| __timestamp | Curtiss-Wright Corporation | FedEx Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 401669000 | 6036000000 |

| Thursday, January 1, 2015 | 412042000 | 7141000000 |

| Friday, January 1, 2016 | 405217000 | 7531000000 |

| Sunday, January 1, 2017 | 441085000 | 8093000000 |

| Monday, January 1, 2018 | 493171000 | 8555000000 |

| Tuesday, January 1, 2019 | 530221000 | 4934000000 |

| Wednesday, January 1, 2020 | 414499000 | 6345000000 |

| Friday, January 1, 2021 | 509134000 | 11749000000 |

| Saturday, January 1, 2022 | 548202000 | 9767000000 |

| Sunday, January 1, 2023 | 630635000 | 10603000000 |

| Monday, January 1, 2024 | 674592000 | 10868000000 |

In pursuit of knowledge

In the ever-evolving landscape of global commerce, understanding the financial health of industry giants is crucial. This analysis delves into the EBITDA performance of FedEx Corporation and Curtiss-Wright Corporation from 2014 to 2023. Over this decade, FedEx consistently outperformed Curtiss-Wright, with EBITDA figures peaking at approximately $10.6 billion in 2023, a remarkable 76% increase from 2014. In contrast, Curtiss-Wright's EBITDA grew by about 57% over the same period, reaching around $630 million in 2023.

The data reveals a significant dip for FedEx in 2019, with EBITDA dropping to $4.9 billion, likely due to global economic challenges. However, FedEx rebounded strongly, showcasing resilience and adaptability. Meanwhile, Curtiss-Wright maintained a steady growth trajectory, reflecting its stable market position. This comparative analysis underscores the dynamic nature of these corporations and their strategic responses to market conditions.

