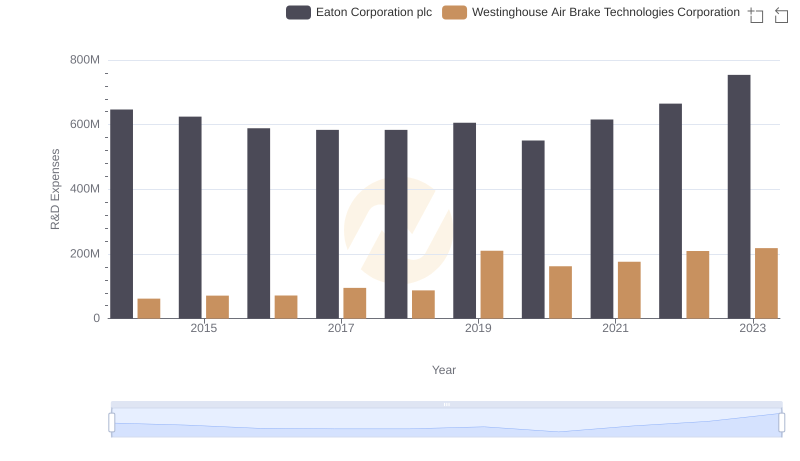

| __timestamp | Eaton Corporation plc | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 22552000000 | 3044454000 |

| Thursday, January 1, 2015 | 20855000000 | 3307998000 |

| Friday, January 1, 2016 | 19747000000 | 2931188000 |

| Sunday, January 1, 2017 | 20404000000 | 3881756000 |

| Monday, January 1, 2018 | 21609000000 | 4363547000 |

| Tuesday, January 1, 2019 | 21390000000 | 8200000000 |

| Wednesday, January 1, 2020 | 17858000000 | 7556100000 |

| Friday, January 1, 2021 | 19628000000 | 7822000000 |

| Saturday, January 1, 2022 | 20752000000 | 8362000000 |

| Sunday, January 1, 2023 | 23196000000 | 9677000000 |

| Monday, January 1, 2024 | 24878000000 | 10387000000 |

Cracking the code

In the competitive landscape of industrial giants, Eaton Corporation plc and Westinghouse Air Brake Technologies Corporation have showcased distinct revenue trajectories over the past decade. From 2014 to 2023, Eaton consistently outperformed, with revenues peaking at approximately $23.2 billion in 2023, marking a 3% increase from 2022. In contrast, Westinghouse Air Brake Technologies saw a robust growth of over 200% from 2014, reaching nearly $9.7 billion in 2023.

Eaton's revenue dipped in 2020, likely due to global economic challenges, but rebounded strongly in subsequent years. Meanwhile, Westinghouse Air Brake Technologies demonstrated a steady upward trend, particularly notable from 2018 onwards. This comparison highlights Eaton's dominance in revenue size, while Westinghouse Air Brake Technologies showcases impressive growth momentum. As these companies continue to innovate, their financial performances remain a focal point for investors and industry analysts alike.

Breaking Down Revenue Trends: Eaton Corporation plc vs Ingersoll Rand Inc.

Revenue Insights: Eaton Corporation plc and Ferguson plc Performance Compared

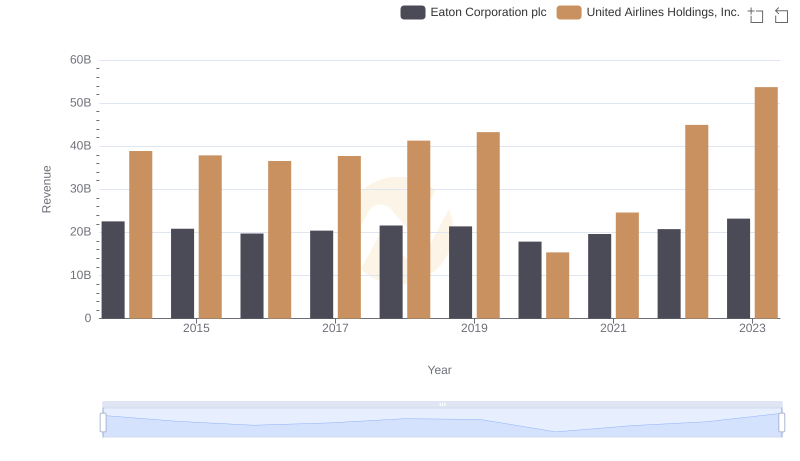

Revenue Insights: Eaton Corporation plc and United Airlines Holdings, Inc. Performance Compared

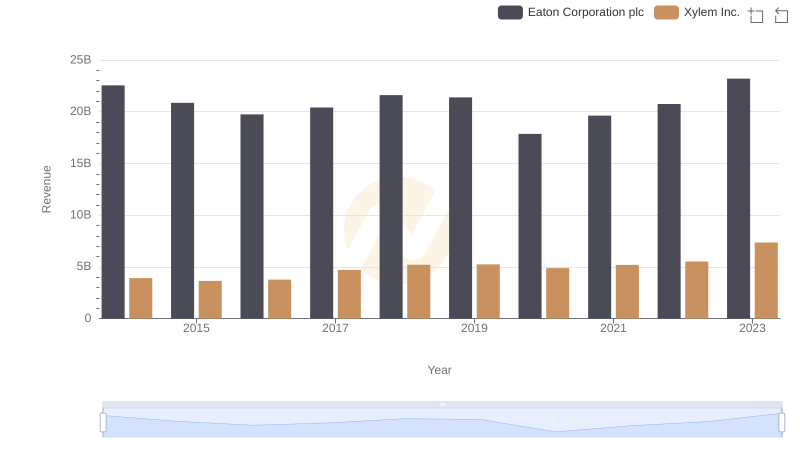

Revenue Insights: Eaton Corporation plc and Xylem Inc. Performance Compared

Research and Development Investment: Eaton Corporation plc vs Westinghouse Air Brake Technologies Corporation