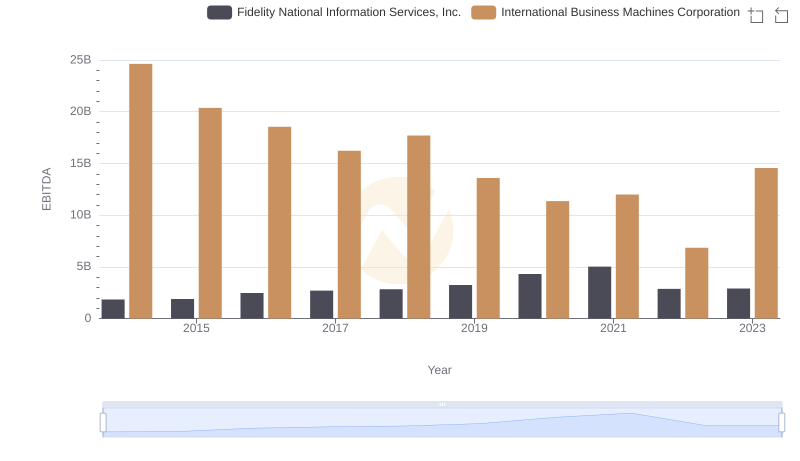

| __timestamp | International Business Machines Corporation | Wipro Limited |

|---|---|---|

| Wednesday, January 1, 2014 | 24962000000 | 128105000000 |

| Thursday, January 1, 2015 | 20268000000 | 107958000000 |

| Friday, January 1, 2016 | 17341000000 | 133082000000 |

| Sunday, January 1, 2017 | 16556000000 | 126406000000 |

| Monday, January 1, 2018 | 16545000000 | 114648000000 |

| Tuesday, January 1, 2019 | 14609000000 | 122279000000 |

| Wednesday, January 1, 2020 | 10555000000 | 168413000000 |

| Friday, January 1, 2021 | 12409000000 | 165303000000 |

| Saturday, January 1, 2022 | 7174000000 | 189377000000 |

| Sunday, January 1, 2023 | 14693000000 | 193833000000 |

| Monday, January 1, 2024 | 6015000000 | 193833000000 |

Infusing magic into the data realm

In the ever-evolving landscape of global technology, the EBITDA performance of International Business Machines Corporation (IBM) and Wipro Limited offers a fascinating glimpse into their financial health over the past decade. From 2014 to 2024, Wipro consistently outperformed IBM, with EBITDA figures often exceeding IBM's by over 500%. This trend highlights Wipro's robust growth strategy and market adaptability.

This comparison underscores the dynamic nature of the tech industry, where strategic pivots and market positioning can significantly impact financial outcomes. As we look to the future, these insights provide valuable lessons for investors and industry leaders alike.

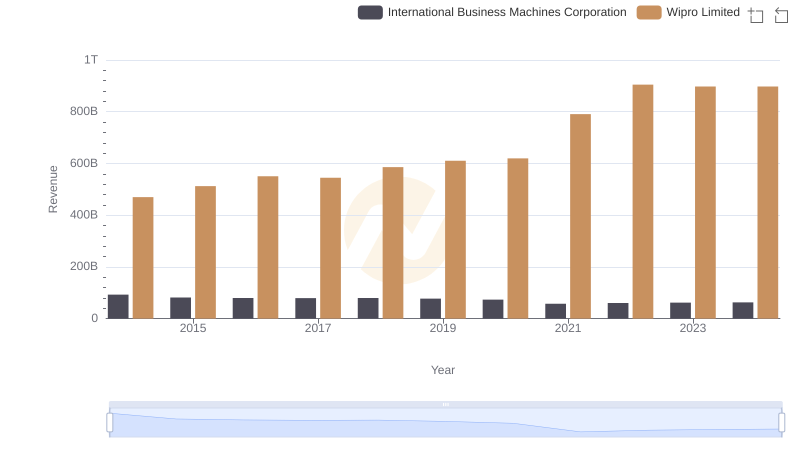

International Business Machines Corporation vs Wipro Limited: Examining Key Revenue Metrics

International Business Machines Corporation vs Fidelity National Information Services, Inc.: In-Depth EBITDA Performance Comparison

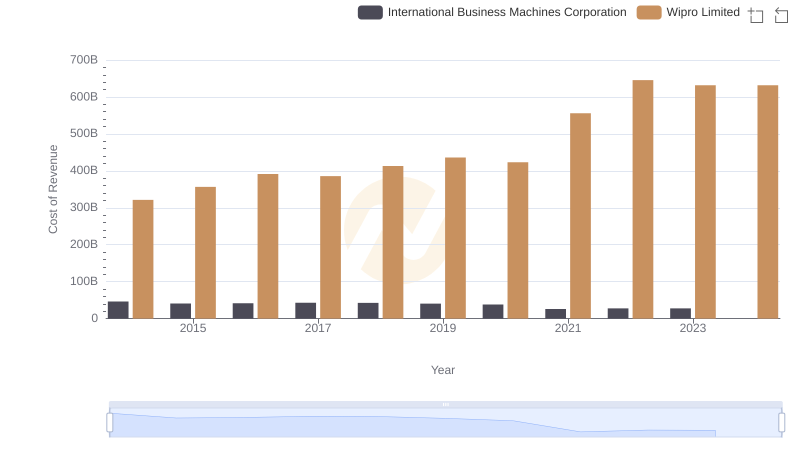

Analyzing Cost of Revenue: International Business Machines Corporation and Wipro Limited

