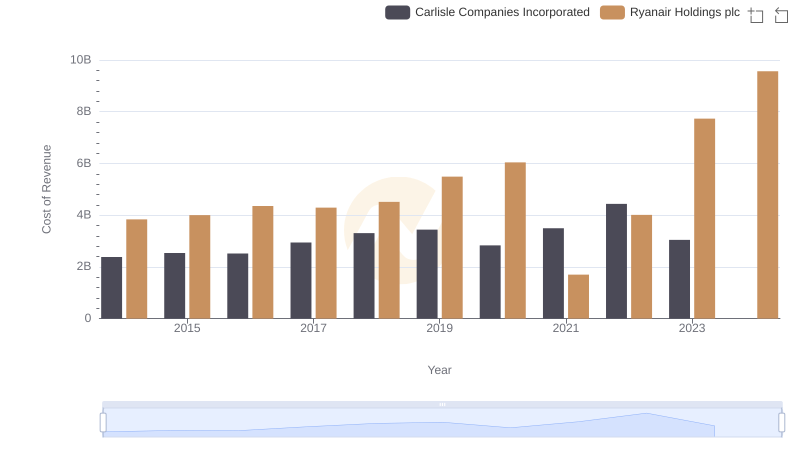

| __timestamp | Carlisle Companies Incorporated | Ryanair Holdings plc |

|---|---|---|

| Wednesday, January 1, 2014 | 3204000000 | 5036700000 |

| Thursday, January 1, 2015 | 3543200000 | 5654000000 |

| Friday, January 1, 2016 | 3675400000 | 6535800000 |

| Sunday, January 1, 2017 | 4089900000 | 6647800000 |

| Monday, January 1, 2018 | 4479500000 | 7151000000 |

| Tuesday, January 1, 2019 | 4811600000 | 7697400000 |

| Wednesday, January 1, 2020 | 3969900000 | 8494799999 |

| Friday, January 1, 2021 | 4810300000 | 1635800000 |

| Saturday, January 1, 2022 | 6591900000 | 4800900000 |

| Sunday, January 1, 2023 | 4586900000 | 10775200000 |

| Monday, January 1, 2024 | 5003600000 | 13443800000 |

Unleashing the power of data

In the ever-evolving landscape of global business, Ryanair Holdings plc and Carlisle Companies Incorporated stand as titans in their respective industries. Over the past decade, Ryanair, a leader in low-cost aviation, has consistently outperformed Carlisle, a diversified manufacturing company, in terms of revenue. From 2014 to 2023, Ryanair's revenue soared by approximately 167%, peaking in 2023 with a staggering 13.4 billion. In contrast, Carlisle's revenue grew by about 43% during the same period, reaching its zenith in 2022.

This comparison highlights the dynamic nature of revenue performance across different sectors, offering valuable insights for investors and industry analysts alike.

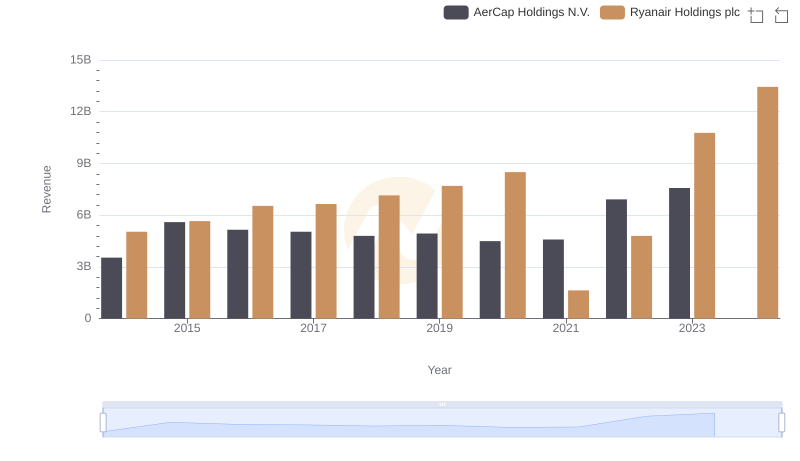

Revenue Showdown: Ryanair Holdings plc vs AerCap Holdings N.V.

