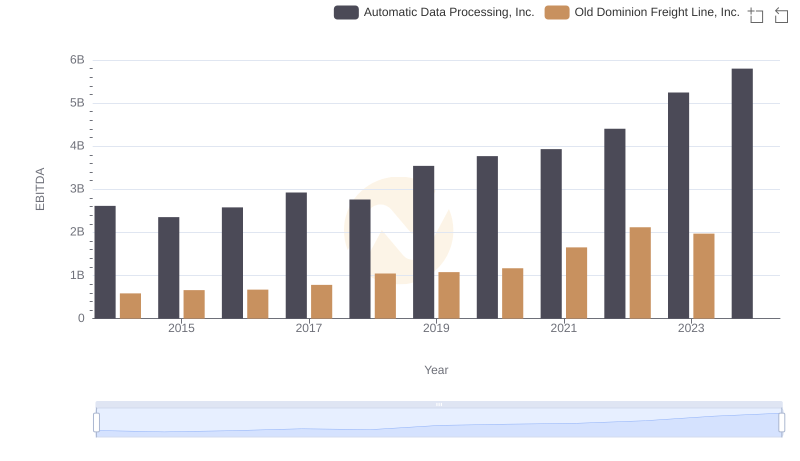

| __timestamp | Automatic Data Processing, Inc. | L3Harris Technologies, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2616900000 | 879000000 |

| Thursday, January 1, 2015 | 2355100000 | 1356000000 |

| Friday, January 1, 2016 | 2579500000 | 1350000000 |

| Sunday, January 1, 2017 | 2927200000 | 1356000000 |

| Monday, January 1, 2018 | 2762900000 | 1538000000 |

| Tuesday, January 1, 2019 | 3544500000 | 2980000000 |

| Wednesday, January 1, 2020 | 3769700000 | 2639000000 |

| Friday, January 1, 2021 | 3931600000 | 3518000000 |

| Saturday, January 1, 2022 | 4405500000 | 2499000000 |

| Sunday, January 1, 2023 | 5244600000 | 2932000000 |

| Monday, January 1, 2024 | 5800000000 | 3561000000 |

In pursuit of knowledge

In the ever-evolving landscape of corporate finance, the EBITDA performance of Automatic Data Processing, Inc. (ADP) and L3Harris Technologies, Inc. offers a fascinating study. Over the past decade, ADP has consistently outperformed L3Harris, with a remarkable 122% increase in EBITDA from 2014 to 2023. In contrast, L3Harris saw a 233% rise during the same period, albeit from a lower base.

ADP's EBITDA peaked in 2024, showcasing its robust growth trajectory, while L3Harris reached its zenith in 2021. The data highlights ADP's steady climb, with a notable surge in 2023, while L3Harris experienced fluctuations, reflecting its dynamic market strategies. Missing data for 2024 suggests potential volatility or strategic shifts. This comparison underscores the diverse strategies and market positions of these industry leaders, offering valuable insights for investors and analysts alike.

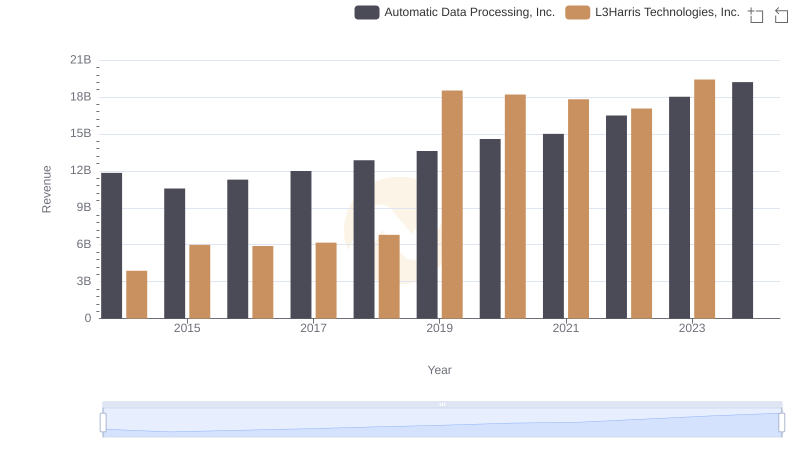

Comparing Revenue Performance: Automatic Data Processing, Inc. or L3Harris Technologies, Inc.?

