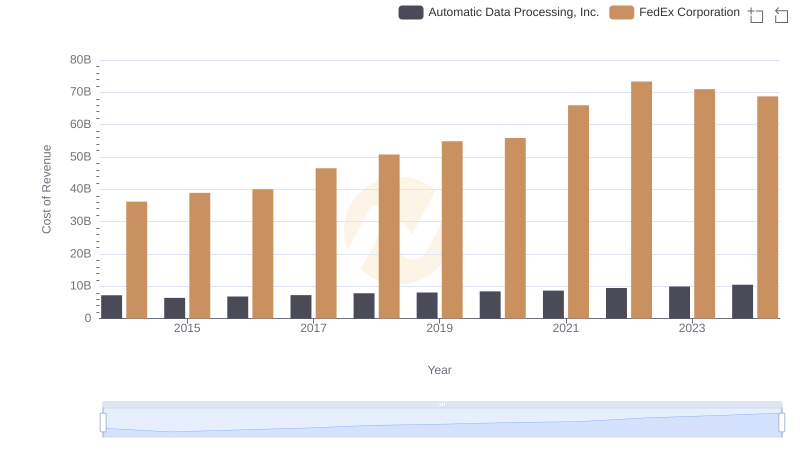

| __timestamp | Automatic Data Processing, Inc. | FedEx Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 4611400000 | 9373000000 |

| Thursday, January 1, 2015 | 4133200000 | 8558000000 |

| Friday, January 1, 2016 | 4450200000 | 10328000000 |

| Sunday, January 1, 2017 | 4712600000 | 13808000000 |

| Monday, January 1, 2018 | 5016700000 | 14700000000 |

| Tuesday, January 1, 2019 | 5526700000 | 14827000000 |

| Wednesday, January 1, 2020 | 6144700000 | 13344000000 |

| Friday, January 1, 2021 | 6365100000 | 17954000000 |

| Saturday, January 1, 2022 | 7036400000 | 20167000000 |

| Sunday, January 1, 2023 | 8058800000 | 19166000000 |

| Monday, January 1, 2024 | 8725900000 | 18952000000 |

Igniting the spark of knowledge

In the world of corporate finance, the gross profit metric serves as a vital indicator of a company's financial health. Over the past decade, Automatic Data Processing, Inc. (ADP) and FedEx Corporation have showcased intriguing trends in their gross profit performance. From 2014 to 2024, ADP's gross profit surged by approximately 89%, reflecting a robust growth trajectory. In contrast, FedEx experienced a 102% increase, underscoring its dominance in the logistics sector.

This analysis highlights the dynamic nature of these industry leaders, offering valuable insights for investors and market enthusiasts alike.

Who Generates More Revenue? Automatic Data Processing, Inc. or FedEx Corporation

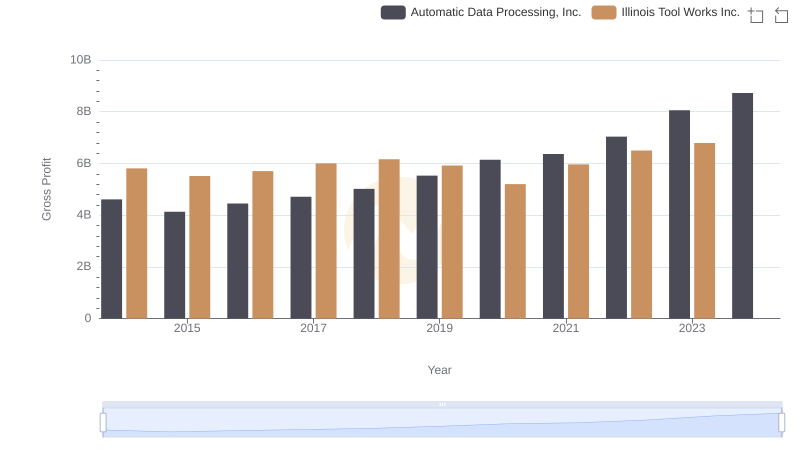

Gross Profit Trends Compared: Automatic Data Processing, Inc. vs Illinois Tool Works Inc.

Cost Insights: Breaking Down Automatic Data Processing, Inc. and FedEx Corporation's Expenses

Gross Profit Analysis: Comparing Automatic Data Processing, Inc. and Thomson Reuters Corporation

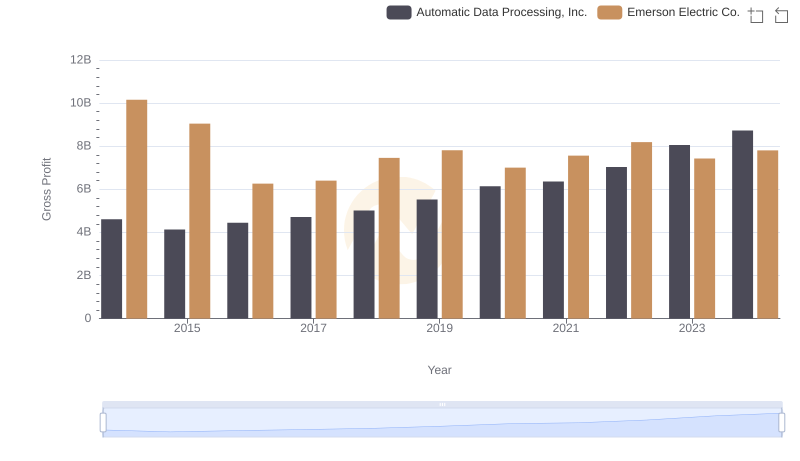

Automatic Data Processing, Inc. vs Emerson Electric Co.: A Gross Profit Performance Breakdown

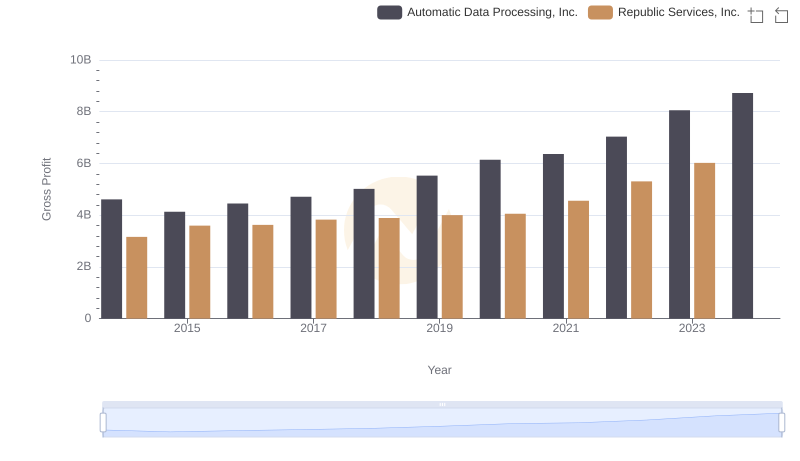

Gross Profit Comparison: Automatic Data Processing, Inc. and Republic Services, Inc. Trends