| __timestamp | Rentokil Initial plc | The Boeing Company |

|---|---|---|

| Wednesday, January 1, 2014 | 297500000 | 76752000000 |

| Thursday, January 1, 2015 | 310200000 | 82088000000 |

| Friday, January 1, 2016 | 376100000 | 80790000000 |

| Sunday, January 1, 2017 | 474900000 | 76066000000 |

| Monday, January 1, 2018 | 514200000 | 81490000000 |

| Tuesday, January 1, 2019 | 2099000000 | 72093000000 |

| Wednesday, January 1, 2020 | 2136400000 | 63843000000 |

| Friday, January 1, 2021 | 2239100000 | 59237000000 |

| Saturday, January 1, 2022 | 2737000000 | 63078000000 |

| Sunday, January 1, 2023 | 927000000 | 70070000000 |

| Monday, January 1, 2024 | 68508000000 |

In pursuit of knowledge

In the ever-evolving landscape of global business, understanding cost efficiency is paramount. This analysis delves into the cost of revenue efficiency of two industry giants: The Boeing Company and Rentokil Initial plc, from 2014 to 2023.

Boeing, a leader in aerospace, consistently reported a high cost of revenue, peaking at approximately $82 billion in 2015. Despite fluctuations, Boeing's cost efficiency remained robust, with a notable dip in 2020, reflecting the pandemic's impact.

Conversely, Rentokil, a global pest control leader, showcased a steady increase in cost efficiency, with a significant rise in 2019, reaching nearly $2.1 billion. This growth underscores Rentokil's strategic expansion and operational efficiency.

While Boeing's cost of revenue is significantly higher, Rentokil's growth trajectory highlights its efficient scaling. Missing data for 2024 suggests ongoing financial adjustments. This comparison offers valuable insights into the strategic financial management of these two diverse companies.

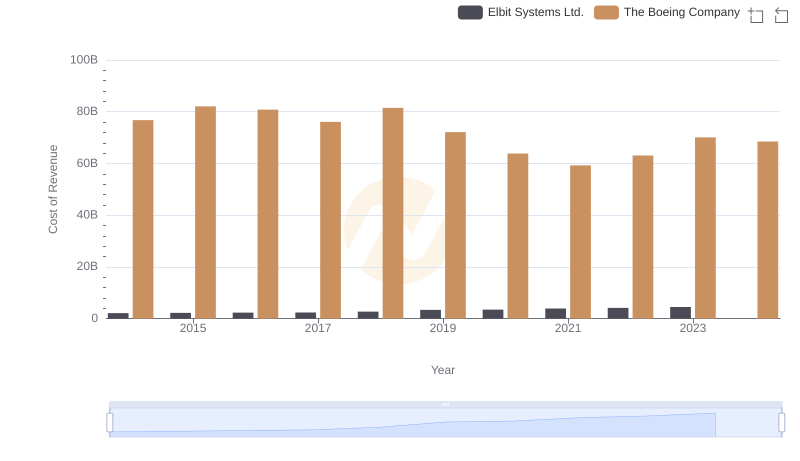

Cost Insights: Breaking Down The Boeing Company and Elbit Systems Ltd.'s Expenses

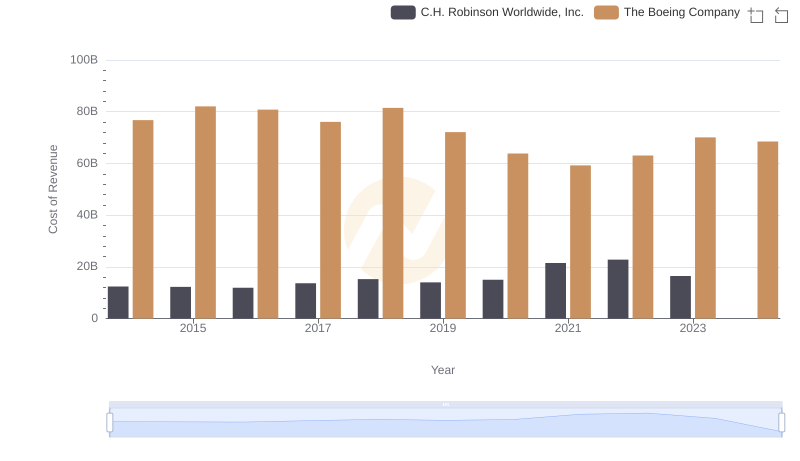

Cost Insights: Breaking Down The Boeing Company and C.H. Robinson Worldwide, Inc.'s Expenses

