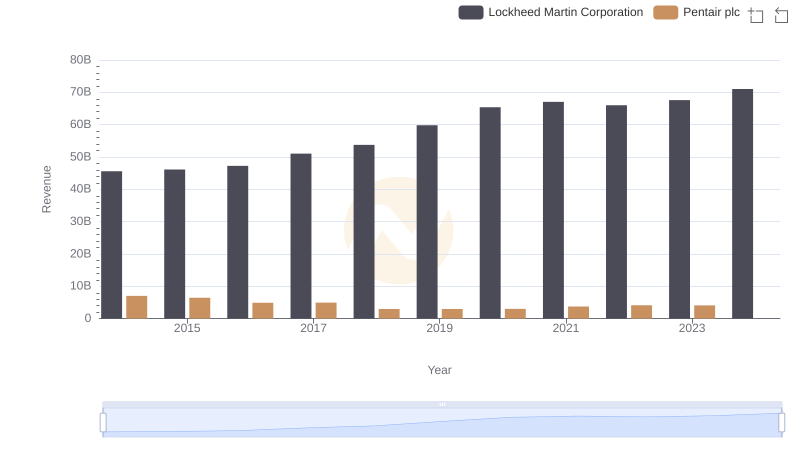

| __timestamp | Lockheed Martin Corporation | Pentair plc |

|---|---|---|

| Wednesday, January 1, 2014 | 40226000000 | 4563000000 |

| Thursday, January 1, 2015 | 40830000000 | 4263200000 |

| Friday, January 1, 2016 | 42106000000 | 3095900000 |

| Sunday, January 1, 2017 | 45500000000 | 3107400000 |

| Monday, January 1, 2018 | 46392000000 | 1917400000 |

| Tuesday, January 1, 2019 | 51445000000 | 1905700000 |

| Wednesday, January 1, 2020 | 56744000000 | 1960200000 |

| Friday, January 1, 2021 | 57983000000 | 2445600000 |

| Saturday, January 1, 2022 | 57697000000 | 2757200000 |

| Sunday, January 1, 2023 | 59092000000 | 2585300000 |

| Monday, January 1, 2024 | 64113000000 | 2484000000 |

In pursuit of knowledge

In the competitive landscape of global industries, understanding cost efficiency is paramount. Lockheed Martin Corporation, a titan in aerospace and defense, and Pentair plc, a leader in water solutions, offer a fascinating study in contrasts. From 2014 to 2023, Lockheed Martin's cost of revenue surged by approximately 59%, reflecting its expansive operations and strategic investments. In contrast, Pentair's cost of revenue exhibited a more modest fluctuation, peaking in 2014 and gradually stabilizing thereafter.

Lockheed Martin's consistent growth trajectory underscores its robust market position, while Pentair's efficiency highlights its focus on streamlined operations. Notably, data for 2024 is incomplete, suggesting a need for cautious interpretation. This comparison not only highlights the diverse strategies of these industry leaders but also underscores the importance of cost management in sustaining competitive advantage.

Who Generates More Revenue? Lockheed Martin Corporation or Pentair plc

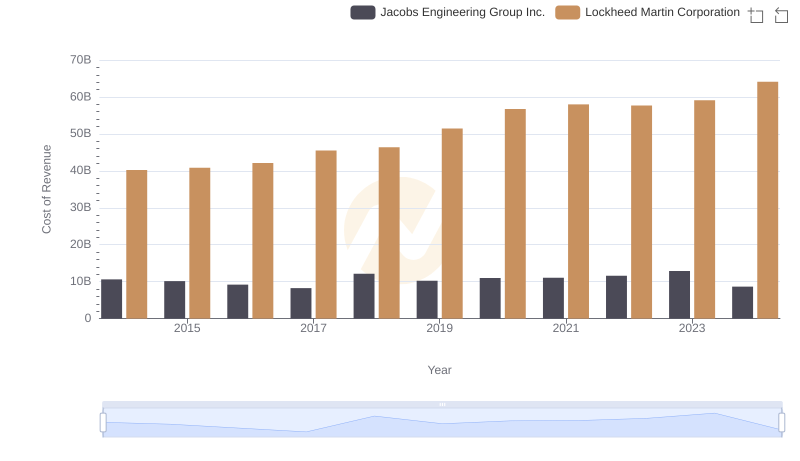

Analyzing Cost of Revenue: Lockheed Martin Corporation and Jacobs Engineering Group Inc.

