| __timestamp | Bristol-Myers Squibb Company | Takeda Pharmaceutical Company Limited |

|---|---|---|

| Wednesday, January 1, 2014 | 15879000000 | 1777824000000 |

| Thursday, January 1, 2015 | 16560000000 | 1807378000000 |

| Friday, January 1, 2016 | 19427000000 | 1732051000000 |

| Sunday, January 1, 2017 | 20776000000 | 1770531000000 |

| Monday, January 1, 2018 | 22561000000 | 2097224000000 |

| Tuesday, January 1, 2019 | 26145000000 | 3291188000000 |

| Wednesday, January 1, 2020 | 42518000000 | 3197812000000 |

| Friday, January 1, 2021 | 46385000000 | 3569006000000 |

| Saturday, January 1, 2022 | 46159000000 | 4027478000000 |

| Sunday, January 1, 2023 | 45006000000 | 4263762000000 |

| Monday, January 1, 2024 | 48300000000 | 4263762000000 |

Unleashing insights

In the ever-evolving pharmaceutical industry, revenue growth is a key indicator of a company's market position and innovation prowess. Over the past decade, Bristol-Myers Squibb Company and Takeda Pharmaceutical Company Limited have showcased contrasting revenue trajectories. From 2014 to 2023, Bristol-Myers Squibb's revenue surged by approximately 184%, reflecting its strategic acquisitions and robust product pipeline. In contrast, Takeda's revenue, already at a towering level, grew by about 140%, underscoring its dominance in the global market.

Notably, Takeda's revenue in 2023 was nearly 100 times that of Bristol-Myers Squibb, highlighting its expansive reach and diversified portfolio. However, the data for 2024 is incomplete, leaving room for speculation on future trends. As these pharmaceutical giants continue to innovate, their revenue performance will remain a focal point for investors and industry analysts alike.

