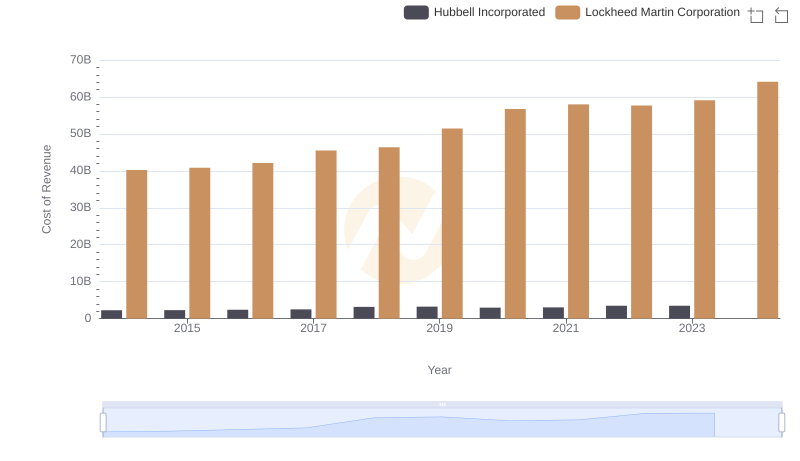

| __timestamp | Hubbell Incorporated | Lockheed Martin Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 594700000 | 6592000000 |