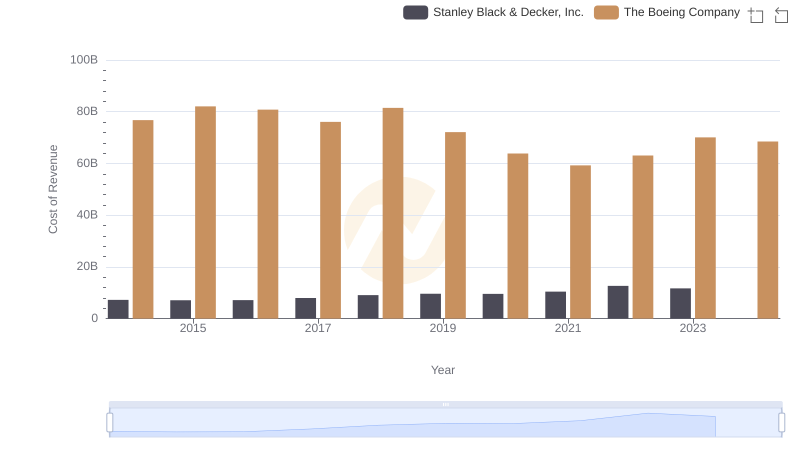

Cost of Revenue Comparison: The Boeing Company vs Stanley Black & Decker, Inc.

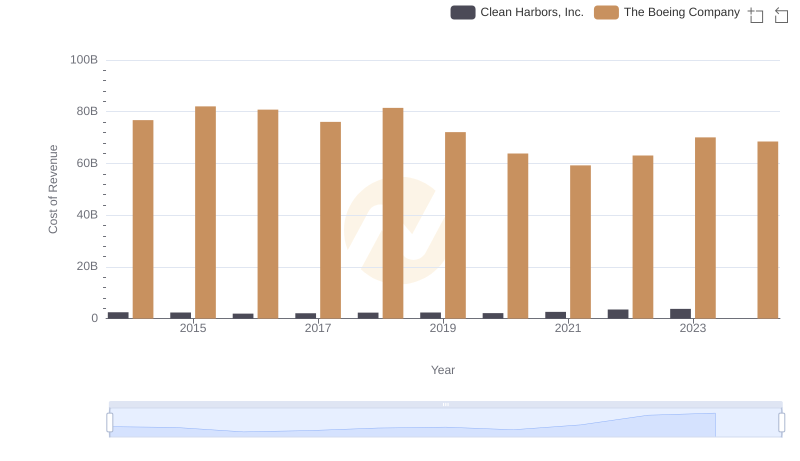

Cost of Revenue Comparison: The Boeing Company vs Clean Harbors, Inc.