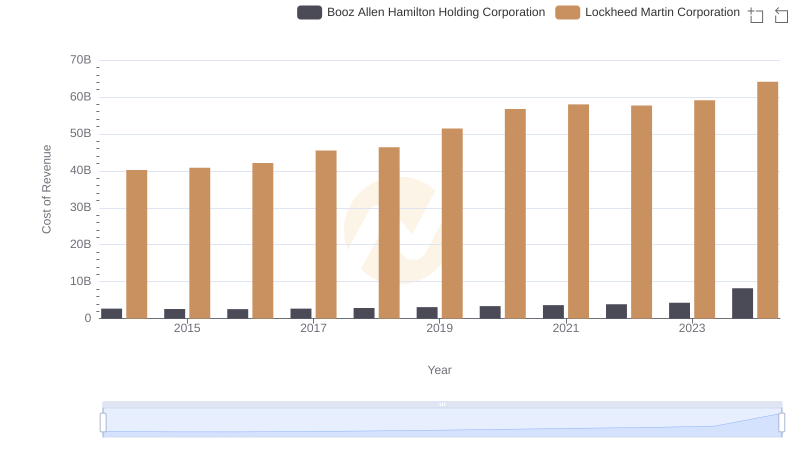

Cost of Revenue: Key Insights for Lockheed Martin Corporation and Booz Allen Hamilton Holding Corporation

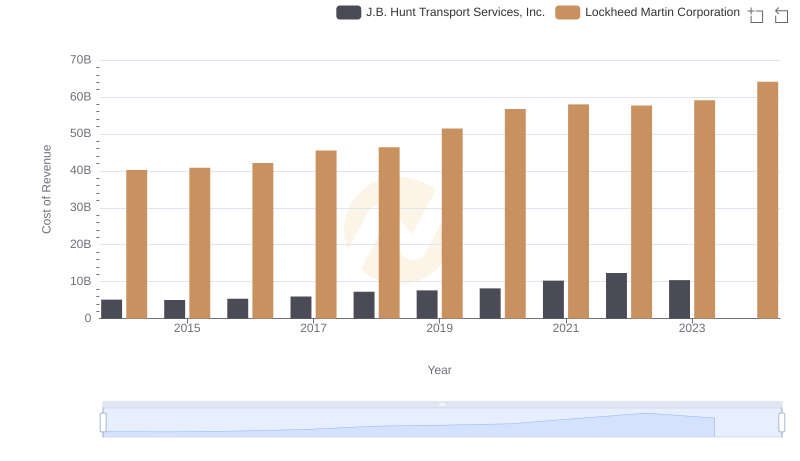

Cost of Revenue: Key Insights for Lockheed Martin Corporation and J.B. Hunt Transport Services, Inc.

Cost of Revenue Comparison: Lockheed Martin Corporation vs RB Global, Inc.

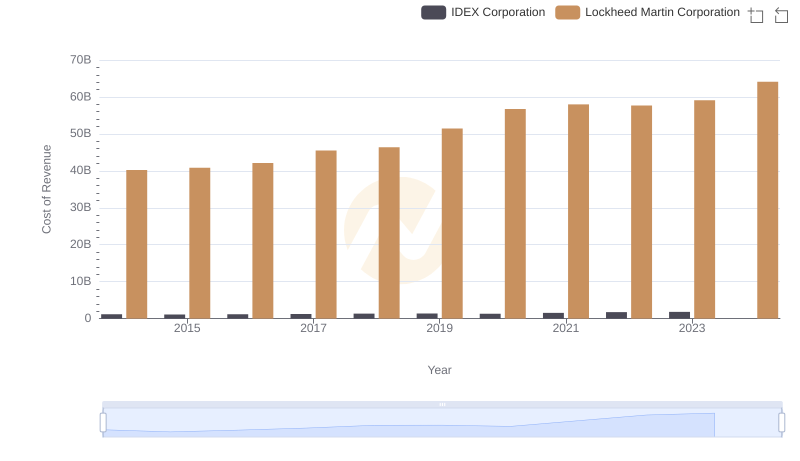

Cost Insights: Breaking Down Lockheed Martin Corporation and IDEX Corporation's Expenses

