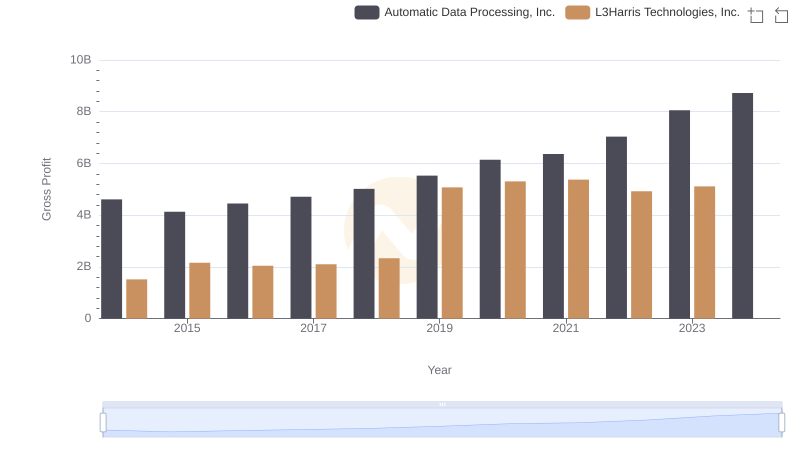

| __timestamp | Automatic Data Processing, Inc. | L3Harris Technologies, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 11832800000 | 3885000000 |

| Thursday, January 1, 2015 | 10560800000 | 5992000000 |

| Friday, January 1, 2016 | 11290500000 | 5897000000 |

| Sunday, January 1, 2017 | 11982400000 | 6168000000 |

| Monday, January 1, 2018 | 12859300000 | 6801000000 |

| Tuesday, January 1, 2019 | 13613300000 | 18526000000 |

| Wednesday, January 1, 2020 | 14589800000 | 18194000000 |

| Friday, January 1, 2021 | 15005400000 | 17814000000 |

| Saturday, January 1, 2022 | 16498300000 | 17062000000 |

| Sunday, January 1, 2023 | 18012200000 | 19419000000 |

| Monday, January 1, 2024 | 19202600000 | 21325000000 |

Unleashing the power of data

In the ever-evolving landscape of the U.S. stock market, Automatic Data Processing, Inc. (ADP) and L3Harris Technologies, Inc. (LHX) have emerged as formidable players. Over the past decade, ADP has consistently demonstrated robust growth, with its revenue surging by approximately 62% from 2014 to 2023. This growth trajectory underscores ADP's strategic prowess in the payroll and human resources sector.

Conversely, L3Harris Technologies, a key player in the defense and aerospace industry, experienced a remarkable revenue leap of nearly 400% between 2014 and 2023. This surge is indicative of the increasing demand for advanced defense technologies. However, it's noteworthy that data for 2024 is missing for L3Harris, leaving room for speculation about its future performance.

As these two giants continue to shape their respective industries, investors and analysts alike are keenly observing their next moves.

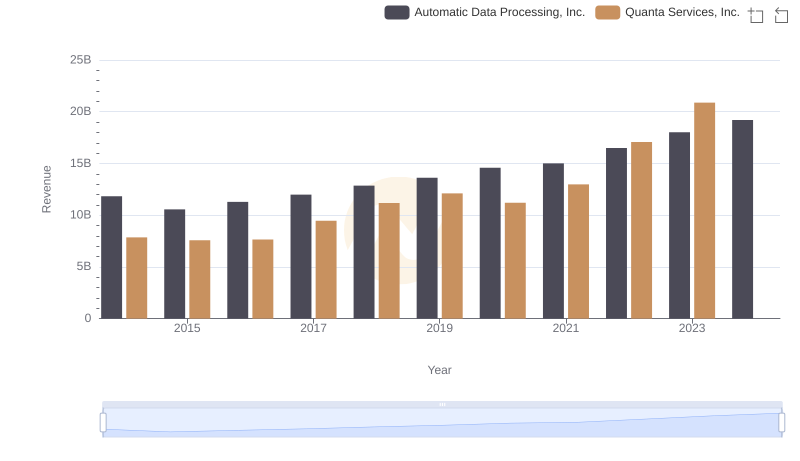

Automatic Data Processing, Inc. vs Quanta Services, Inc.: Examining Key Revenue Metrics

