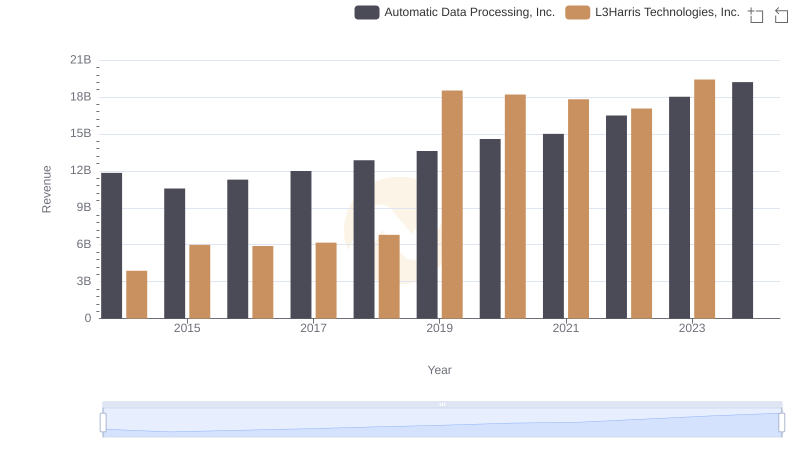

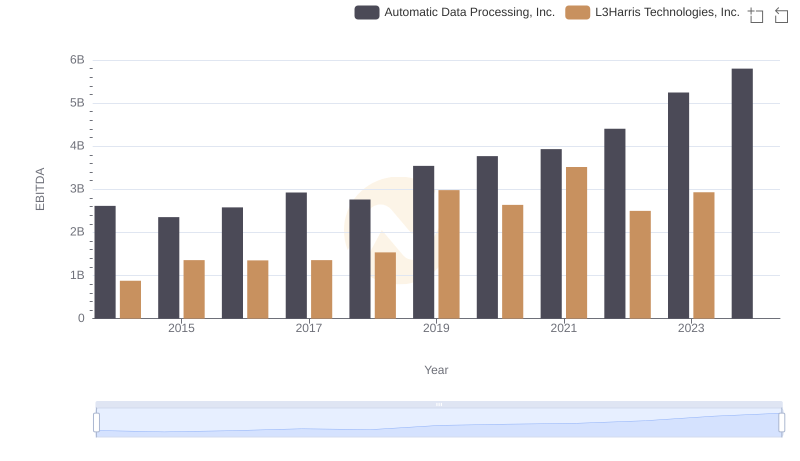

| __timestamp | Automatic Data Processing, Inc. | L3Harris Technologies, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 4611400000 | 1515000000 |