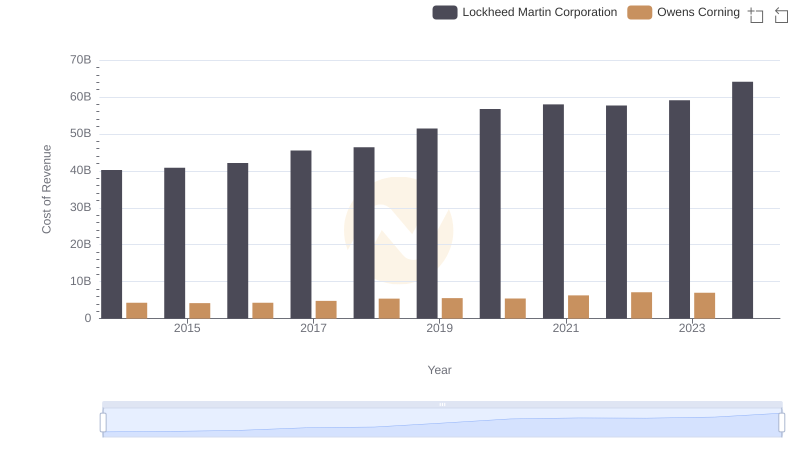

Cost of Revenue Comparison: Lockheed Martin Corporation vs Owens Corning

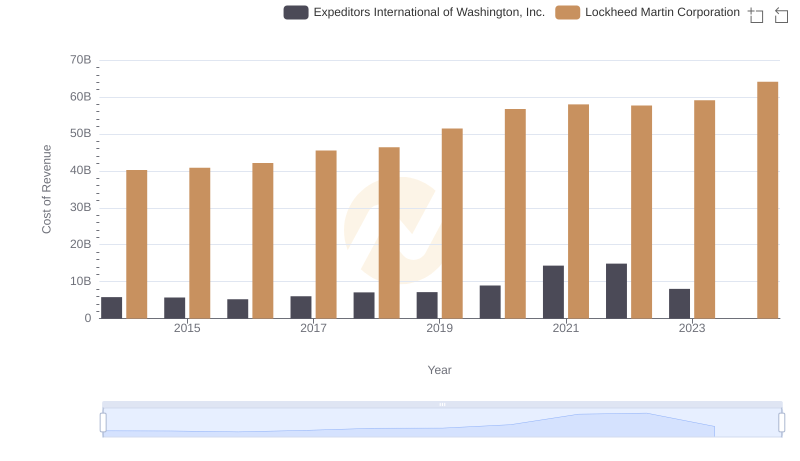

Cost of Revenue: Key Insights for Lockheed Martin Corporation and Expeditors International of Washington, Inc.

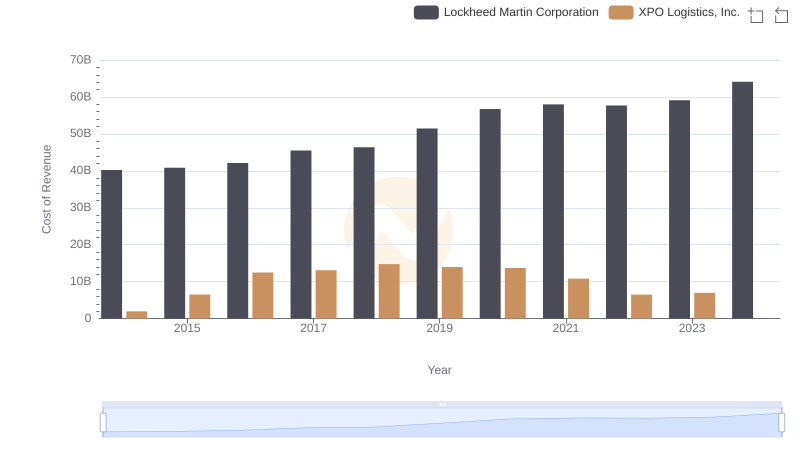

Cost of Revenue Comparison: Lockheed Martin Corporation vs XPO Logistics, Inc.

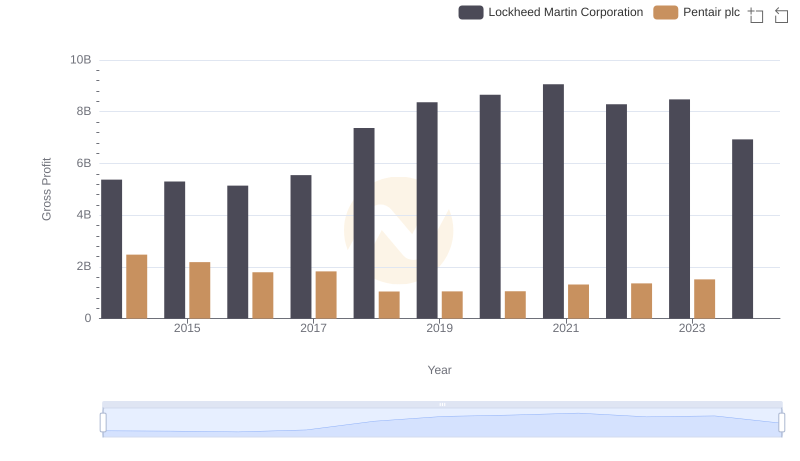

Gross Profit Comparison: Lockheed Martin Corporation and Pentair plc Trends

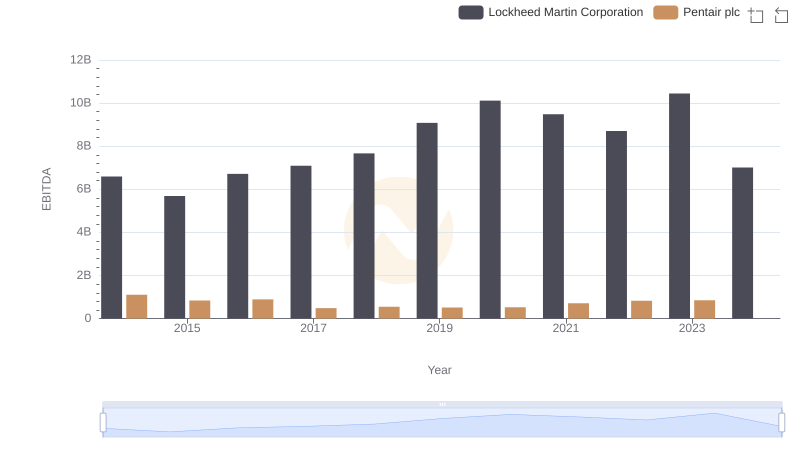

Comparative EBITDA Analysis: Lockheed Martin Corporation vs Pentair plc