 29900325000 |

| Wednesday, January 1, 2020 | 225264000 | 30350881000 |

| Friday, January 1, 2021 | 257984000 | 34169261000 |

| Saturday, January 1, 2022 | 250641000 | 41892766000 |

| Sunday, January 1, 2023 | 271298000 | 43380138000 |

| Monday, January 1, 2024 | 279819000 | 43734147000 |

Unveiling the hidden dimensions of data

In the ever-evolving landscape of corporate finance, understanding the cost structures of leading companies is crucial. This analysis delves into the cost of revenue trends for Accenture plc and ANSYS, Inc. over the past decade, offering a window into their financial strategies and market positioning.

Accenture's cost of revenue has shown a consistent upward trajectory from 2014 to 2023, with a notable increase of approximately 96% over this period. This growth reflects Accenture's expanding global footprint and its strategic investments in technology and talent.

ANSYS, Inc. has also experienced a rise in its cost of revenue, albeit at a more modest pace. From 2014 to 2023, ANSYS's costs increased by around 77%, indicating a steady expansion in its operations and product offerings.

While Accenture's data extends into 2024, ANSYS's figures are not available for this year, suggesting potential reporting delays or strategic shifts.

This comparative analysis highlights the dynamic nature of cost management in the tech industry, offering valuable insights for investors and analysts alike.

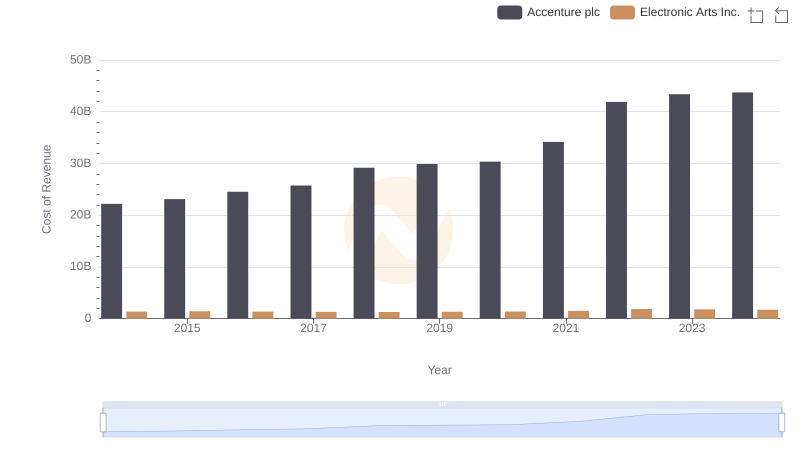

Cost Insights: Breaking Down Accenture plc and Electronic Arts Inc.'s Expenses

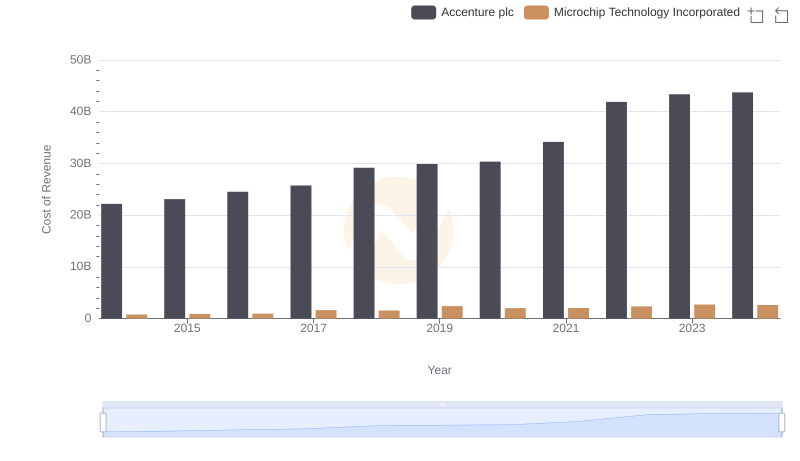

Comparing Cost of Revenue Efficiency: Accenture plc vs Microchip Technology Incorporated

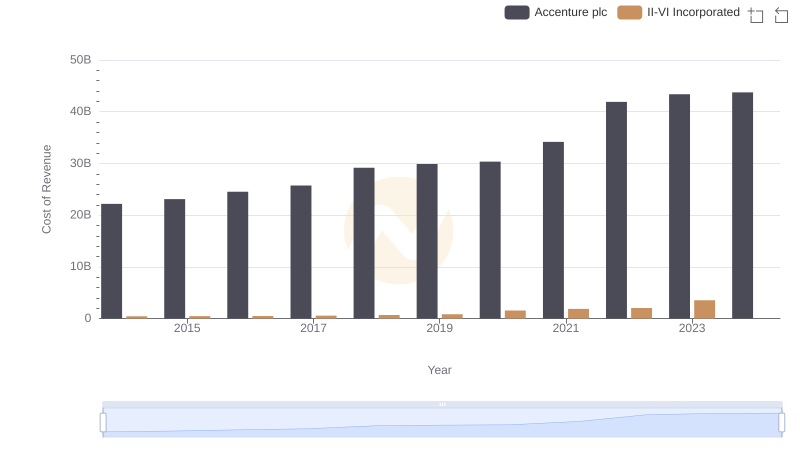

Cost of Revenue Comparison: Accenture plc vs II-VI Incorporated

Who Generates More Revenue? Accenture plc or ANSYS, Inc.