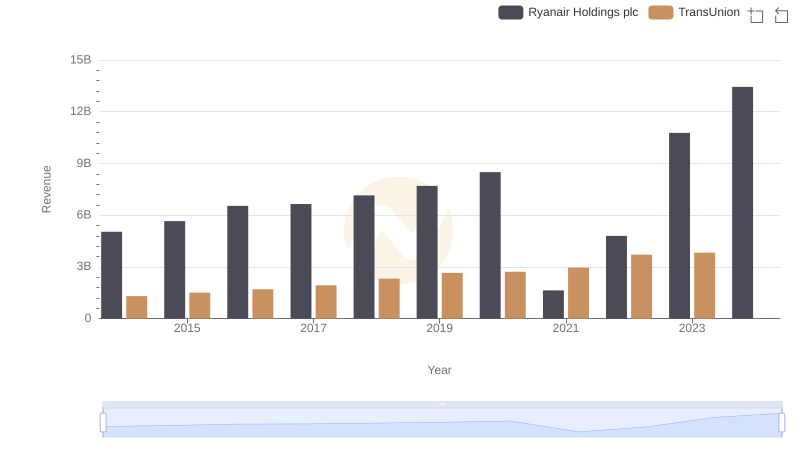

Ryanair Holdings plc or TransUnion: Who Leads in Yearly Revenue?

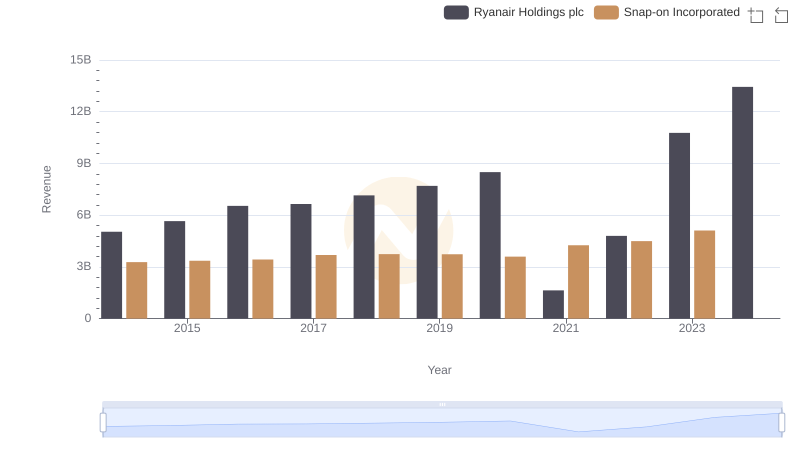

Ryanair Holdings plc vs Snap-on Incorporated: Examining Key Revenue Metrics

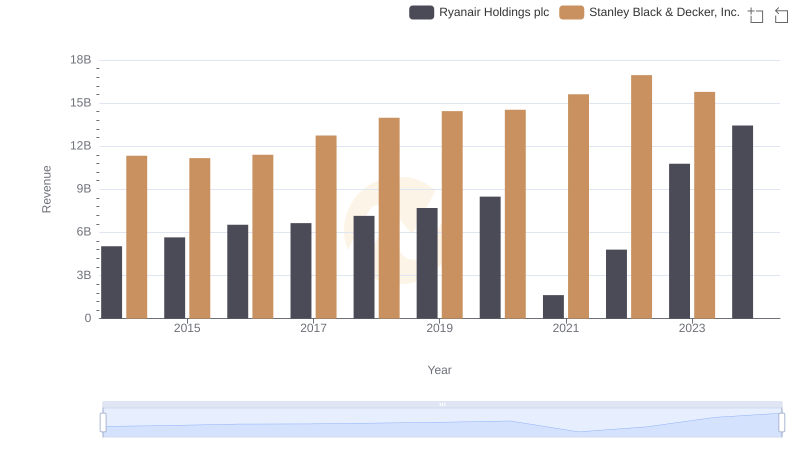

Annual Revenue Comparison: Ryanair Holdings plc vs Stanley Black & Decker, Inc.

