| __timestamp | Delta Air Lines, Inc. | Eaton Corporation plc |

|---|---|---|

| Wednesday, January 1, 2014 | 32858000000 | 15646000000 |

| Thursday, January 1, 2015 | 27707000000 | 14292000000 |

| Friday, January 1, 2016 | 27876000000 | 13400000000 |

| Sunday, January 1, 2017 | 30671000000 | 13756000000 |

| Monday, January 1, 2018 | 34209000000 | 14511000000 |

| Tuesday, January 1, 2019 | 34982000000 | 14338000000 |

| Wednesday, January 1, 2020 | 23546000000 | 12408000000 |

| Friday, January 1, 2021 | 30078000000 | 13293000000 |

| Saturday, January 1, 2022 | 42767000000 | 13865000000 |

| Sunday, January 1, 2023 | 43913000000 | 14763000000 |

| Monday, January 1, 2024 | 46801000000 | 15375000000 |

Data in motion

In the ever-evolving landscape of corporate efficiency, Eaton Corporation plc and Delta Air Lines, Inc. stand as intriguing case studies. Over the past decade, Delta Air Lines has consistently demonstrated a robust cost of revenue, peaking at approximately 47% higher in 2024 compared to 2014. This growth trajectory underscores Delta's strategic prowess in managing operational costs amidst fluctuating market conditions.

Conversely, Eaton Corporation, a leader in power management, showcases a more stable cost of revenue, with a modest 6% increase from 2014 to 2023. This stability reflects Eaton's commitment to sustainable growth and operational efficiency. Notably, Eaton's data for 2024 remains elusive, leaving room for speculation on its future performance.

As these industry titans navigate the complexities of their respective sectors, their cost of revenue efficiency offers valuable insights into their strategic priorities and market adaptability.

Comparing Cost of Revenue Efficiency: Eaton Corporation plc vs Howmet Aerospace Inc.

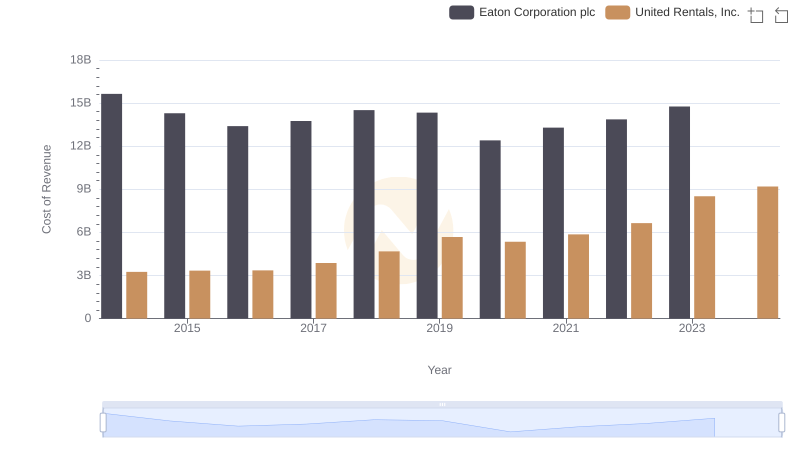

Cost Insights: Breaking Down Eaton Corporation plc and United Rentals, Inc.'s Expenses

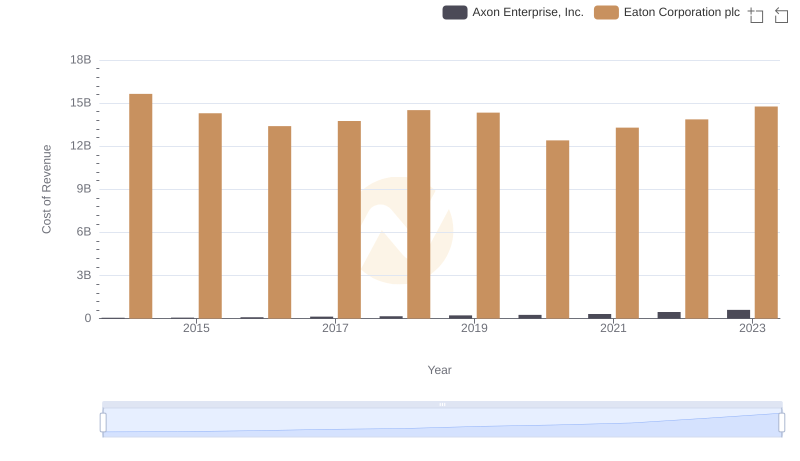

Cost of Revenue Trends: Eaton Corporation plc vs Axon Enterprise, Inc.

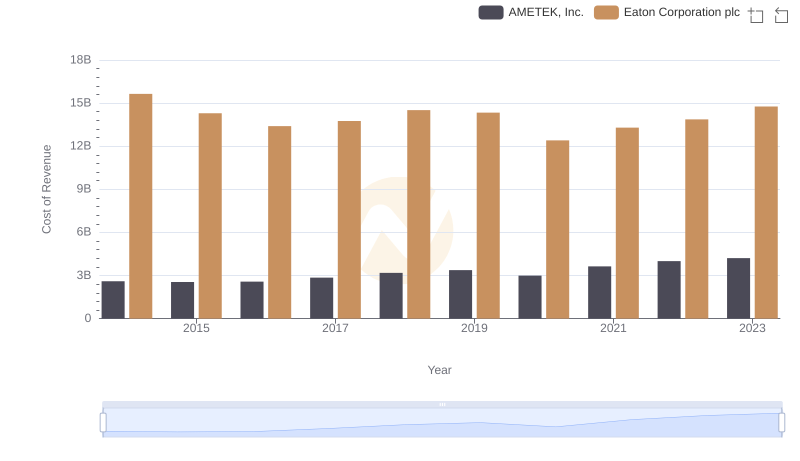

Comparing Cost of Revenue Efficiency: Eaton Corporation plc vs AMETEK, Inc.

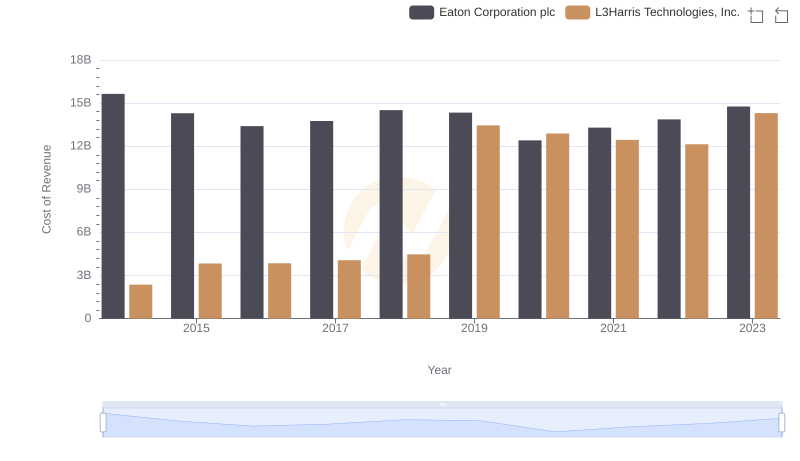

Analyzing Cost of Revenue: Eaton Corporation plc and L3Harris Technologies, Inc.