| Thursday, January 1, 2015 | 533600000 | 5687000000 |

| Friday, January 1, 2016 | 564700000 | 6716000000 |

| Sunday, January 1, 2017 | 585600000 | 7092000000 |

| Monday, January 1, 2018 | 677500000 | 7667000000 |

| Tuesday, January 1, 2019 | 740900000 | 9083000000 |

| Wednesday, January 1, 2020 | 671400000 | 10116000000 |

| Friday, January 1, 2021 | 661000000 | 9483000000 |

| Saturday, January 1, 2022 | 854300000 | 8707000000 |

| Sunday, January 1, 2023 | 1169700000 | 10444000000 |

| Monday, January 1, 2024 | 1291200000 | 8815000000 |

Unleashing the power of data

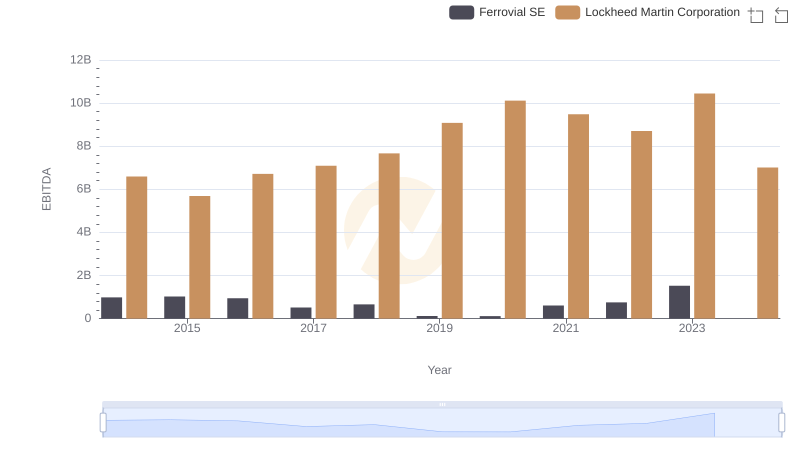

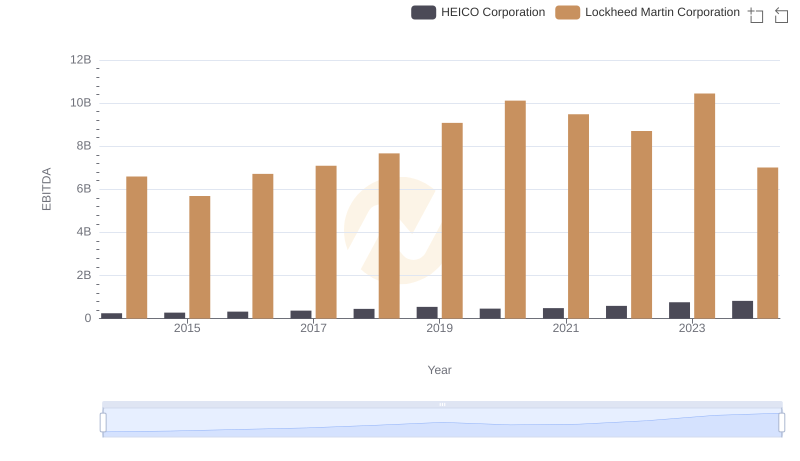

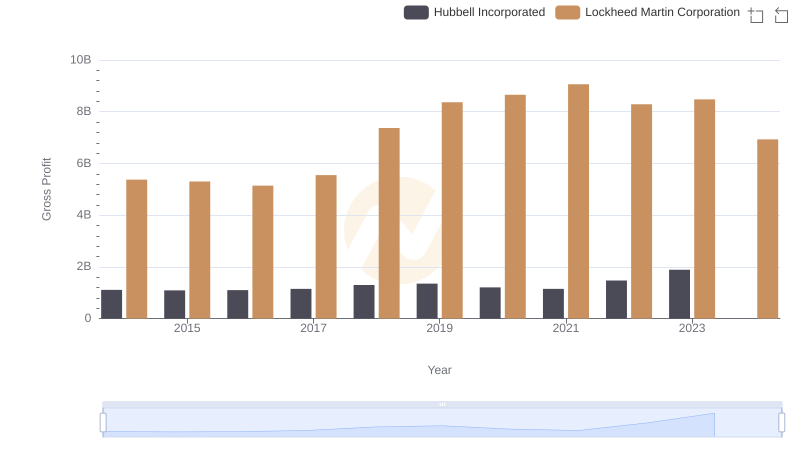

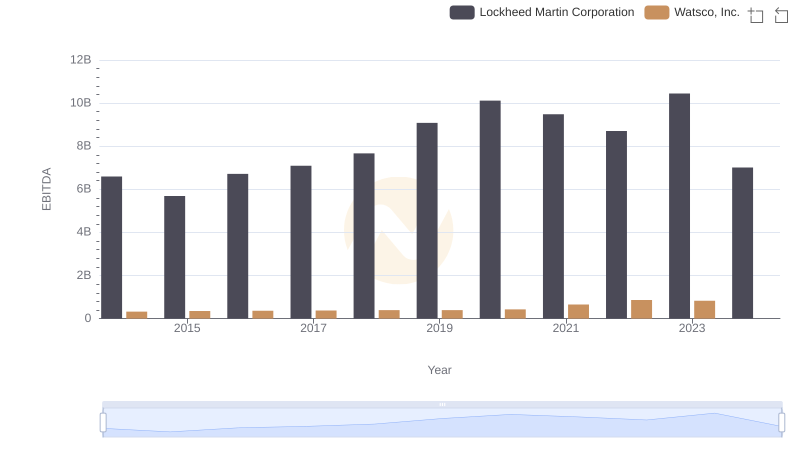

In the ever-evolving landscape of American industry, Lockheed Martin Corporation and Hubbell Incorporated stand as titans in their respective fields. Over the past decade, from 2014 to 2023, these companies have showcased their financial prowess through EBITDA performance. Lockheed Martin, a leader in aerospace and defense, consistently outperformed Hubbell, an electrical and electronic products manufacturer, with EBITDA figures often exceeding Hubbell's by over 1,000%. Notably, in 2023, Lockheed Martin's EBITDA peaked at approximately $10.4 billion, while Hubbell reached its highest at $1.17 billion, marking a significant 37% increase from the previous year. This data highlights the resilience and growth potential of these companies, even amidst economic fluctuations. However, 2024 data for Hubbell remains elusive, leaving room for speculation on future trends. As these giants continue to innovate, their financial trajectories will be closely watched by investors and industry analysts alike.

Lockheed Martin Corporation or Hubbell Incorporated: Who Leads in Yearly Revenue?

Cost of Revenue Comparison: Lockheed Martin Corporation vs Hubbell Incorporated

A Professional Review of EBITDA: Lockheed Martin Corporation Compared to Verisk Analytics, Inc.

Comprehensive EBITDA Comparison: Lockheed Martin Corporation vs Ferrovial SE

EBITDA Metrics Evaluated: Lockheed Martin Corporation vs HEICO Corporation

Lockheed Martin Corporation and Hubbell Incorporated: A Detailed Gross Profit Analysis

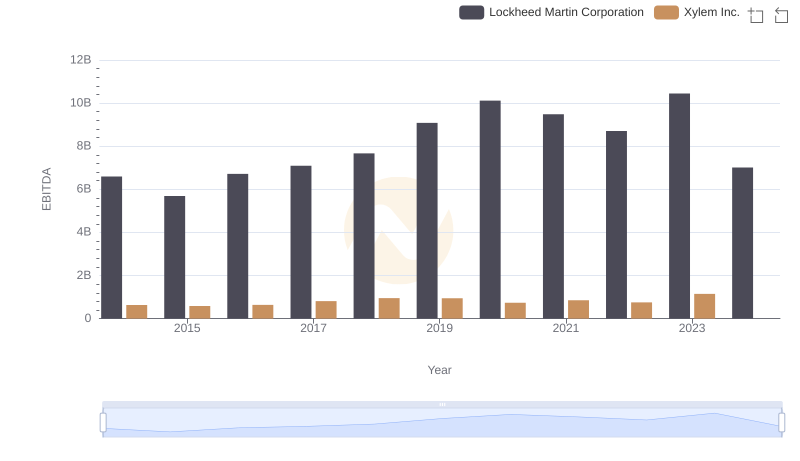

A Side-by-Side Analysis of EBITDA: Lockheed Martin Corporation and Xylem Inc.