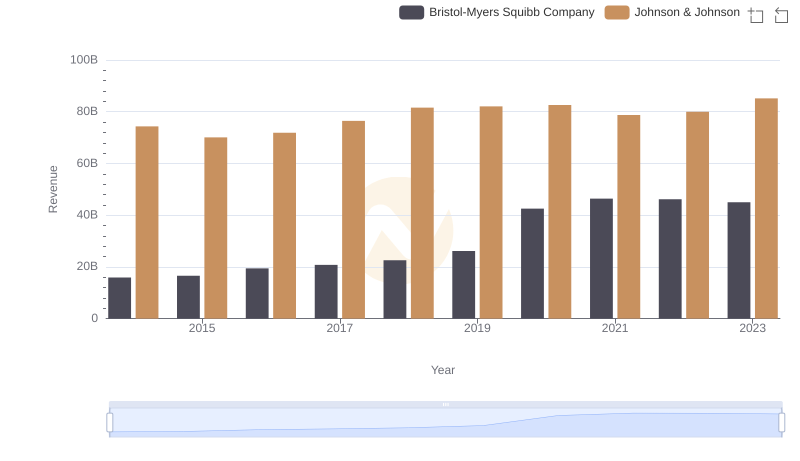

Breaking Down Revenue Trends: Johnson & Johnson vs Bristol-Myers Squibb Company

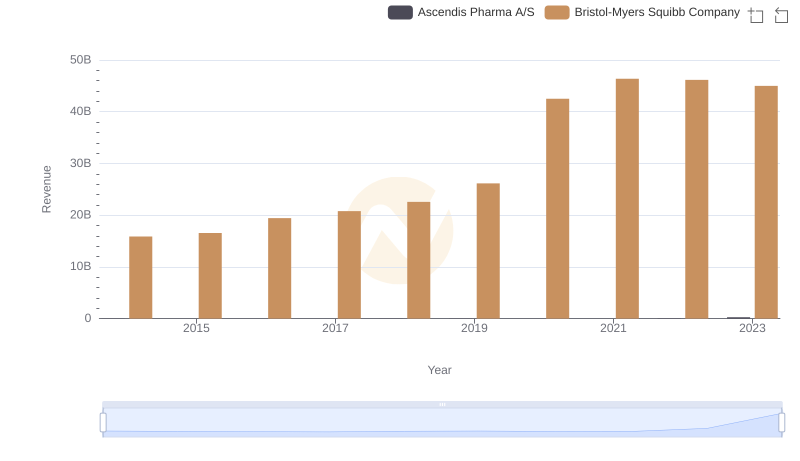

Bristol-Myers Squibb Company vs Ascendis Pharma A/S: Annual Revenue Growth Compared

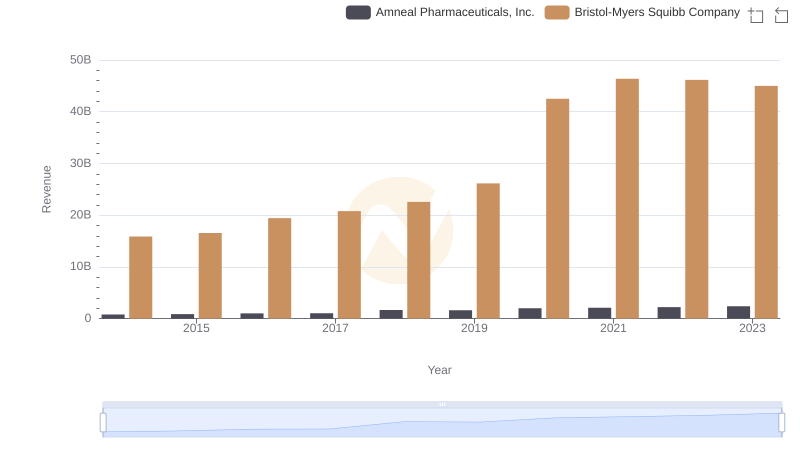

Revenue Showdown: Bristol-Myers Squibb Company vs Amneal Pharmaceuticals, Inc.

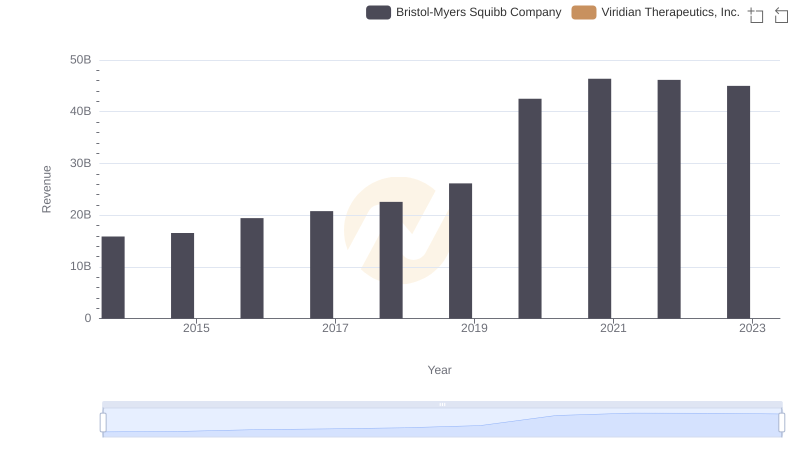

Revenue Showdown: Bristol-Myers Squibb Company vs Viridian Therapeutics, Inc.