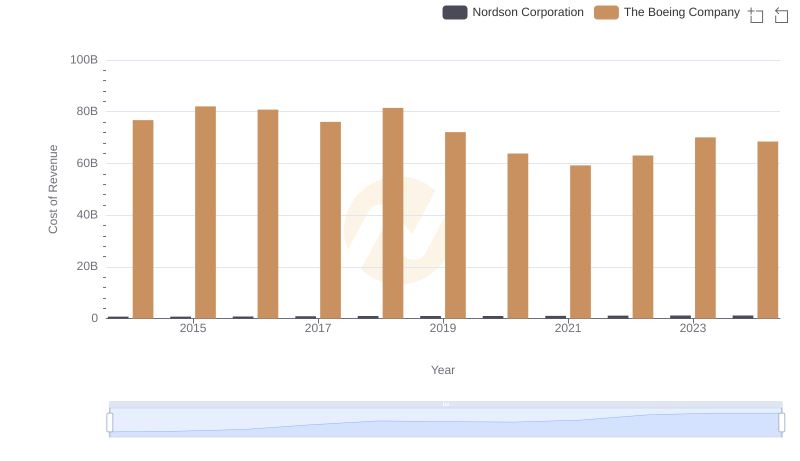

Analyzing Cost of Revenue: The Boeing Company and Nordson Corporation

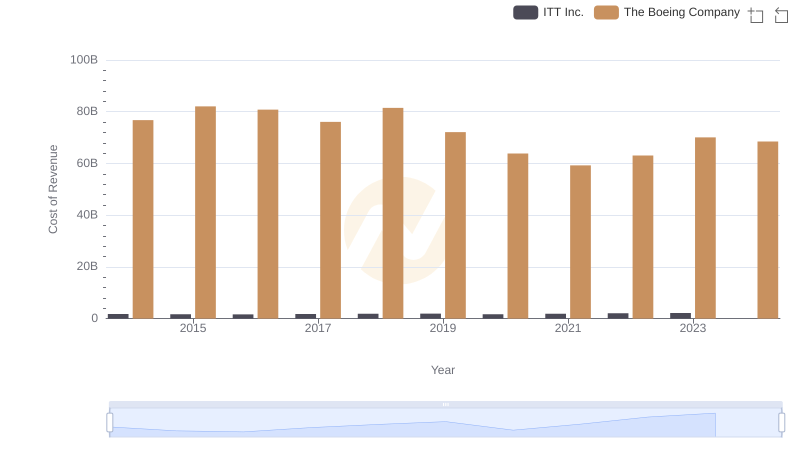

Cost of Revenue Trends: The Boeing Company vs ITT Inc.

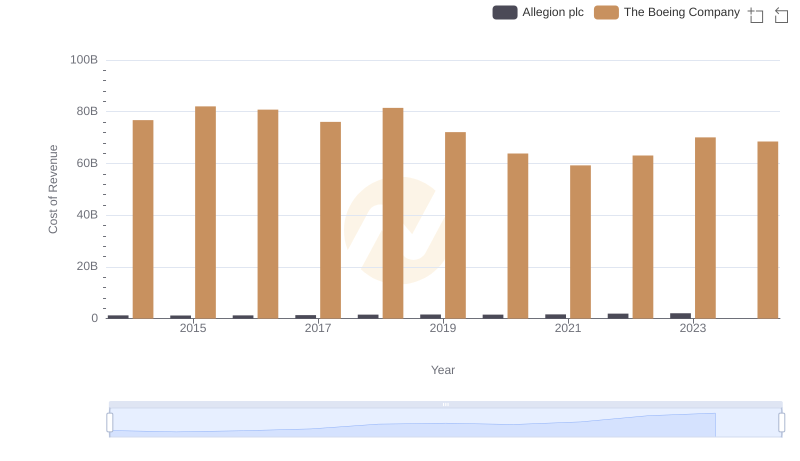

Analyzing Cost of Revenue: The Boeing Company and Allegion plc

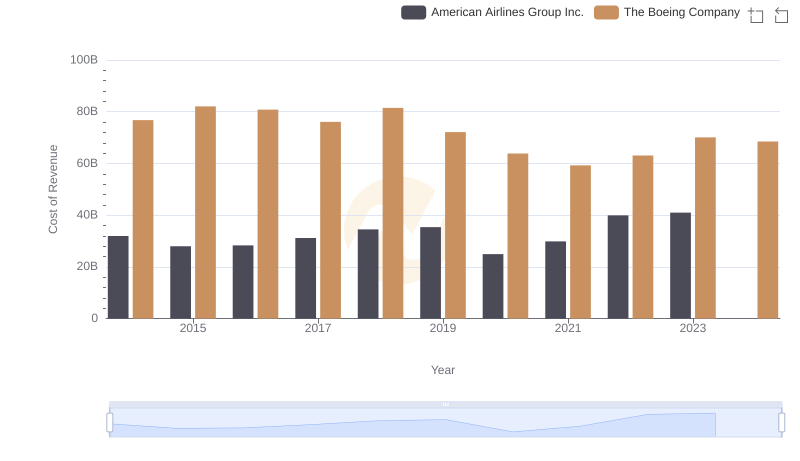

Cost of Revenue Trends: The Boeing Company vs American Airlines Group Inc.