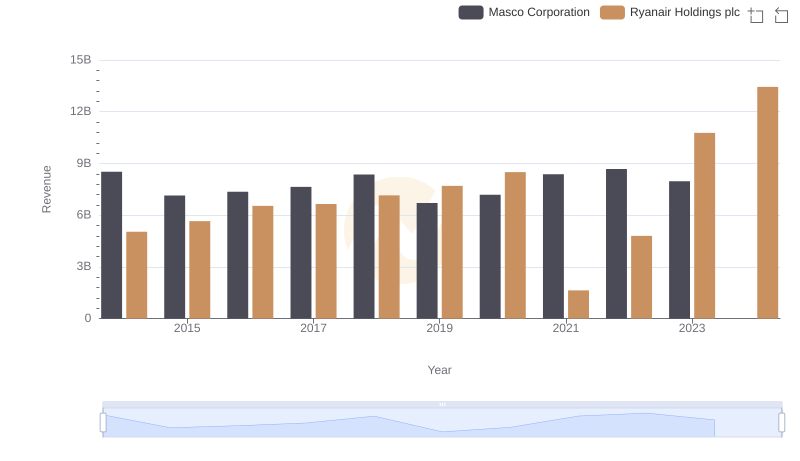

Revenue Insights: Ryanair Holdings plc and Masco Corporation Performance Compared

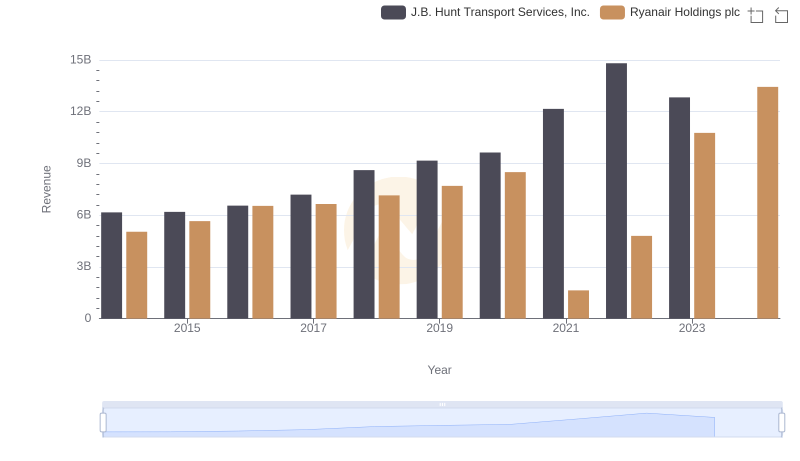

Ryanair Holdings plc vs J.B. Hunt Transport Services, Inc.: Annual Revenue Growth Compared

Revenue Insights: Ryanair Holdings plc and Booz Allen Hamilton Holding Corporation Performance Compared

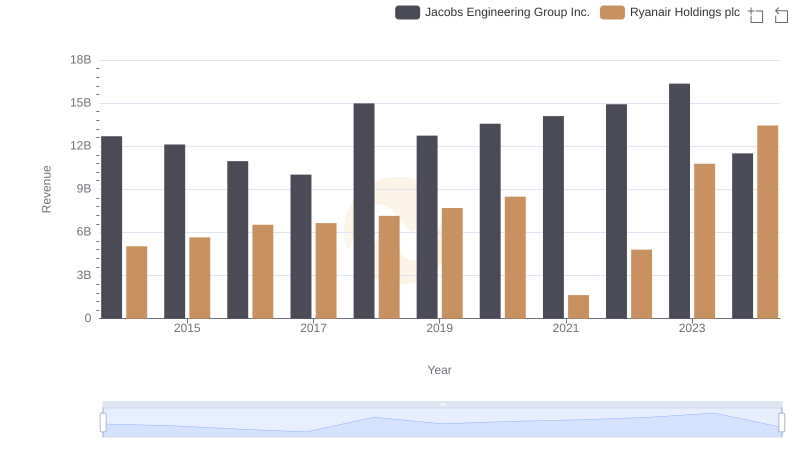

Who Generates More Revenue? Ryanair Holdings plc or Jacobs Engineering Group Inc.