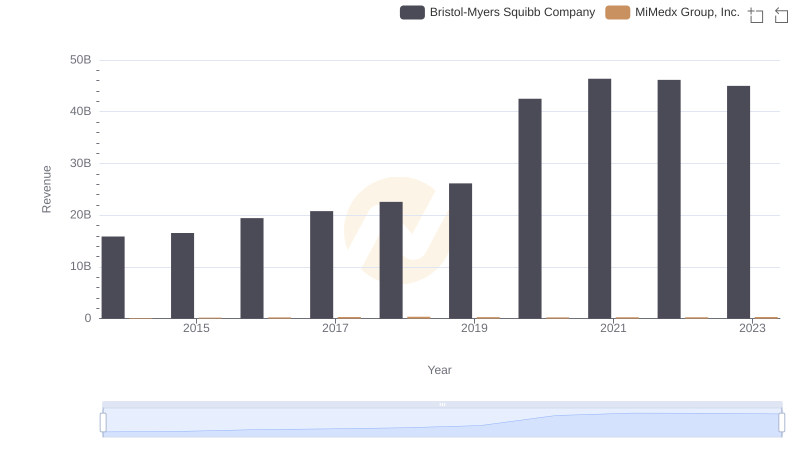

Who Generates More Revenue? Bristol-Myers Squibb Company or MiMedx Group, Inc.

Comparing Revenue Performance: Vertex Pharmaceuticals Incorporated or Takeda Pharmaceutical Company Limited?

Takeda Pharmaceutical Company Limited or Viatris Inc.: Who Leads in Yearly Revenue?

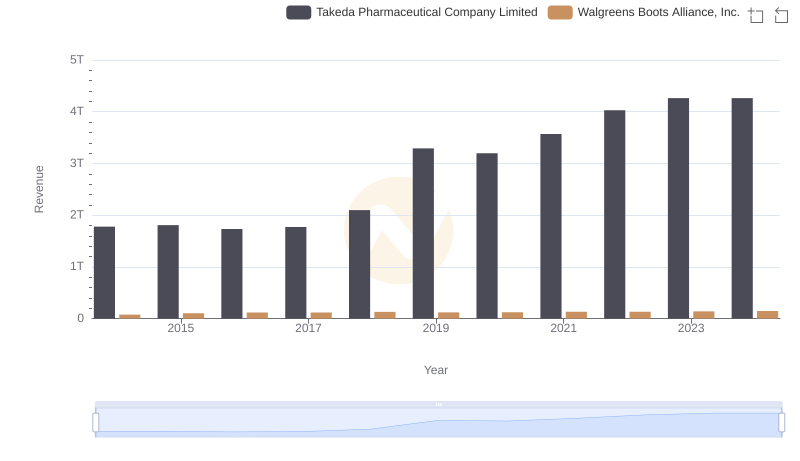

Who Generates More Revenue? Takeda Pharmaceutical Company Limited or Walgreens Boots Alliance, Inc.

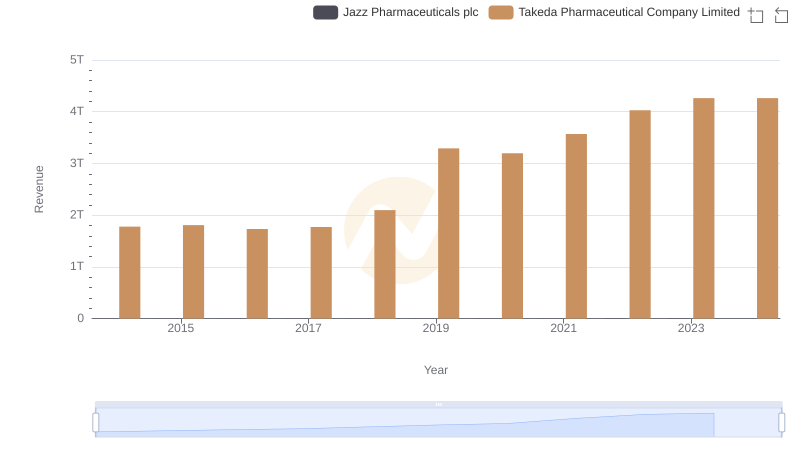

Revenue Showdown: Takeda Pharmaceutical Company Limited vs Jazz Pharmaceuticals plc

