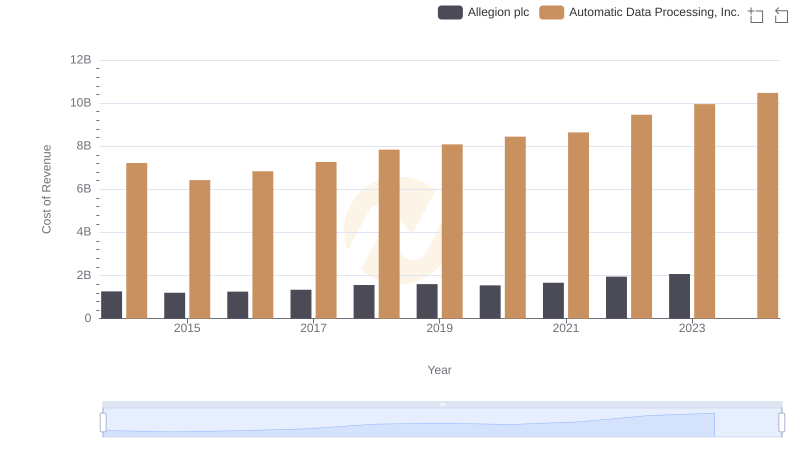

| __timestamp | Allegion plc | Automatic Data Processing, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2118300000 | 11832800000 |

| Thursday, January 1, 2015 | 2068100000 | 10560800000 |

| Friday, January 1, 2016 | 2238000000 | 11290500000 |

| Sunday, January 1, 2017 | 2408200000 | 11982400000 |

| Monday, January 1, 2018 | 2731700000 | 12859300000 |

| Tuesday, January 1, 2019 | 2854000000 | 13613300000 |

| Wednesday, January 1, 2020 | 2719900000 | 14589800000 |

| Friday, January 1, 2021 | 2867400000 | 15005400000 |

| Saturday, January 1, 2022 | 3271900000 | 16498300000 |

| Sunday, January 1, 2023 | 3650800000 | 18012200000 |

| Monday, January 1, 2024 | 3772200000 | 19202600000 |

Data in motion

In the competitive landscape of corporate America, Automatic Data Processing, Inc. (ADP) and Allegion plc have showcased distinct revenue trajectories over the past decade. From 2014 to 2023, ADP's revenue surged by approximately 52%, reflecting its robust market position and strategic growth initiatives. In contrast, Allegion plc experienced a commendable 72% increase, highlighting its expanding footprint in the security solutions sector.

ADP consistently outperformed Allegion in absolute revenue terms, with 2023 figures showing ADP's revenue at nearly five times that of Allegion. However, Allegion's growth rate underscores its dynamic adaptation to market demands. Notably, 2024 data for Allegion is missing, suggesting potential volatility or reporting delays.

This analysis underscores the importance of strategic positioning and market adaptation in driving revenue growth, offering valuable insights for investors and industry analysts alike.

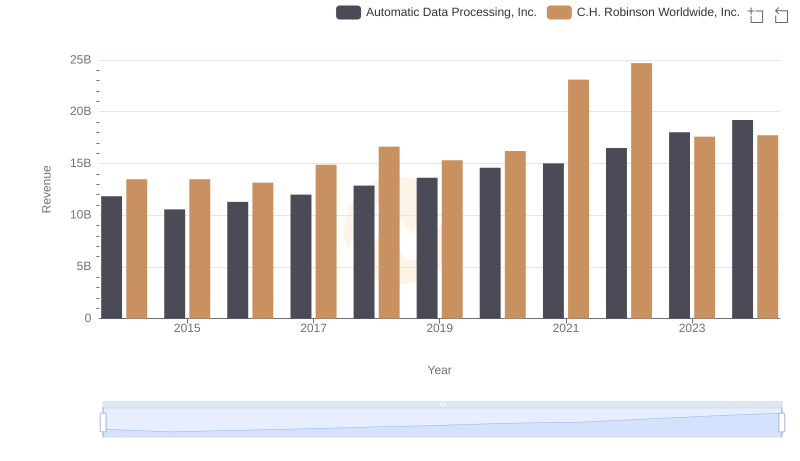

Annual Revenue Comparison: Automatic Data Processing, Inc. vs C.H. Robinson Worldwide, Inc.

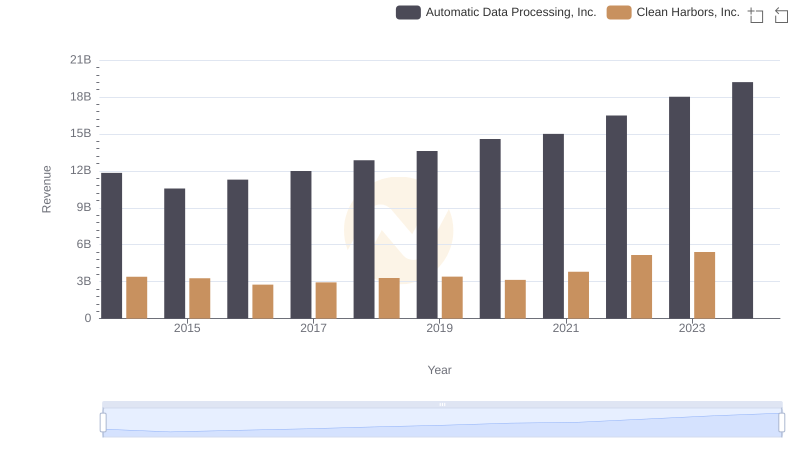

Automatic Data Processing, Inc. vs Clean Harbors, Inc.: Examining Key Revenue Metrics