| Thursday, January 1, 2015 | 4133200000 | 2160000000 |

| Friday, January 1, 2016 | 4450200000 | 2043000000 |

| Sunday, January 1, 2017 | 4712600000 | 2102000000 |

| Monday, January 1, 2018 | 5016700000 | 2334000000 |

| Tuesday, January 1, 2019 | 5526700000 | 5074000000 |

| Wednesday, January 1, 2020 | 6144700000 | 5308000000 |

| Friday, January 1, 2021 | 6365100000 | 5376000000 |

| Saturday, January 1, 2022 | 7036400000 | 4927000000 |

| Sunday, January 1, 2023 | 8058800000 | 5113000000 |

| Monday, January 1, 2024 | 8725900000 | 5524000000 |

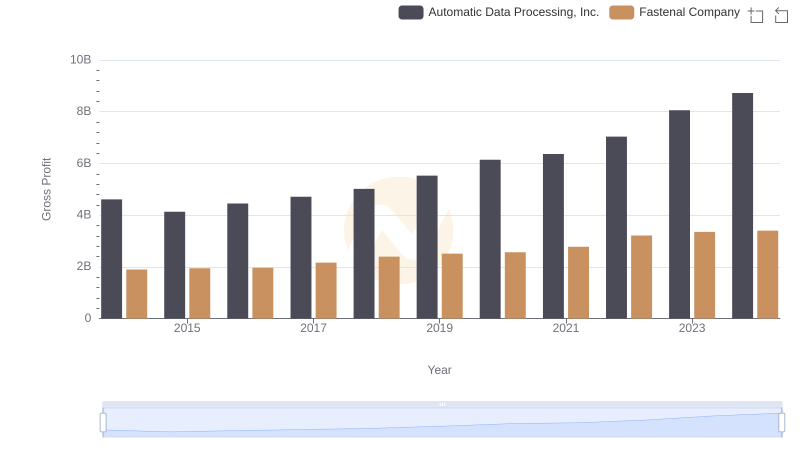

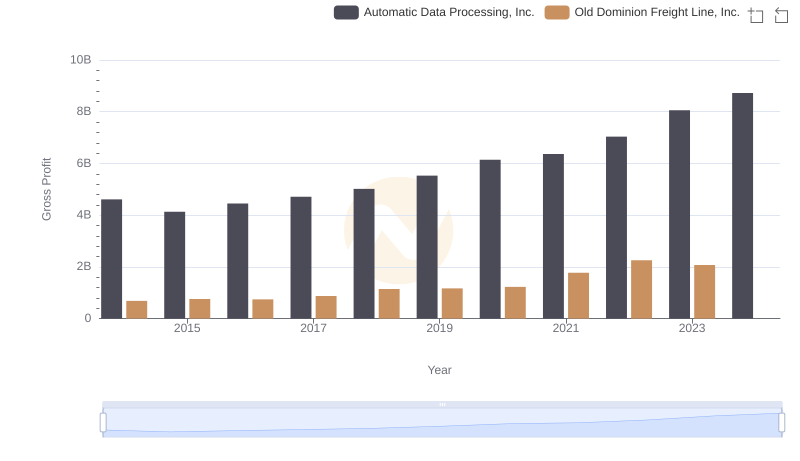

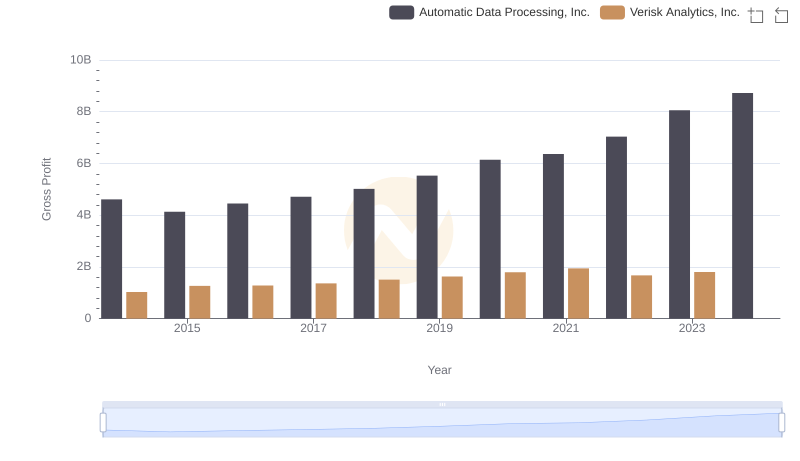

Unveiling the hidden dimensions of data

In the ever-evolving landscape of the U.S. stock market, Automatic Data Processing, Inc. (ADP) and L3Harris Technologies, Inc. (LHX) have emerged as formidable players. Over the past decade, ADP has consistently demonstrated robust growth, with its gross profit surging by approximately 89% from 2014 to 2023. This remarkable increase underscores ADP's strategic prowess in capitalizing on market opportunities.

Conversely, L3Harris Technologies has experienced a more modest growth trajectory, with its gross profit increasing by around 238% during the same period. Notably, L3Harris saw a significant leap in 2019, marking a pivotal year in its financial journey. However, data for 2024 remains elusive, leaving room for speculation on future trends.

These insights offer a compelling glimpse into the financial health and strategic direction of these industry titans, providing investors with valuable information for making informed decisions.

Comparing Revenue Performance: Automatic Data Processing, Inc. or L3Harris Technologies, Inc.?

Gross Profit Trends Compared: Automatic Data Processing, Inc. vs Fastenal Company

Who Generates Higher Gross Profit? Automatic Data Processing, Inc. or Old Dominion Freight Line, Inc.

Gross Profit Analysis: Comparing Automatic Data Processing, Inc. and Verisk Analytics, Inc.

Who Generates Higher Gross Profit? Automatic Data Processing, Inc. or Ingersoll Rand Inc.

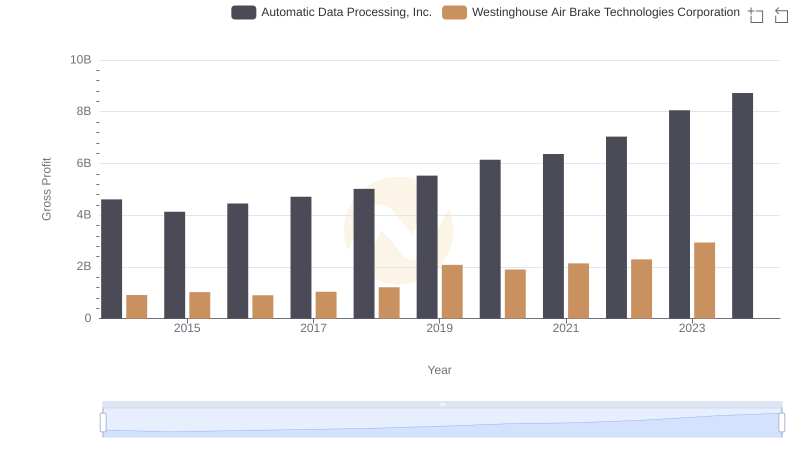

Gross Profit Comparison: Automatic Data Processing, Inc. and Westinghouse Air Brake Technologies Corporation Trends

Automatic Data Processing, Inc. vs L3Harris Technologies, Inc.: In-Depth EBITDA Performance Comparison