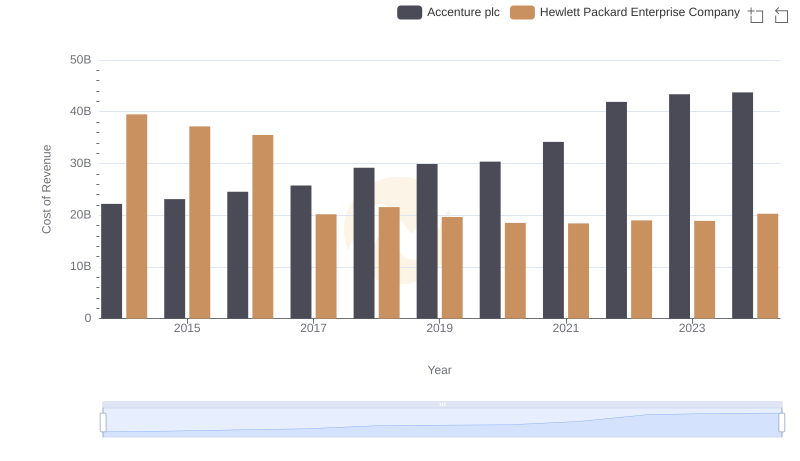

Cost Insights: Breaking Down Accenture plc and Hewlett Packard Enterprise Company's Expenses

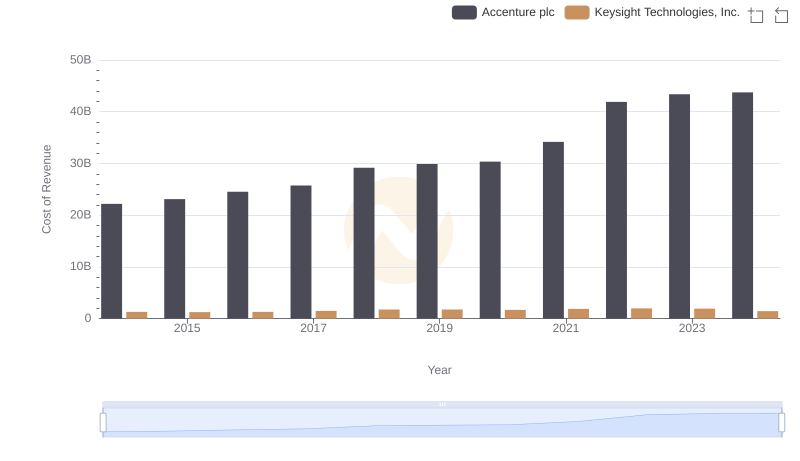

Cost of Revenue Trends: Accenture plc vs Keysight Technologies, Inc.

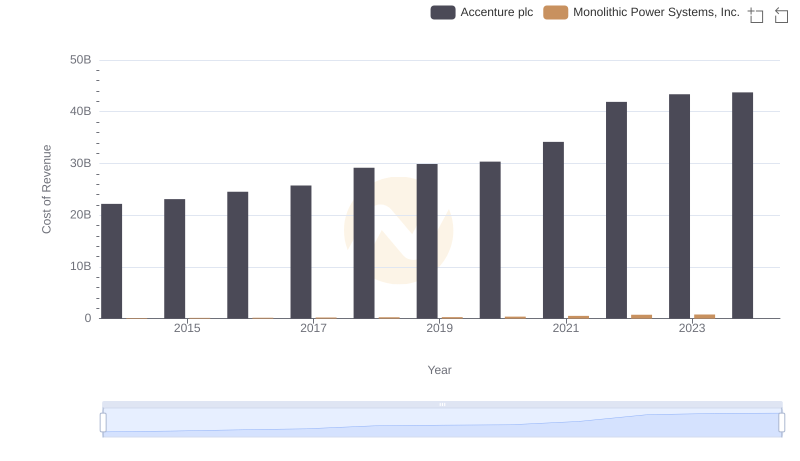

Cost of Revenue Trends: Accenture plc vs Monolithic Power Systems, Inc.

Key Insights on Gross Profit: Accenture plc vs ANSYS, Inc.