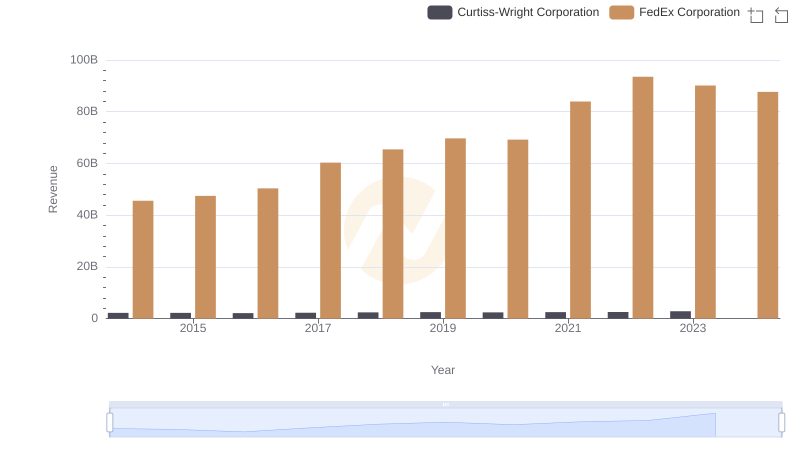

FedEx Corporation vs Curtiss-Wright Corporation: Annual Revenue Growth Compared

A Professional Review of EBITDA: FedEx Corporation Compared to Pool Corporation

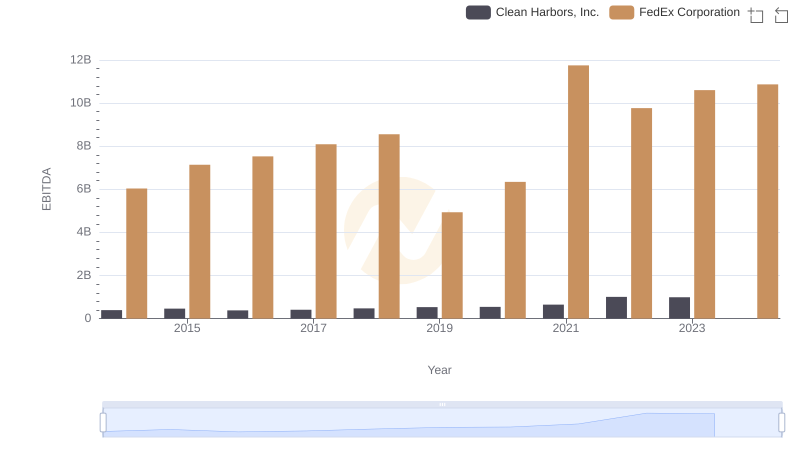

FedEx Corporation vs Clean Harbors, Inc.: In-Depth EBITDA Performance Comparison

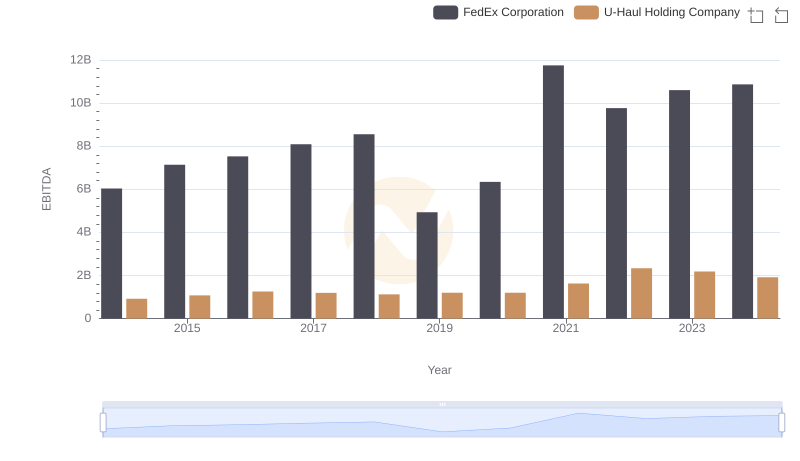

Comprehensive EBITDA Comparison: FedEx Corporation vs U-Haul Holding Company

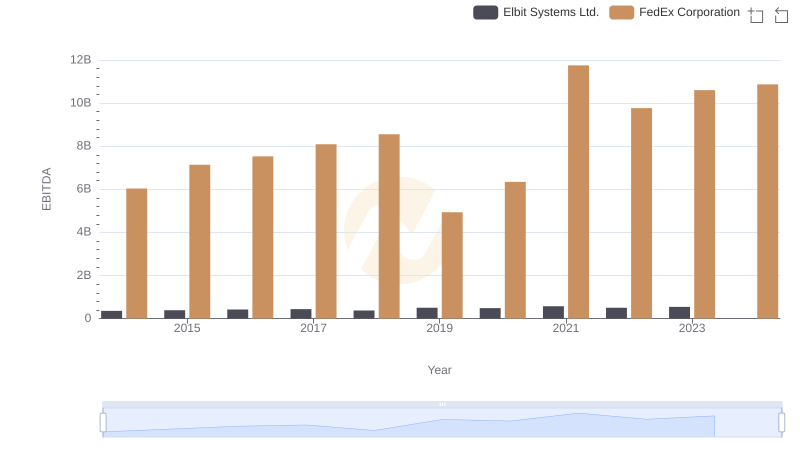

A Side-by-Side Analysis of EBITDA: FedEx Corporation and Elbit Systems Ltd.

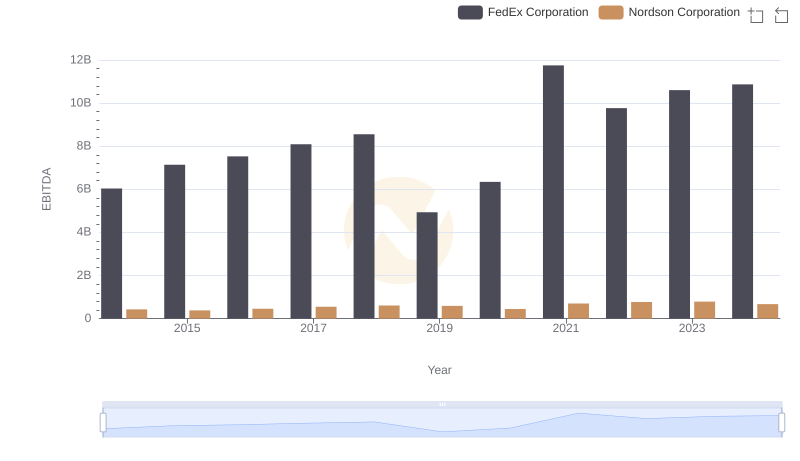

A Professional Review of EBITDA: FedEx Corporation Compared to Nordson Corporation

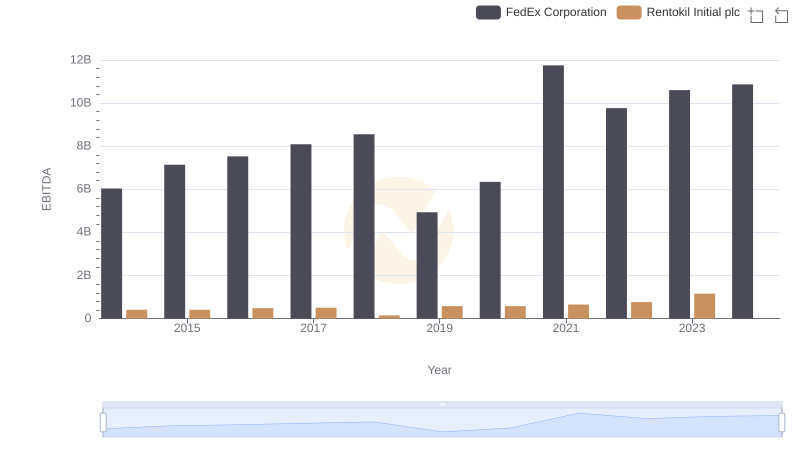

EBITDA Performance Review: FedEx Corporation vs Rentokil Initial plc

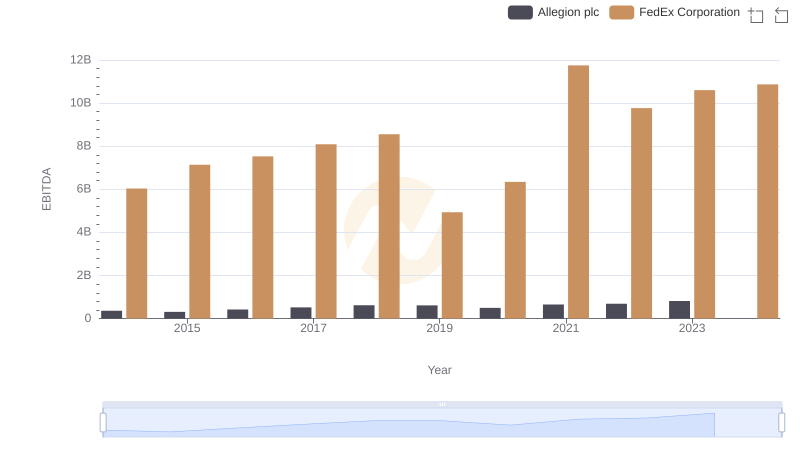

FedEx Corporation and Allegion plc: A Detailed Examination of EBITDA Performance