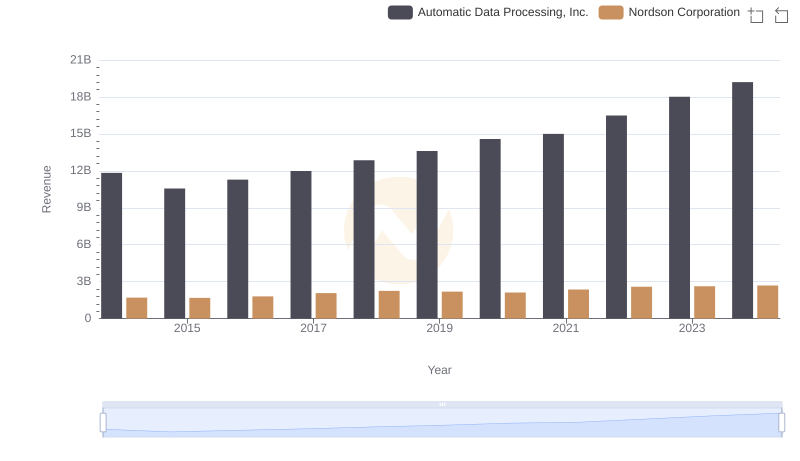

Who Generates More Revenue? Automatic Data Processing, Inc. or Nordson Corporation

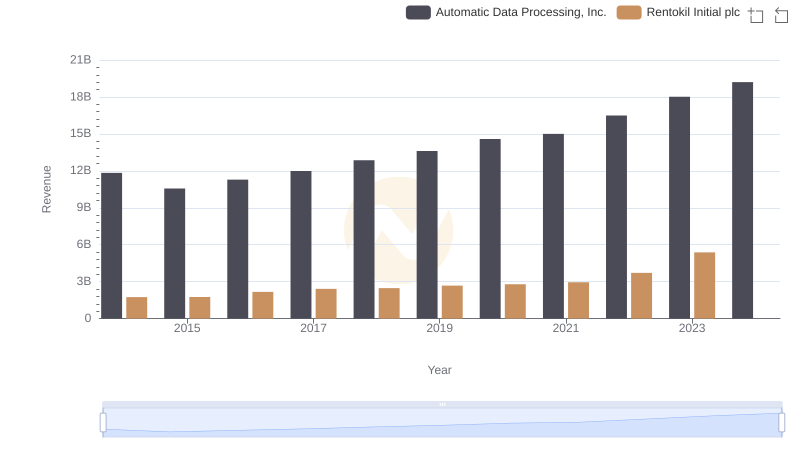

Annual Revenue Comparison: Automatic Data Processing, Inc. vs Rentokil Initial plc

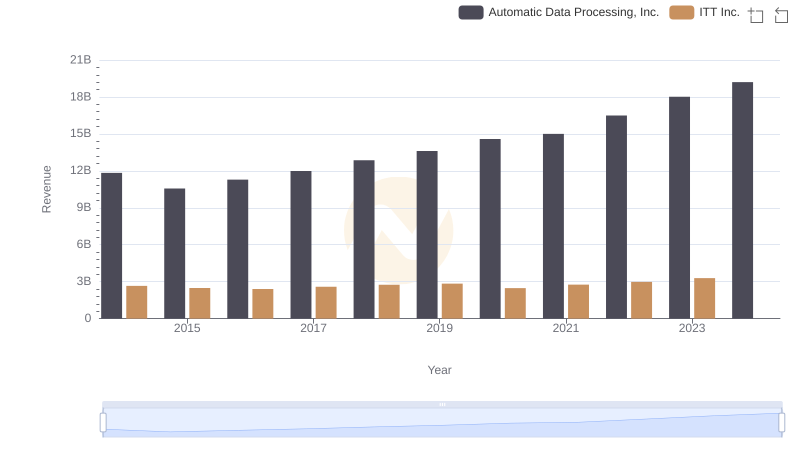

Automatic Data Processing, Inc. and ITT Inc.: A Comprehensive Revenue Analysis

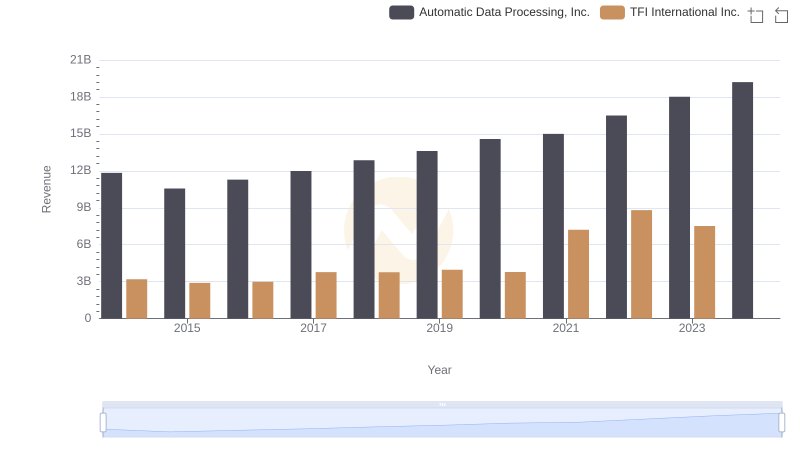

Comparing Revenue Performance: Automatic Data Processing, Inc. or TFI International Inc.?

Comparing Cost of Revenue Efficiency: Automatic Data Processing, Inc. vs Allegion plc

Operational Costs Compared: SG&A Analysis of Automatic Data Processing, Inc. and Allegion plc