| __timestamp | RTX Corporation | Waste Connections, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 47447000000 | 1138388000 |

| Thursday, January 1, 2015 | 40431000000 | 1177409000 |

| Friday, January 1, 2016 | 41460000000 | 1957712000 |

| Sunday, January 1, 2017 | 43953000000 | 2704775000 |

| Monday, January 1, 2018 | 49985000000 | 2865704000 |

| Tuesday, January 1, 2019 | 57065000000 | 3198757000 |

| Wednesday, January 1, 2020 | 48056000000 | 3276808000 |

| Friday, January 1, 2021 | 51897000000 | 3654074000 |

| Saturday, January 1, 2022 | 53406000000 | 4336012000 |

| Sunday, January 1, 2023 | 56831000000 | 4744513000 |

| Monday, January 1, 2024 | 65328000000 | 5191706000 |

Infusing magic into the data realm

In the ever-evolving landscape of corporate finance, understanding the cost of revenue is crucial for evaluating a company's efficiency and profitability. Over the past decade, RTX Corporation and Waste Connections, Inc. have showcased contrasting trajectories in their cost of revenue.

From 2014 to 2023, RTX Corporation's cost of revenue has seen a steady increase, peaking at an impressive 65% growth by 2023. This upward trend reflects RTX's expanding operations and market reach. In contrast, Waste Connections, Inc. has experienced a more modest growth of approximately 317% over the same period, indicating a stable yet consistent expansion in its cost structure.

While RTX's data extends into 2024, Waste Connections' figures for the same year remain unavailable, leaving room for speculation on its future financial strategies. As these companies continue to evolve, monitoring their cost of revenue will provide valuable insights into their operational efficiencies and market strategies.

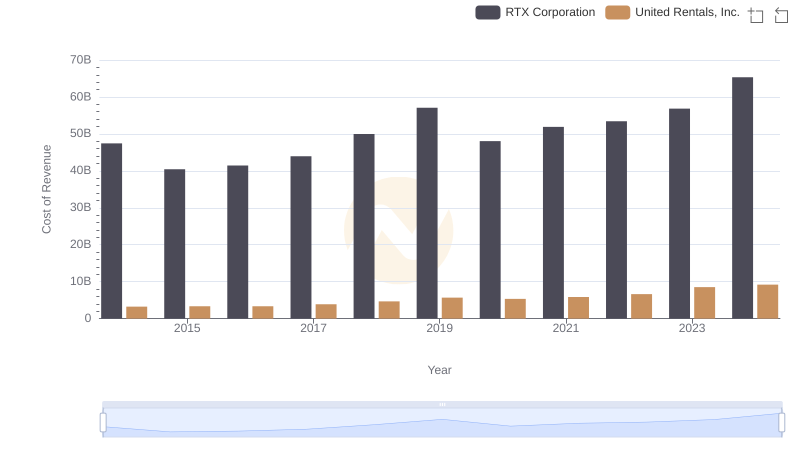

Cost Insights: Breaking Down RTX Corporation and United Rentals, Inc.'s Expenses

Cost Insights: Breaking Down RTX Corporation and Johnson Controls International plc's Expenses

RTX Corporation vs Axon Enterprise, Inc.: Efficiency in Cost of Revenue Explored

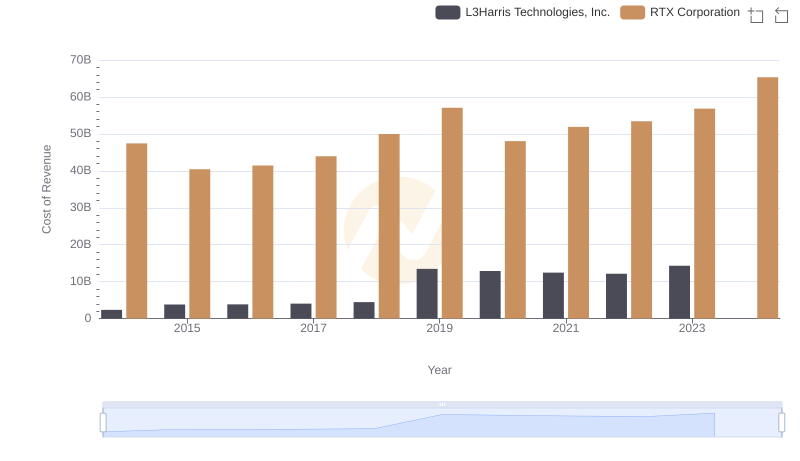

Analyzing Cost of Revenue: RTX Corporation and L3Harris Technologies, Inc.

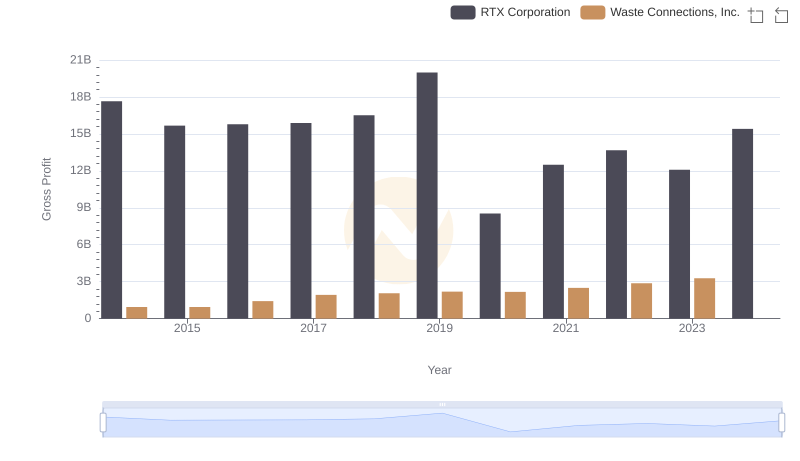

Who Generates Higher Gross Profit? RTX Corporation or Waste Connections, Inc.

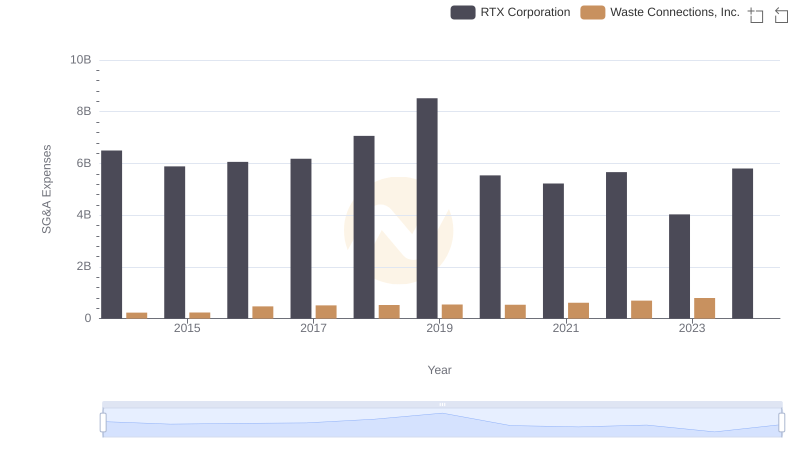

Operational Costs Compared: SG&A Analysis of RTX Corporation and Waste Connections, Inc.