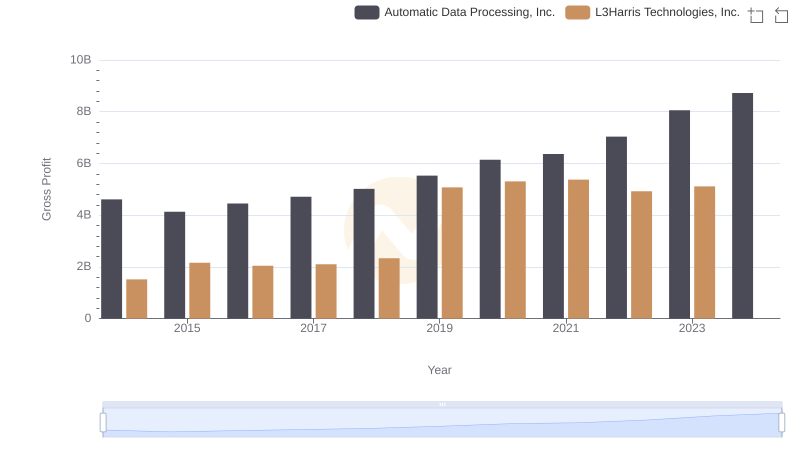

Automatic Data Processing, Inc. and L3Harris Technologies, Inc.: A Detailed Gross Profit Analysis

Comprehensive EBITDA Comparison: Automatic Data Processing, Inc. vs Old Dominion Freight Line, Inc.

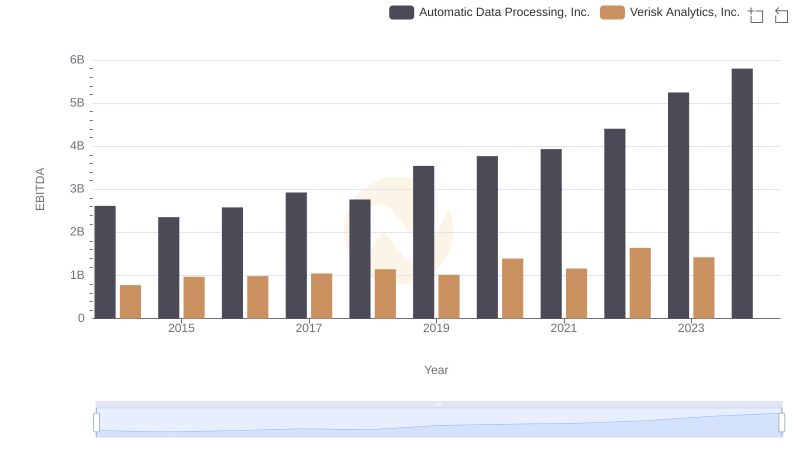

EBITDA Metrics Evaluated: Automatic Data Processing, Inc. vs Verisk Analytics, Inc.

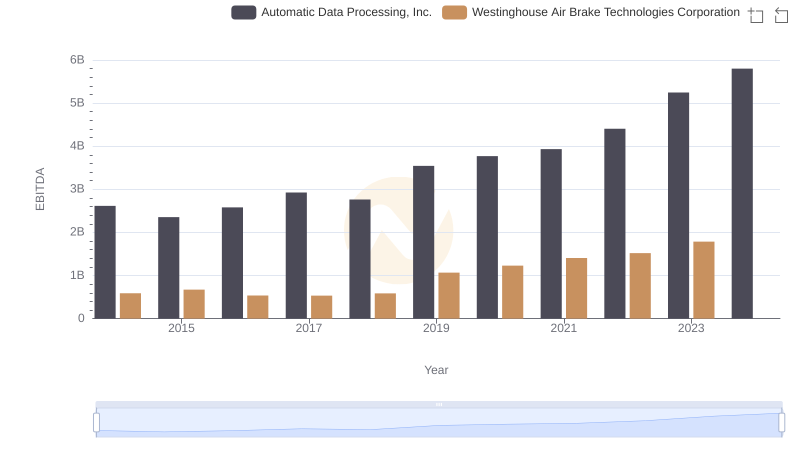

Professional EBITDA Benchmarking: Automatic Data Processing, Inc. vs Westinghouse Air Brake Technologies Corporation

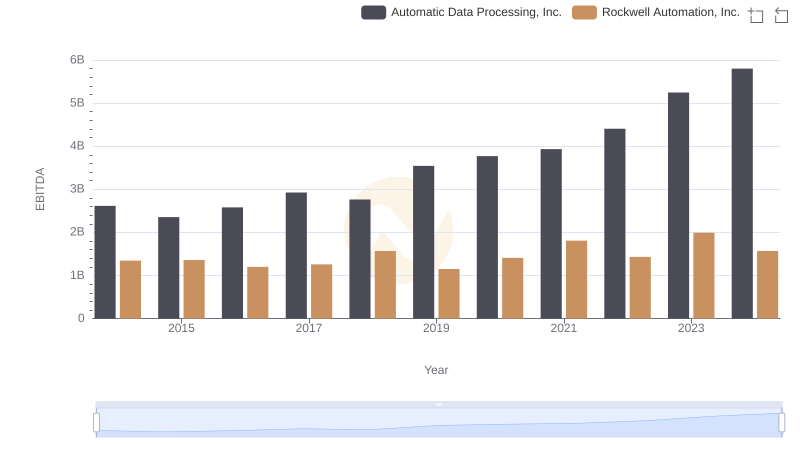

Automatic Data Processing, Inc. and Rockwell Automation, Inc.: A Detailed Examination of EBITDA Performance