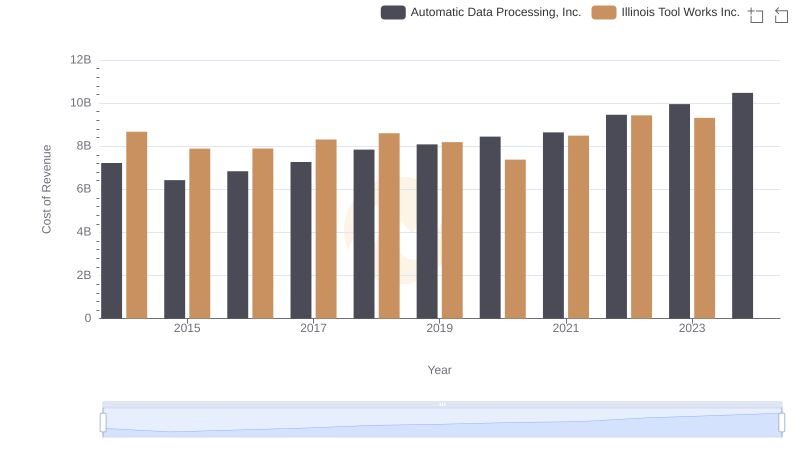

| __timestamp | Automatic Data Processing, Inc. | Canadian Pacific Railway Limited |

|---|---|---|

| Wednesday, January 1, 2014 | 7221400000 | 3300000000 |

| Thursday, January 1, 2015 | 6427600000 | 3032000000 |

| Friday, January 1, 2016 | 6840300000 | 2749000000 |

| Sunday, January 1, 2017 | 7269800000 | 2979000000 |

| Monday, January 1, 2018 | 7842600000 | 3413000000 |

| Tuesday, January 1, 2019 | 8086600000 | 3475000000 |

| Wednesday, January 1, 2020 | 8445100000 | 3349000000 |

| Friday, January 1, 2021 | 8640300000 | 3571000000 |

| Saturday, January 1, 2022 | 9461900000 | 4223000000 |

| Sunday, January 1, 2023 | 9953400000 | 5968000000 |

| Monday, January 1, 2024 | 10476700000 | 7003000000 |

Unleashing the power of data

In the ever-evolving landscape of corporate finance, understanding cost structures is pivotal. Automatic Data Processing, Inc. (ADP) and Canadian Pacific Railway Limited (CP) offer intriguing insights into how two distinct industries manage their expenses. From 2014 to 2023, ADP's cost of revenue surged by approximately 45%, reflecting its strategic investments in technology and services. Meanwhile, CP's costs increased by about 81%, highlighting its expansion and infrastructure enhancements.

ADP's consistent growth, with costs peaking at over $10 billion in 2024, underscores its robust market position. In contrast, CP's expenses, reaching nearly $6 billion in 2023, reveal a more volatile trajectory, possibly due to fluctuating fuel prices and regulatory changes. Notably, 2024 data for CP is missing, suggesting potential reporting delays or strategic shifts. This comparative analysis not only highlights industry-specific challenges but also emphasizes the importance of adaptive financial strategies.

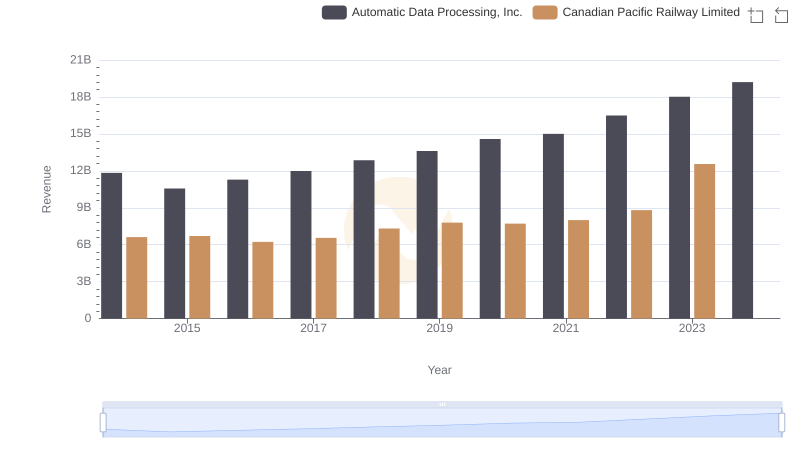

Who Generates More Revenue? Automatic Data Processing, Inc. or Canadian Pacific Railway Limited

Comparing Cost of Revenue Efficiency: Automatic Data Processing, Inc. vs Illinois Tool Works Inc.