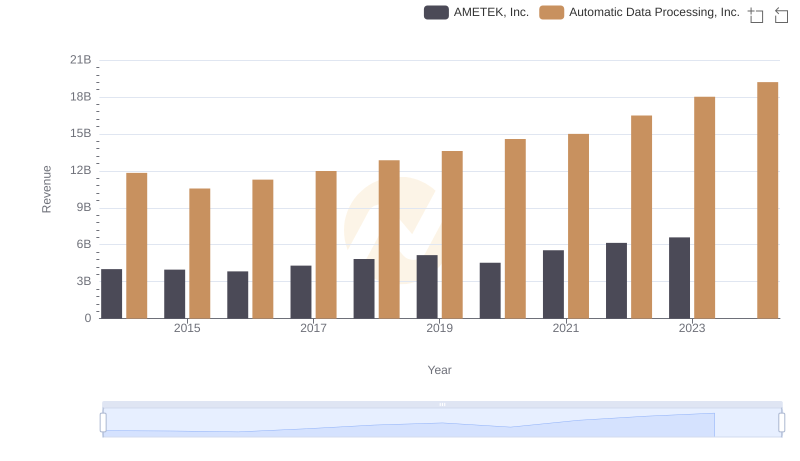

Breaking Down Revenue Trends: Automatic Data Processing, Inc. vs AMETEK, Inc.

Automatic Data Processing, Inc. vs Verisk Analytics, Inc.: Examining Key Revenue Metrics

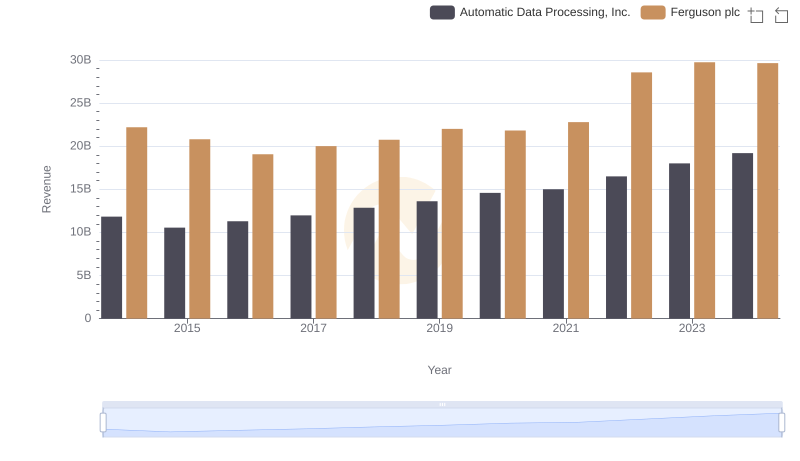

Annual Revenue Comparison: Automatic Data Processing, Inc. vs Ferguson plc

Breaking Down Revenue Trends: Automatic Data Processing, Inc. vs Westinghouse Air Brake Technologies Corporation

Automatic Data Processing, Inc. and L3Harris Technologies, Inc.: A Detailed Gross Profit Analysis

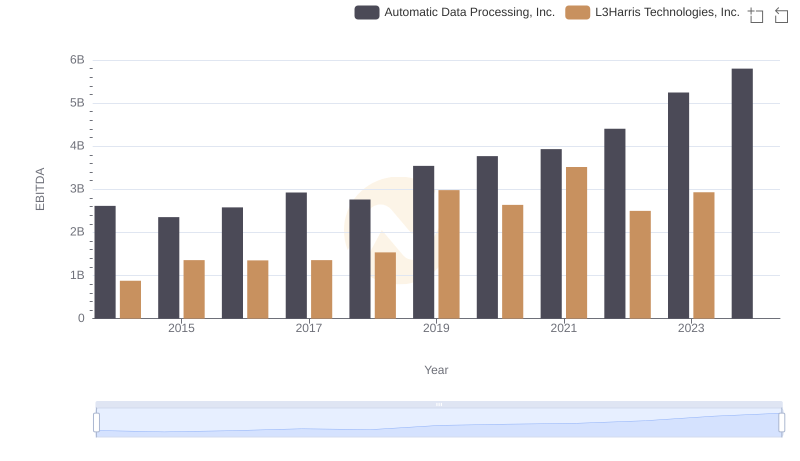

Automatic Data Processing, Inc. vs L3Harris Technologies, Inc.: In-Depth EBITDA Performance Comparison