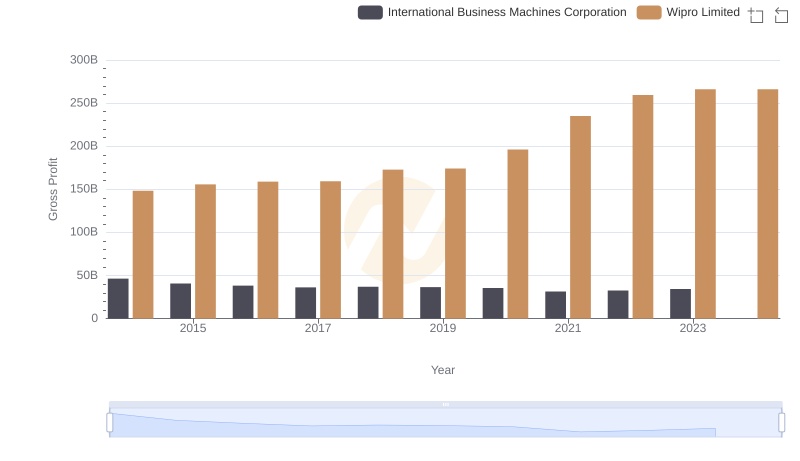

Who Generates Higher Gross Profit? International Business Machines Corporation or Wipro Limited

International Business Machines Corporation and NXP Semiconductors N.V.: A Detailed Examination of EBITDA Performance

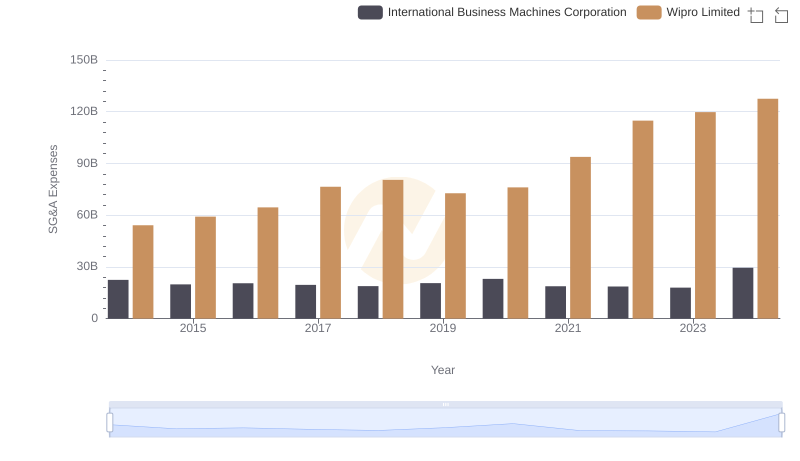

Selling, General, and Administrative Costs: International Business Machines Corporation vs Wipro Limited

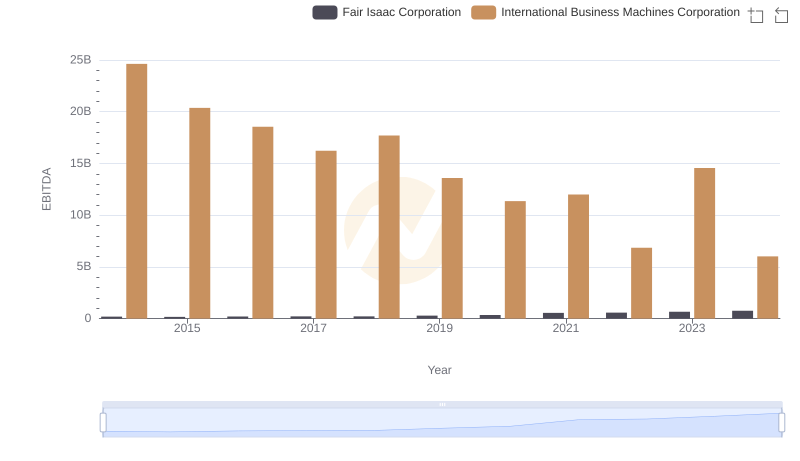

EBITDA Metrics Evaluated: International Business Machines Corporation vs Fair Isaac Corporation

International Business Machines Corporation vs Gartner, Inc.: In-Depth EBITDA Performance Comparison