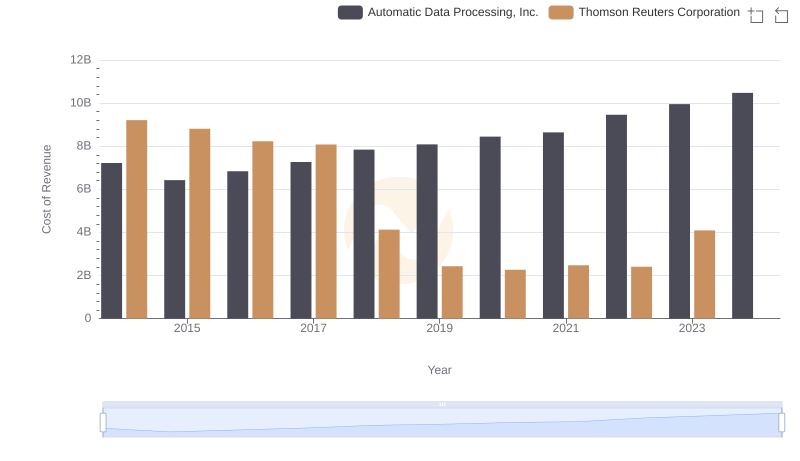

Cost of Revenue Comparison: Automatic Data Processing, Inc. vs Thomson Reuters Corporation

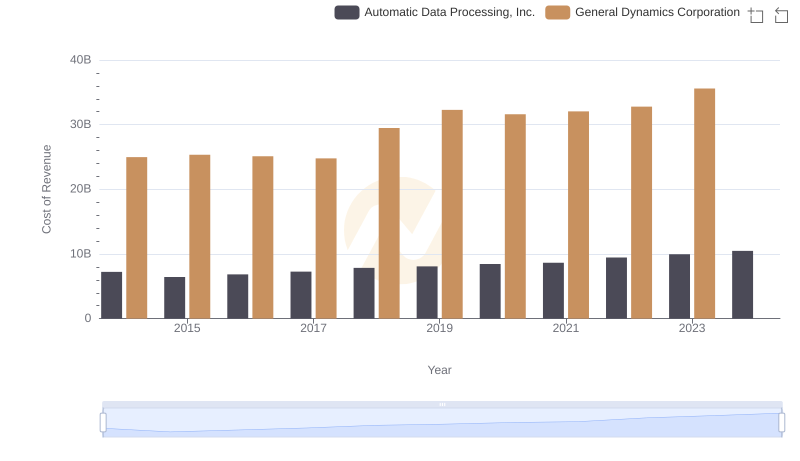

Cost of Revenue Trends: Automatic Data Processing, Inc. vs General Dynamics Corporation

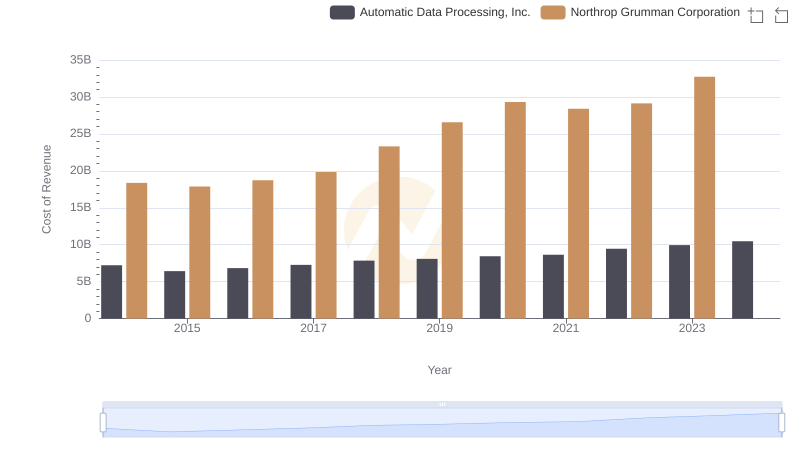

Automatic Data Processing, Inc. vs Northrop Grumman Corporation: Efficiency in Cost of Revenue Explored

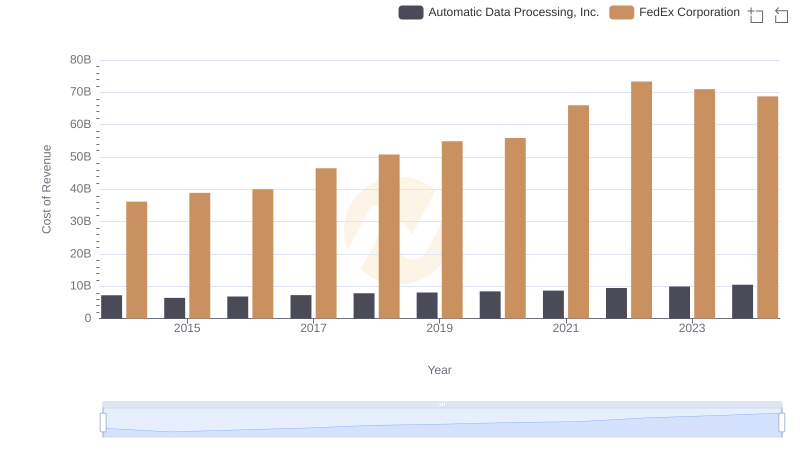

Cost Insights: Breaking Down Automatic Data Processing, Inc. and FedEx Corporation's Expenses