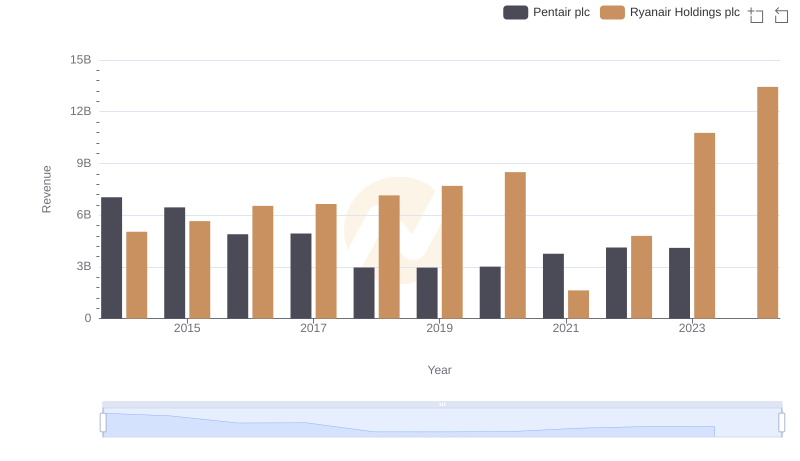

Ryanair Holdings plc vs Pentair plc: Examining Key Revenue Metrics

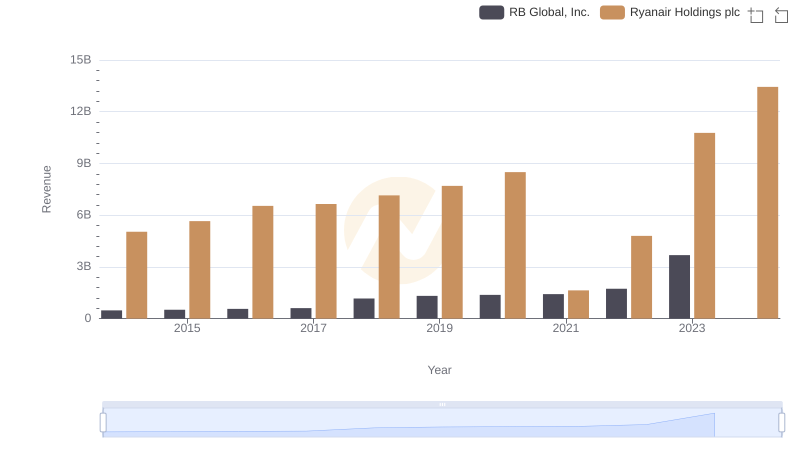

Comparing Revenue Performance: Ryanair Holdings plc or RB Global, Inc.?

Cost of Revenue Comparison: Ryanair Holdings plc vs Carlisle Companies Incorporated

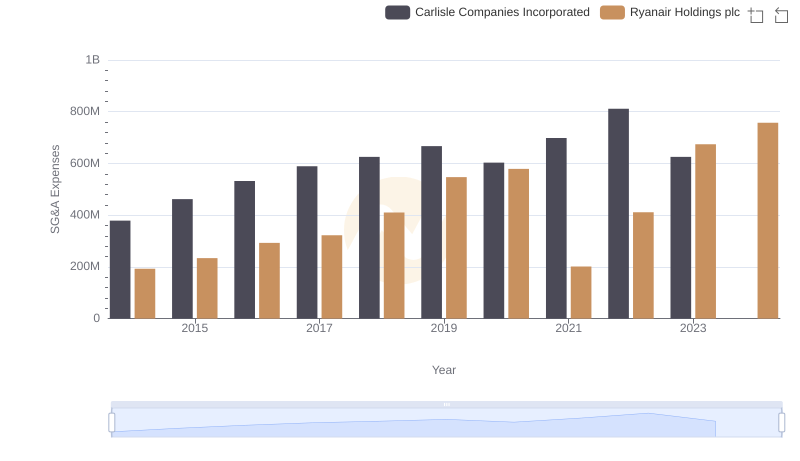

Selling, General, and Administrative Costs: Ryanair Holdings plc vs Carlisle Companies Incorporated