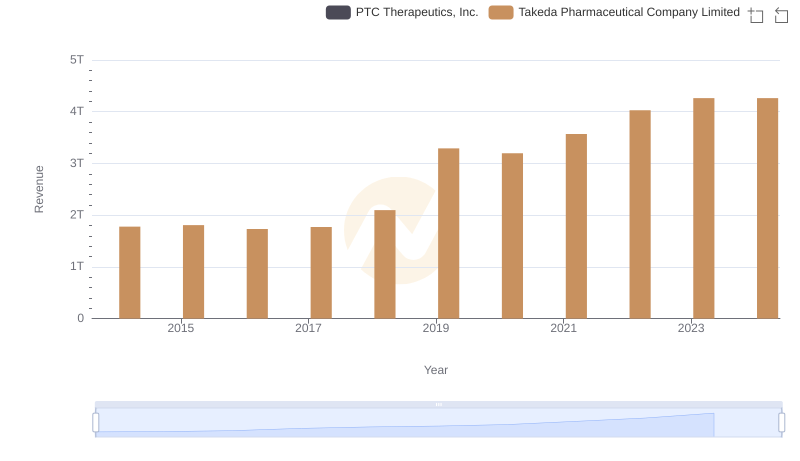

Revenue Showdown: Takeda Pharmaceutical Company Limited vs PTC Therapeutics, Inc.

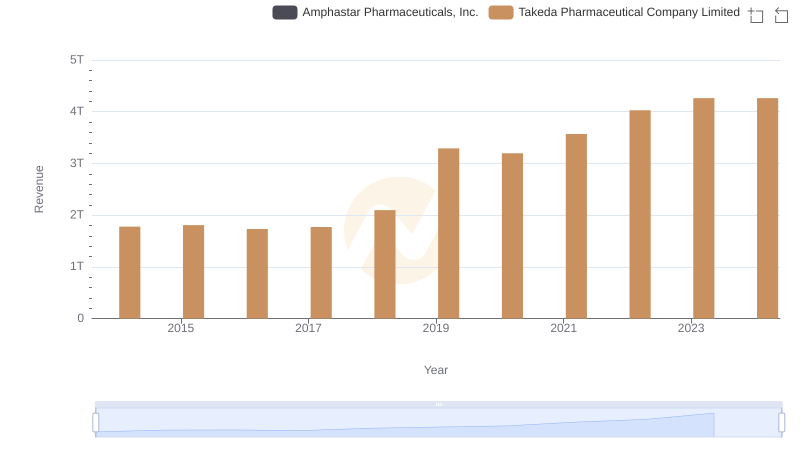

Who Generates More Revenue? Takeda Pharmaceutical Company Limited or Amphastar Pharmaceuticals, Inc.

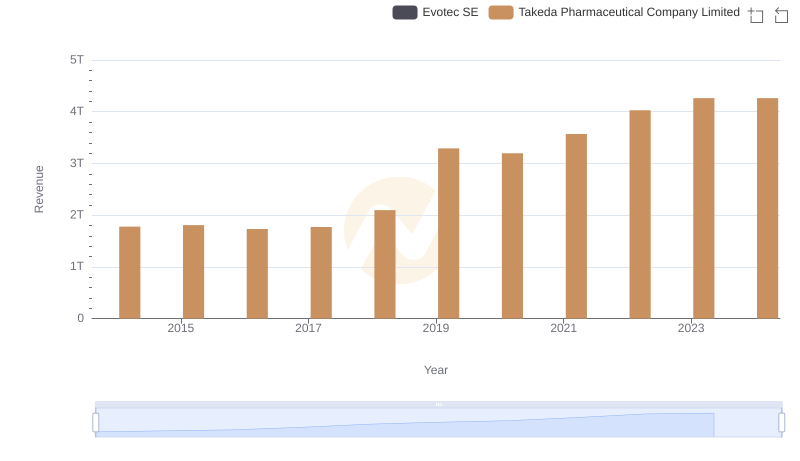

Takeda Pharmaceutical Company Limited vs Evotec SE: Examining Key Revenue Metrics