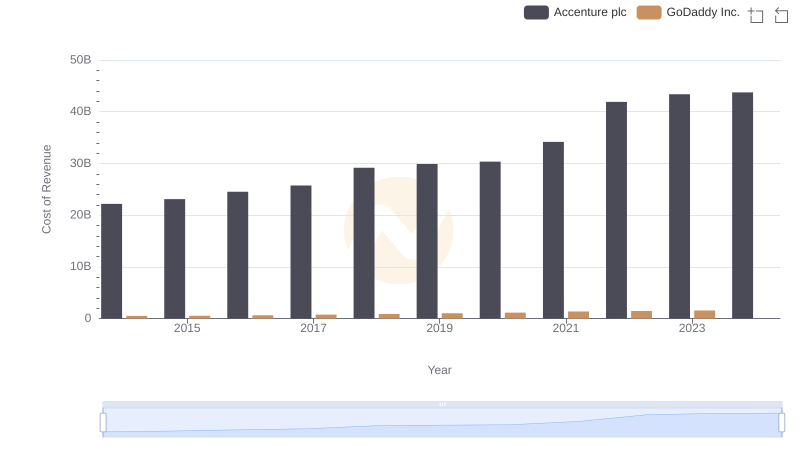

Analyzing Cost of Revenue: Accenture plc and GoDaddy Inc.

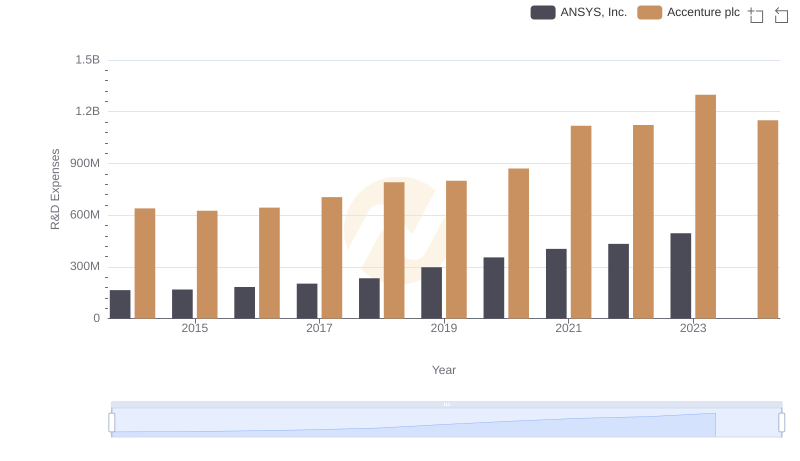

Who Prioritizes Innovation? R&D Spending Compared for Accenture plc and ANSYS, Inc.

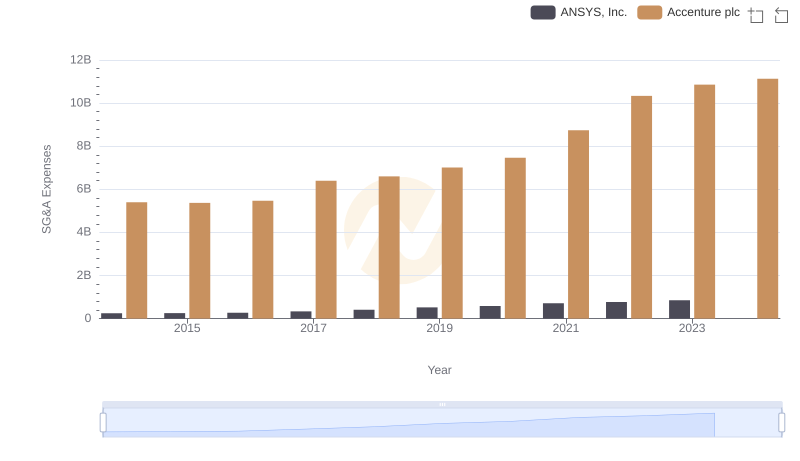

Accenture plc and ANSYS, Inc.: SG&A Spending Patterns Compared

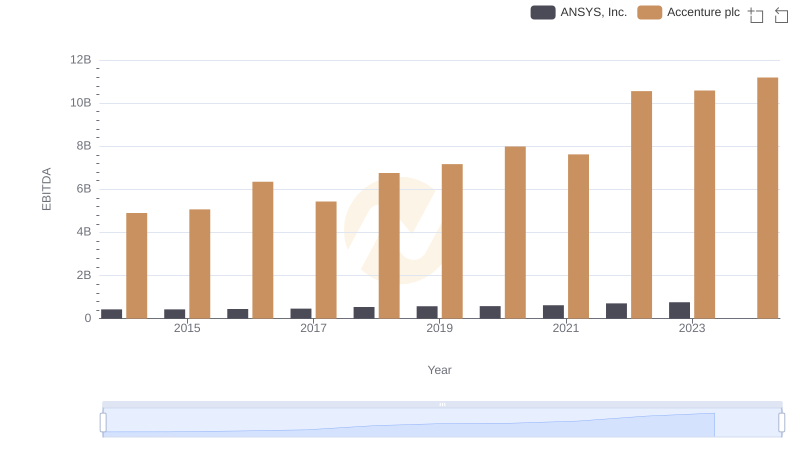

Accenture plc vs ANSYS, Inc.: In-Depth EBITDA Performance Comparison