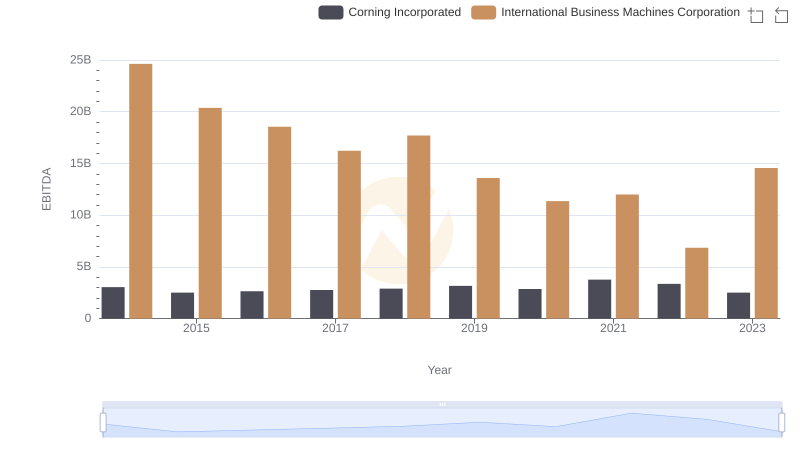

Comprehensive EBITDA Comparison: International Business Machines Corporation vs Corning Incorporated

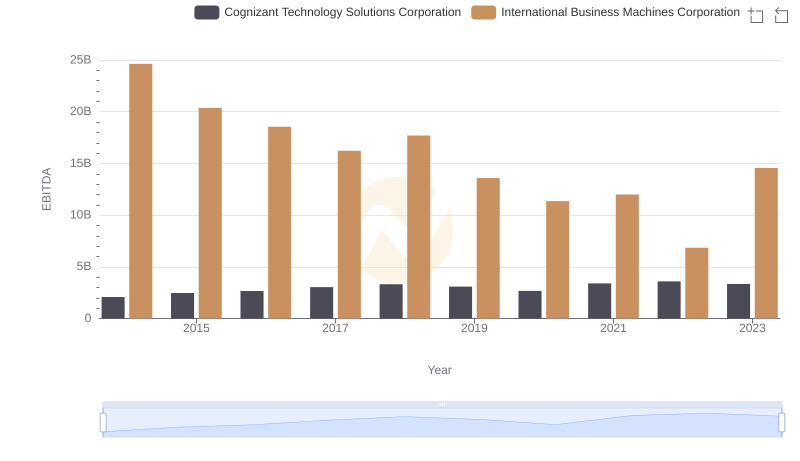

A Side-by-Side Analysis of EBITDA: International Business Machines Corporation and Cognizant Technology Solutions Corporation

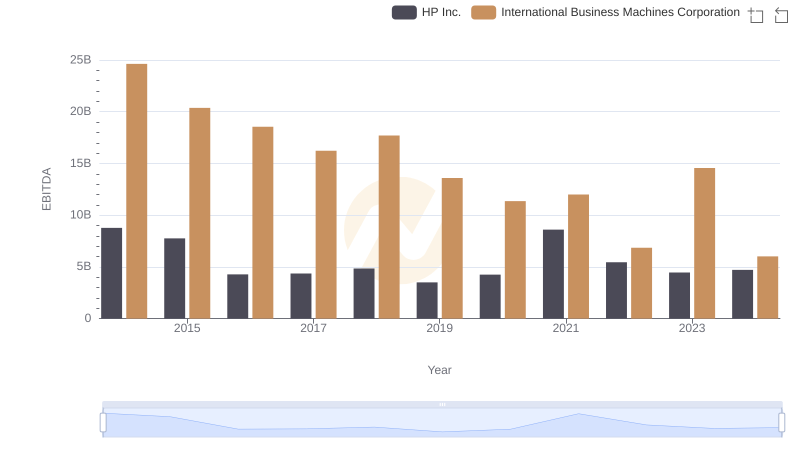

Professional EBITDA Benchmarking: International Business Machines Corporation vs HP Inc.

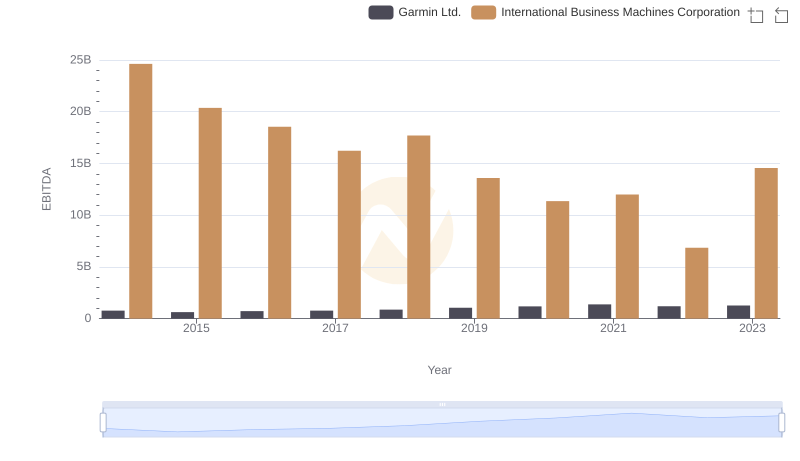

EBITDA Metrics Evaluated: International Business Machines Corporation vs Garmin Ltd.