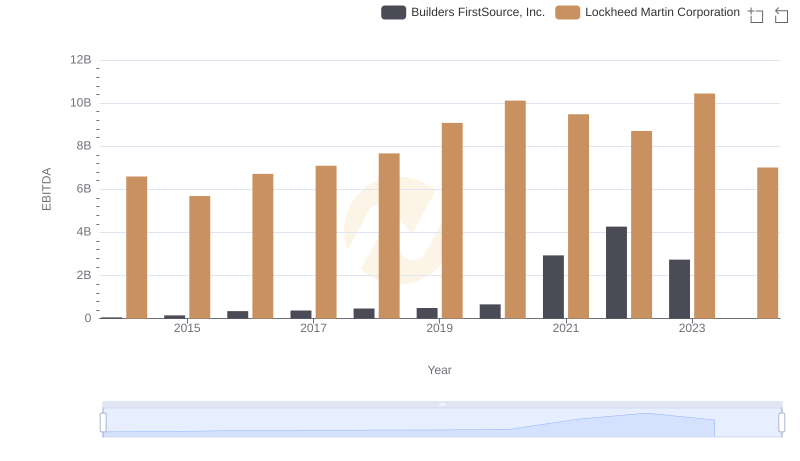

Comparative EBITDA Analysis: Lockheed Martin Corporation vs Builders FirstSource, Inc.

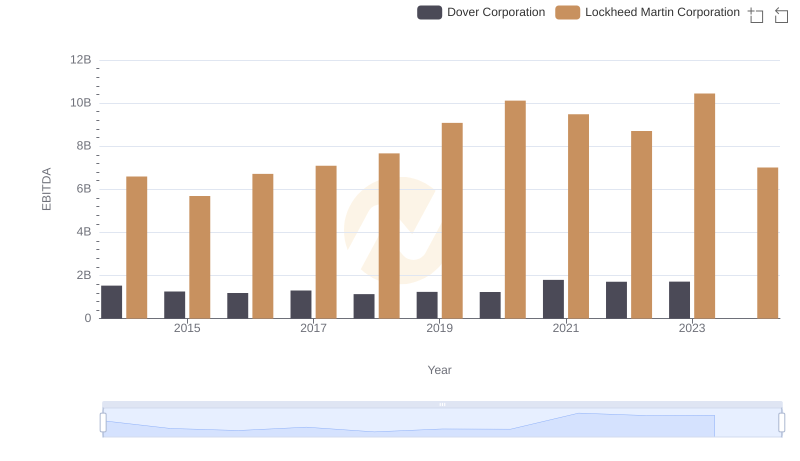

EBITDA Performance Review: Lockheed Martin Corporation vs Dover Corporation

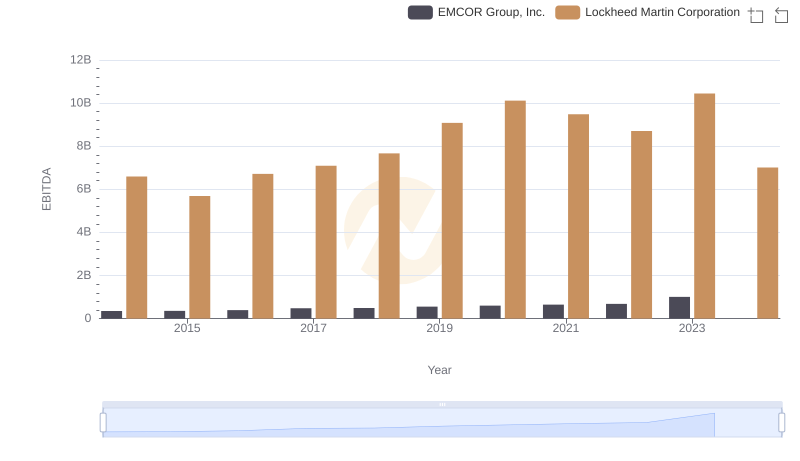

A Professional Review of EBITDA: Lockheed Martin Corporation Compared to EMCOR Group, Inc.

EBITDA Performance Review: Lockheed Martin Corporation vs Watsco, Inc.